These factors are primed to spur Ethereum’s long-term rally

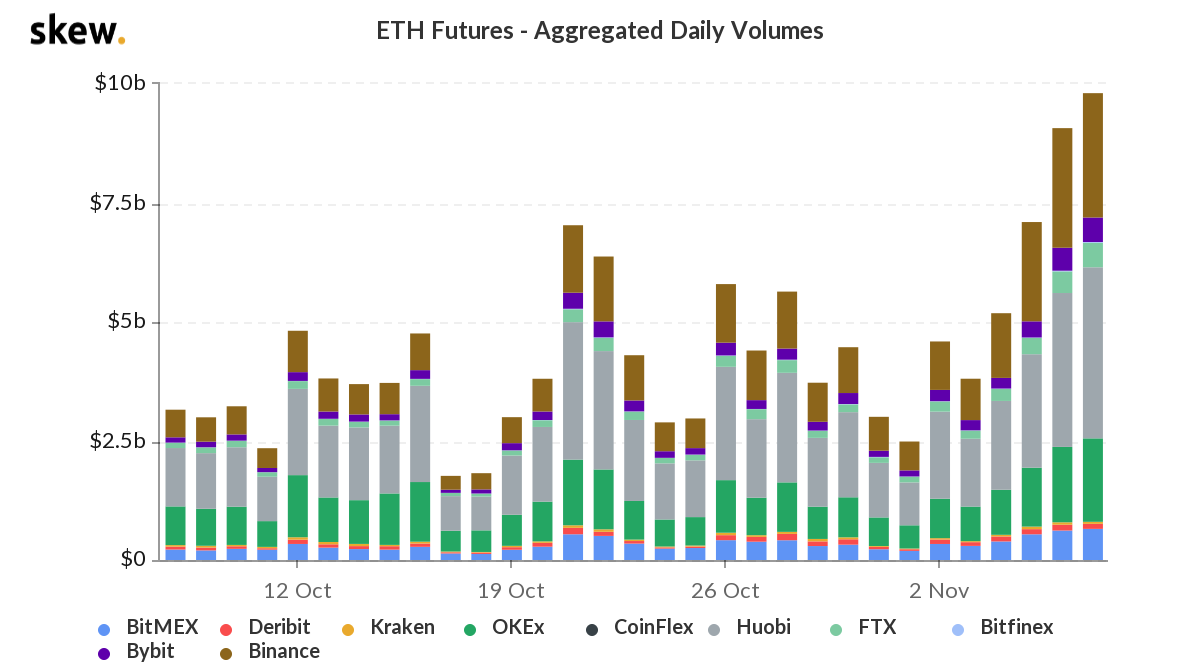

ETH Futures trade volume was up by 38% in 2 days, at the time of writing, according to Skew’s charts. Not just the trade volume, but even the Open Interest was up by 8% based on Skew’s charts. On spot exchanges, the trade volume dropped by nearly 25%, but on derivatives exchanges, it climbed up. This finding implies an increase in volatility and fear of correction and a short-lived price rally as traders are inclined to trade derivatives, but not the underlying asset on spot exchanges.

ETH Futures Aggregate Daily Volume || Source: Skew

Based on data from Skew, the rise in volatility in ETH, and the fear of correction that is evident from trade volume on derivatives exchanges, ETH may be up for correction. Retail traders are keener on trading the derivative, rather than the underlying asset. On spot markets, besides trade volume, there are other indicators like volatility and outflows. Both volatility and outflows of ETH on spot exchanges have increased and the narrative driving ETH’s price could be the scarcity narrative, rather than the crypto-asset’s correlation with BTC.

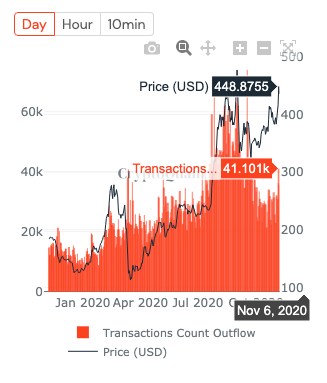

At the time of writing, ETH’s price had hit a high of $465.68, having opened at $454, with a weekly price rise of 14.47%. As previously highlighted, the volatility in ETH’s price has risen and at the same time, ETH outflows from spot exchanges have increased. Further, the number of outflow transactions is up too, based on data from Cryptoquant.

ETH Outflow Transactions || Source: Cryptoquant

The volatility in price is high due to the increase in the number of outflow transactions, however, it may be short-lived, just as retail traders fear. This may be another reason why more activity has been recorded on derivatives exchanges, compared to spot exchanges. The scarcity narrative is supported by Vitalik Buterin’s bullish tweets two days after ETH’s mainnet launchpad went live. The ETH Founder reminded everyone that being online even 60% of the time is profitable.

Source: Twitter

In fact, the present ETH price rally may possibly be in response to the launchpad going live, and the sentiment may have turned bullish in response to the same. The launchpad brings the ETH community one step closer to the realization of ETH 2.0, its much-awaited upgrade. Further, retail traders’ sentiment is evident from the increasing number of non-zero wallet addresses on the ETH network.

This was confirmed by Glassnode after it shared an update on non-zero wallet addresses.

Source: Twitter

Ergo, it can be inferred that more retail traders are active on ETH now, with the number of non-zero wallet addresses hitting an ATH of 49,014,477. Such a development suggests that ETH has captured mainstream retail and institutional interest, and an ETH price rally is likely. Though the current price rally may be short-lived based on charts and traders’ sentiment, ETH traders may be in for a rally in the long-run.