Ethereum Options OI hits new ATH on Deribit

Top derivatives exchange, Deribit has hit a new all-time high in terms of open interest for Ethereum options. The Exchange announced on 4 December that it hit this new peak as the value of the ETH options reached $826 million. With Ethereum’s value still being high at $589, at press time and returning 370% to its investors in YTD, the new ATH was a bullish sign for the days to come.

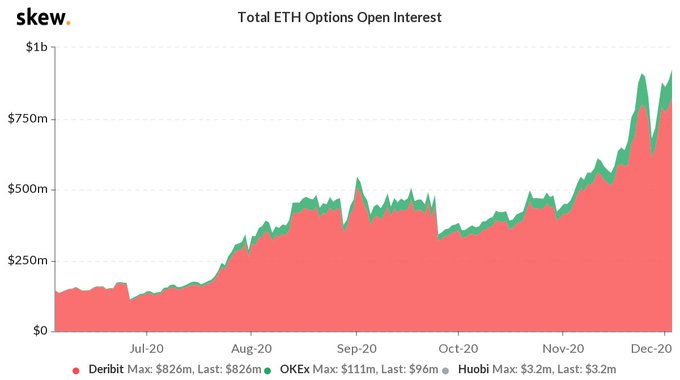

Data provider Skew marked this all-time high OI.

Source: Skew

Ethereum Options also hit an ATH in terms of OI nearly a week ago by surpassing $976 million. The bullish sentiment in the market was visible from the 60% jump in the options trade volume on 23 November. This rise indicated the bullish sentiment of the institutional and retail traders on derivatives exchanges.

The rise in OI and volume have been due to the hype around Ethereum 2.0. As the volume noted a spike along with Interest in late November, it was following by the increase in the deposited funds on ETH 2.0 taking the total to 1005 in less than 48 hours. As the Beacon Chain or Phase 0 going live, the stake in Ethereum 2.0 has been rising and reached 900,129 ETH on 3 December – the equivalent of $532 million. This was a 66% rise from the expected target for the launch of the network.

Additionally, Deribit has also been noting the Christmas day expiry lead with over 669k ETH open interest. This was an indication of the great expectations from traders for the year’s last options’ expiry. This was a bullish sign for the traders, whereas the Maximum pain for 25 December was noted to be $400. The max pain price is the strike price with the most open contract puts and calls and the price at which the stock or in this case, the digital asset would cause financial losses for the largest number of option holders at expiry. $400 was the a meager amount of loss that can be incurred by the Ethereum traders, which in itself was a positive sign.

The impact of the expiry will be seen on the Etheruem market in the following days.