Ethereum OI rises as DeFi TVL hits $3 billion

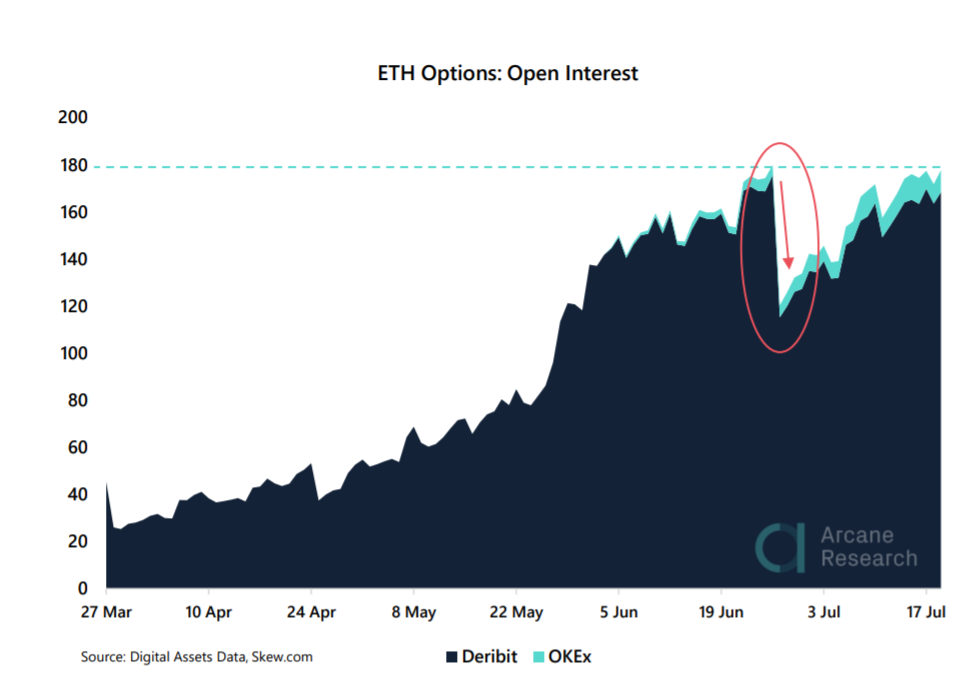

The Ethereum derivatives market, like its spot market, was lying low. The last time the Options market witnessed increased activity was on 26 June, wherein a bulk of contract expiry was supposed to take place. According to data provider Skew, the Open Interest [OI] on 26 June was close to $170 million, which shrunk close to $112 million the following day. However, as the Ethereum ecosystem has been noticing growth, interest has flocked back into the market as OI reached $180 million.

Source: Arcane Research

According to data collected by Arcane Research, the expiry had the heaviest impact on bitcoin as its OI dropped by 50%. Ethereum was hard hit by a loss of nearly 34% of its total OI.

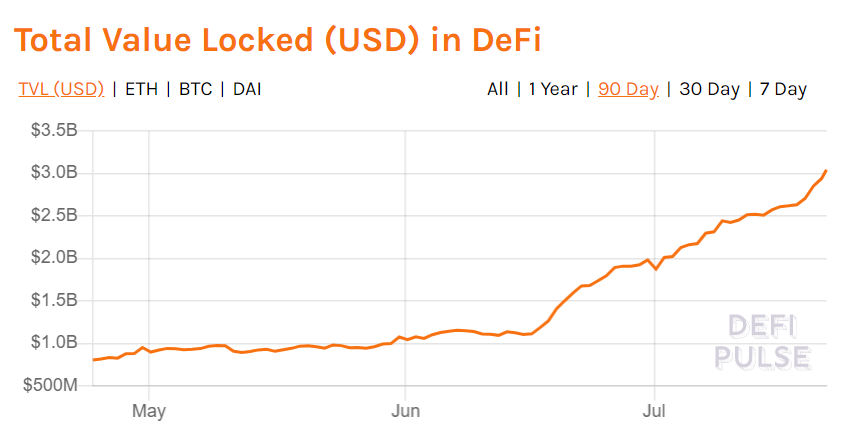

As the derivatives market gains interest, the spot market also experienced a much-required shakeup. The price of the second-largest digital asset, spiked by $9 within the last few hours. ETH was trading at $243.42, at press time, as the price was dipping. As the market volatility experienced a jerk, the total value locked [TVL] in DeFi reached a peak of $3 billion.

Source: DEFI pulse

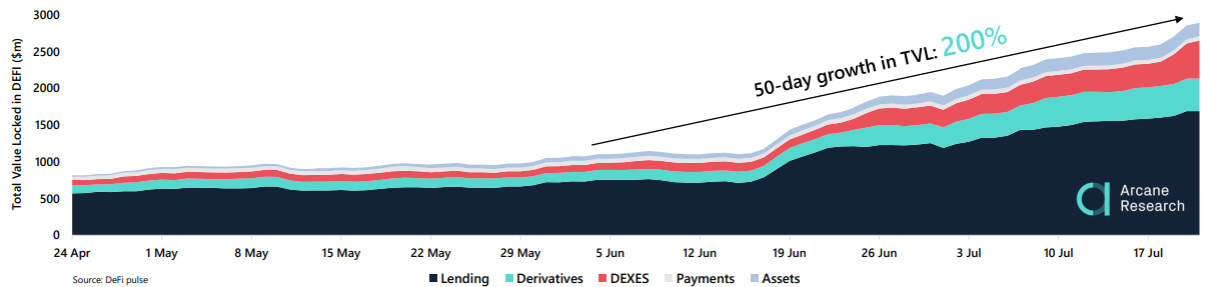

The DeFi TVL had noted a $1 billion peak in February, however, the events of Black Thursday sunk the rising TVL. As the market rallied to recover, the TVL surpassed $1 billion in June. However, DeFi’s growth escalated as Yield farming began to catch the users’ attention and Compound launch its governance token later in June. Lending platforms witnessed a local peak and held 72% of the TVL in DeFi. But July saw this value reduce to 58%, as Dexes and Derivatives TV increased by 238% and 140% in a month, respectively.

Source: Arcane Research

Meanwhile, a new entrant in the DeFi world, mStable’s Meta token has been witnessing great spike upon its launch on 18 July. On the given date, Ryan Watkins of Messari noted that the token was trading at 16x its $0.15 seed price. If the analyst is to be believed, FOMO was the driver of the price. Similarly, Lend Token of Aave protocol has earned 1,500% over the last year.