Ethereum’s monthly close: Here’s what you shouldn’t do

Ethereum, unlike Bitcoin, had a relatively active weekend in terms of price action, with ETH hovering around the $550-mark, at press time. In fact, Ethereum shorts equivalent to over 2500 ETH were liquidated across derivatives exchanges like OKEx and Binance. While more and more retail traders expected ETH’s price to slow down over the weekend, the cryptocurrency’s price trend has continued unopposed.

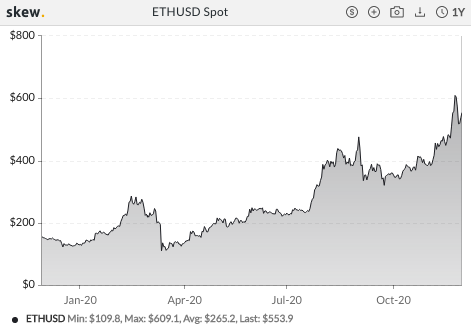

ETH Spot Price || Source: Skew

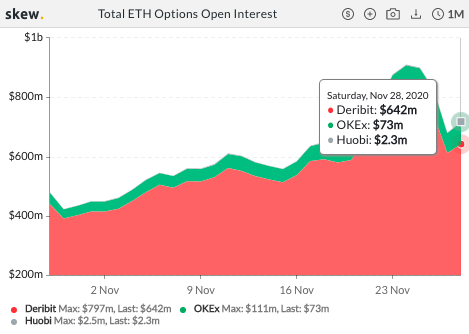

Though there are several factors driving the demand for ETH and subsequently its price, the OI and trade volume on derivatives exchange have both proven to be reliable metrics that might signal a change in price trend. At the time of writing, the OI in ETH was low on derivatives exchanges like Deribit, Huobi, and OKEx. After hitting a high of nearly $900M on 24 November 2020 when the price was $603, it dropped to $650M, based on charts from Skew.

ETH Options OI || Source: Skew

Not just OI, but the trade volume dropped from $130M to $40-$45M too. However, a drop of over 70% in a single day on 27 November 2020 did not stop the price rally. ETH’s price continued to rally accompanied by demand from retail traders and unique addresses across spot exchanges.

While it may be lucrative for retail traders to open shorts here, based on metrics and data from charts, it may turn out to be less than ideal. As of 30 November 2020, 94.43% of orders were longs and 5.57% of orders were shorts on BitMEX. The launch of ETH 2.0 has precipitated bullish sentiment among retail and trader’s sentiment for ETH is negative.

Opening shorts in a seemingly bullish market would be like riding against the tide and it is important to note that further correction is not predicted in the short-term, based on the on-chain analysis of ETH. While a drop in volatility was anticipated over the weekend, however, ETH’s price has continued to rally.

With increasing unique addresses (3.7% since 1 November 2020) and demand, we are heading towards a monthly close of over $600. Even the worst-case scenario currently does not indicate a close below the press time price of $550. Opening shorts this close to the monthly close and at the cusp of the launch of ETH 2.0 may not be in the best interest of your portfolio. After ETH 2.0 is launched and the demand moves towards Bitcoin or other altcoins, it might be the right time to consider shorts on BitMEX, OKEx, or Deribit. Until that happens, ETH will rally close to over $600, based on the spot price chart.