Ethereum worth $5.5 million longs liquidated on BitMEX

As the price of the king coin surrendered under the selling pressure, other altcoins followed its lead. Ethereum, the world’s second-largest cryptocurrency and a highly correlated asset to Bitcoin, fell by 10.54% within three hours as its vale shrunk from $240.47 to $215.13. As the price of the coin was collapsing, BitMEX noted liquidations worth millions of dollars over this period.

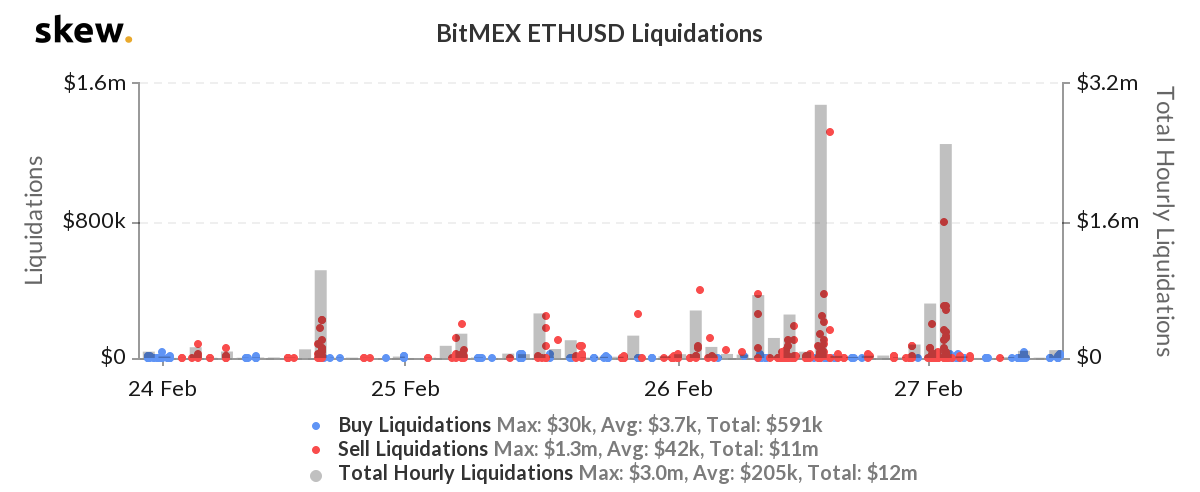

According to data provided by analytics firm, Skew, massive liquidations took between 26 February and early-27 February.

Source: Skew

The first set of liquidations took place at around 16:00 UTC, a time when Ethereum worth $3 million longs were liquidated on BitMEX. Seven hours later, longs worth almost $2.5 million saw liquidation. The total sell liquidation was noted to be $11 million, whereas the total buy liquidation was a mere $594k.

Lately, the Ethereum Futures market has been noting the highest longs liquidation over the past three months, wherein the peak was marked on 19 February, noting liquidation of longs worth almost $9 million. On the other hand, Bitcoin liquidations were recorded to be over $150 million, highest in 2020.

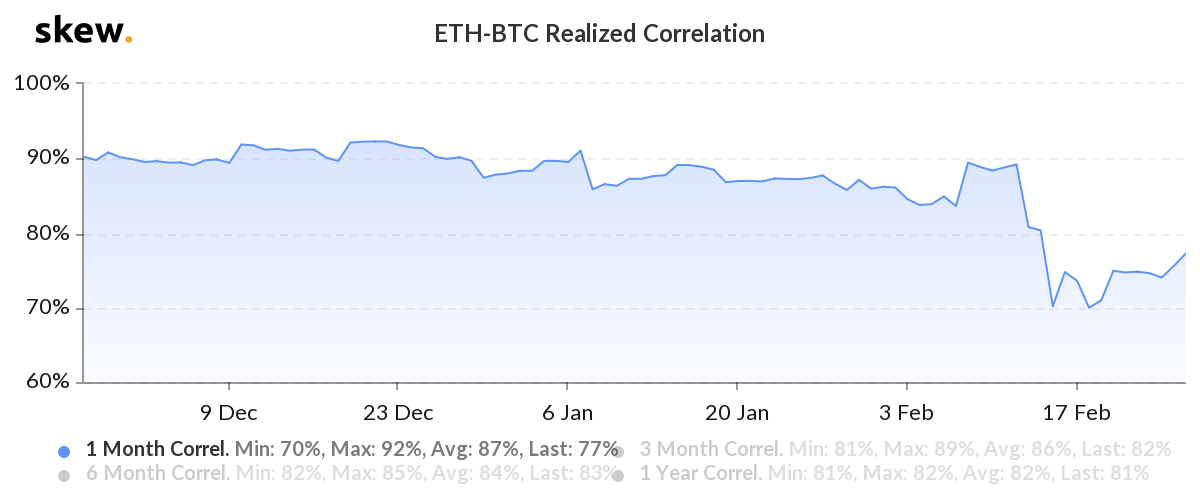

However, Ethereum’s performance in the market has been better than that of Bitcoin, reporting 62.19% gains. On the opposite end of the spectrum, Bitcoin’s gain, accounting for recent falls, was reported to be 19.21%. However, the strong correlation between Bitcoin and Ethereum may result in unfavored losses in the alts as the correlation was taking an upwards turn, at press time.

Source: Skew

The realized correlation between the two had dropped massively between 12 February and 15 February, falling to 70%. However, since then, the realized correlation between the two has been growing. At press time, the correlation was on a rise and it was marked at 77% over a one-month correlation frame.

At the time of writing, Ethereum was trading at $231.12, with a 24-hour trading volume of $17.1B.

Source: Coinstats