Ethereum network witnesses an exodus as validators exit – Why?

- The Ethereum network has seen a surge in daily validator exit since the beginning of October.

- This may be due to the recent uptick in Ether’s value.

Ethereum’s [ETH] staking pool has experienced a shift since the beginning of October, with an increasing number of validators opting to withdraw their staked ETH, Glassnode found in a new report.

According to the on-chain data provider, since the beginning of October, an average count of 1018 validators have exited the proof-of-stake (PoS) network daily.

This trend coincides with the recent upswing in the altcoin’s price in the last month, suggesting that validators are capitalizing on the opportunity to capture gains on their previously staked ETH.

Validator exit has network-wide impacts

To serve as a validator on the Ethereum network, a minimum amount of 32 ETH is to be staked. Since the October rally began, there has been a steady decline in the number of unique addresses holding this amount of ETH.

At press time, 125,189 addresses held at least 32 ETH, having declined by 1% since the 1st of October.

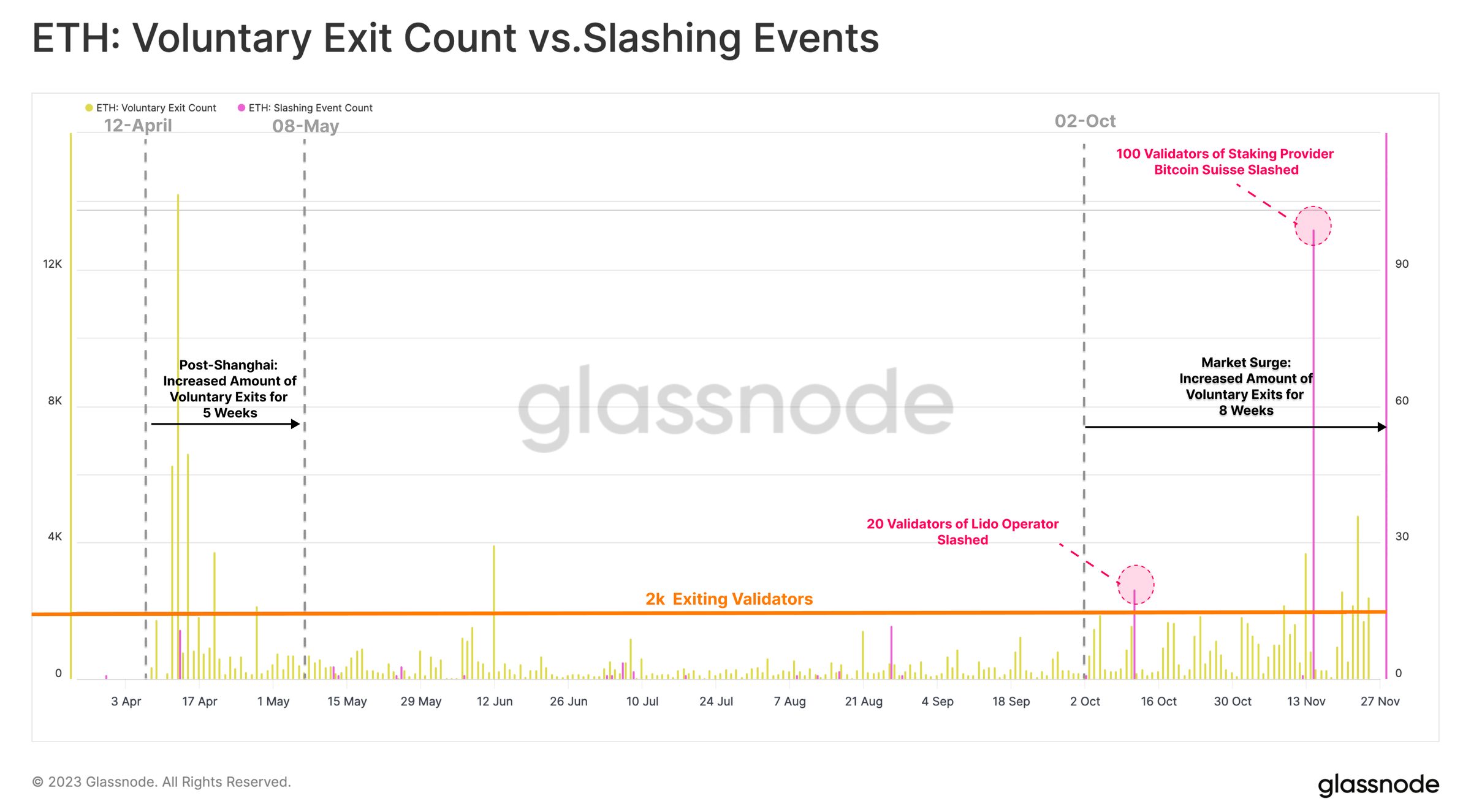

Glassnode found further that most exits recorded in the last eight weeks have been voluntary. Validators are deemed to have exited the network voluntarily when they independently decide to exit the ETH 2.0 staking pool.

This differs from slashing events that account for validators being removed from the network for violating protocol rules. In the last two weeks, only two of such events were recorded, Glassnode said.

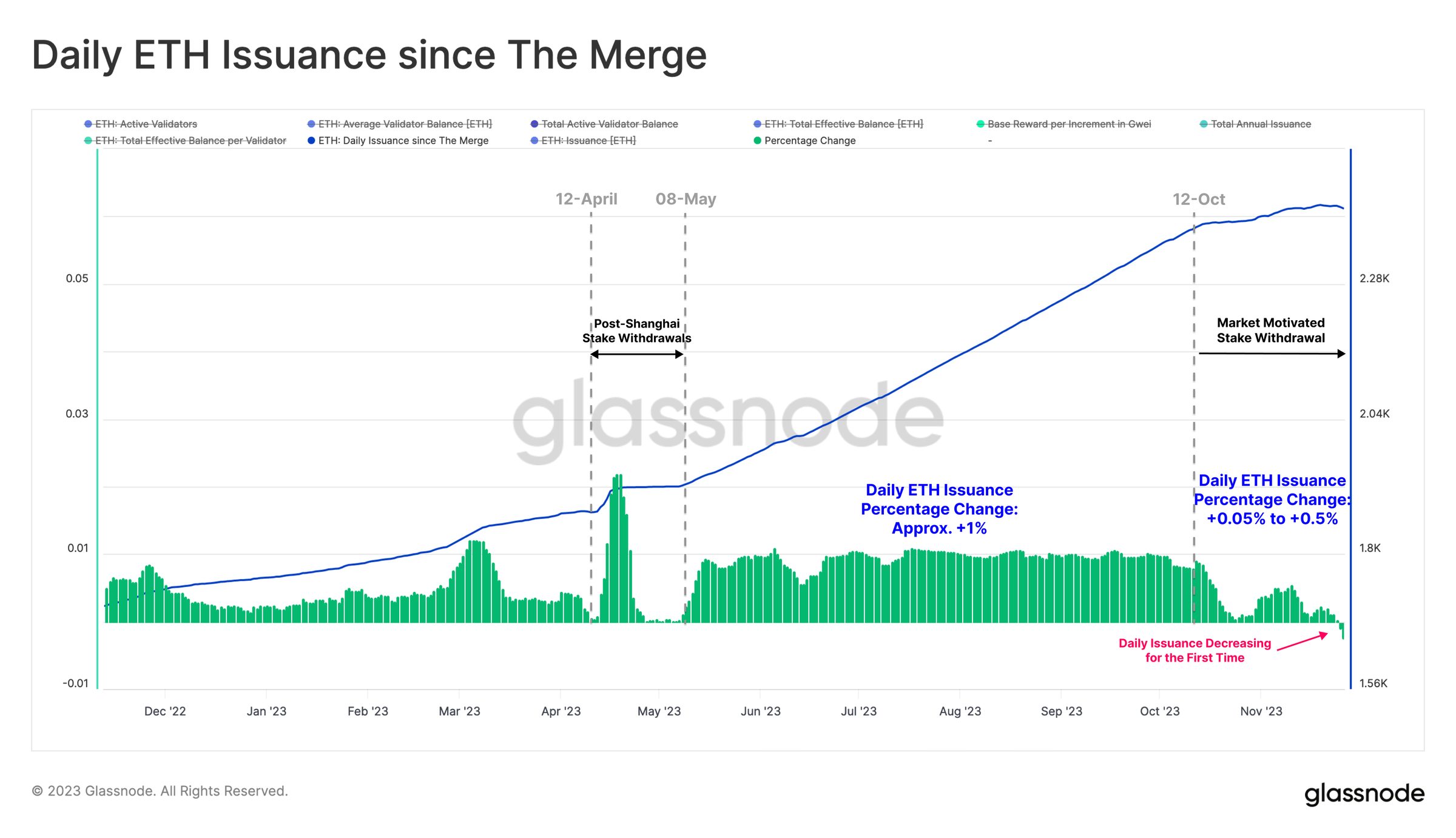

In addition, due to a rise in the daily number of exiting validators on the network, there has been a corresponding fall in ETH issuance. This refers to the total amount of new ETH coins added to its current supply.

According to the report:

“As the growth rate of validators slows and declines, the daily ETH issuance has experienced a corresponding slowdown. Over the last 7-days, the growth rate of ETH issuance has slowed by up to 0.5% per day. Notably, the rate of issuance has decreased for the first time in recent days.”

How much are 1,10,100 ETHs worth today?

Regarding the entity types that have facilitated the most withdrawals since the beginning of October, Glassnode found that centralized exchanges have been responsible.

“Centralized exchanges (CEXs) have consistently dominated stake withdrawal events since October, with Kraken and Coinbase seeing the largest outflows.”