Ethereum

Ethereum Futures volume surges by 15% as trading interest rises

Bitcoin’s latest surge has contributed to many altcoins rallying along. Ethereum, the world’s second-largest coin in terms of market cap, reported growth worth 18% over the past day and this rally in the Ethereum market has encouraged many traders to benefit from any potential growth in the digital asset’s price. This trend was observed in the Futures trading activity sector as it reported over a 15% surge, according to market data provider Skew.

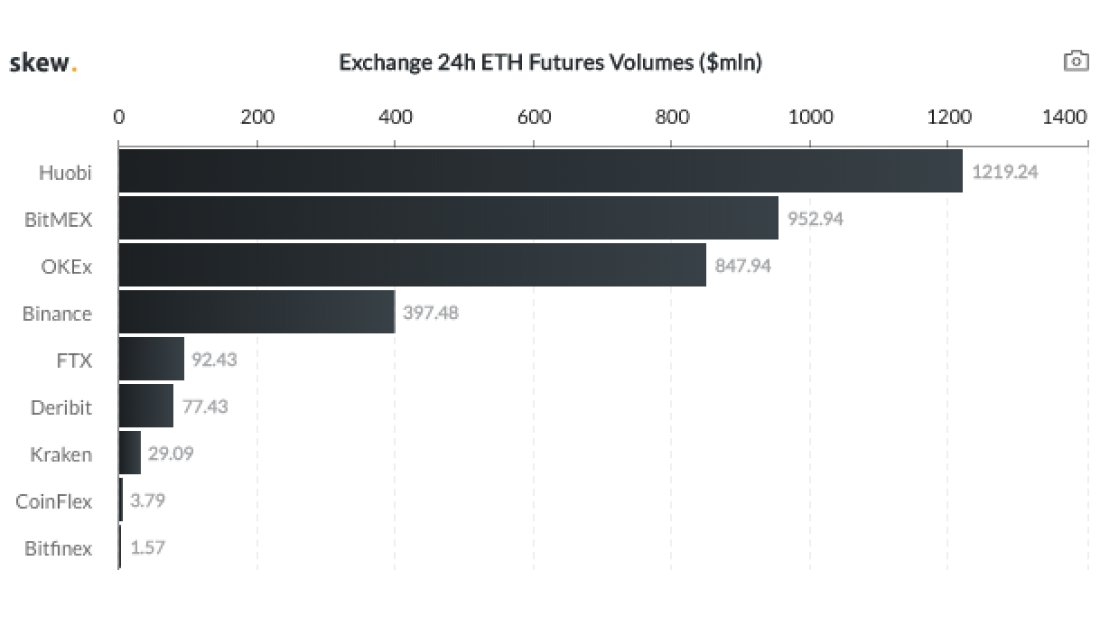

Source: Skew

Ethereum’s rally could have caused this surge in its Futures trading activity. However, there has been some progress setting in owing to the CFTC Chairman’s latest stance on Ethereum Futures. Heath Tarbert, in a recent interview, had said that both digital assets, Bitcoin and Ethereum, fell under the CFTC’s jurisdiction, calling Ether a commodity. Tarbert claimed that the CFTC is expecting to see regulated Ether Futures in the United States in the next six months, while also expressing confusion about it moving to the Proof of Stake [PoS] protocol.

Ethereum Futures, on the other hand, have responded well to this piece of information as the Open Interest also rose significantly.

Source: Skew

The aggregated interest was high on OKEx and BitMEX with $196 million and $190 million, respectively. Additionally, the chart above highlighted the increasing investment from traders. On the other hand, BitMEX, a prominent derivatives exchange, was reportedly noting a daily volume of $592 million, with Huobi leading the same with $840 million.

Source: Skew

Even though Ethereum Futures has been a popular choice among traders, the Ethereum network might have a long way to go. According to Ethereum’s Co-founder Vitalik Buterin, the network currently processes only 15 Transactions Per Second. However, this number needs to be closer to 100,000 to be a viable platform in the future. The daily transaction count on the network was reported to be 709,280 on 11 February and data from Etherscan highlighted a reduced Transaction count.

Source: Etherscan