Analysis

Ethereum Classic, Maker, Bitcoin Cash price: Alts hint at mild revival signs

Another day, another market correction. The collective cryptocurrency market fell to a market cap of $168 billion as Bitcoin’s dominance stood firm at 65%. Following Bitcoin’s footsteps were alts and its fork coins which also sustained minor losses over the past 24-hours.

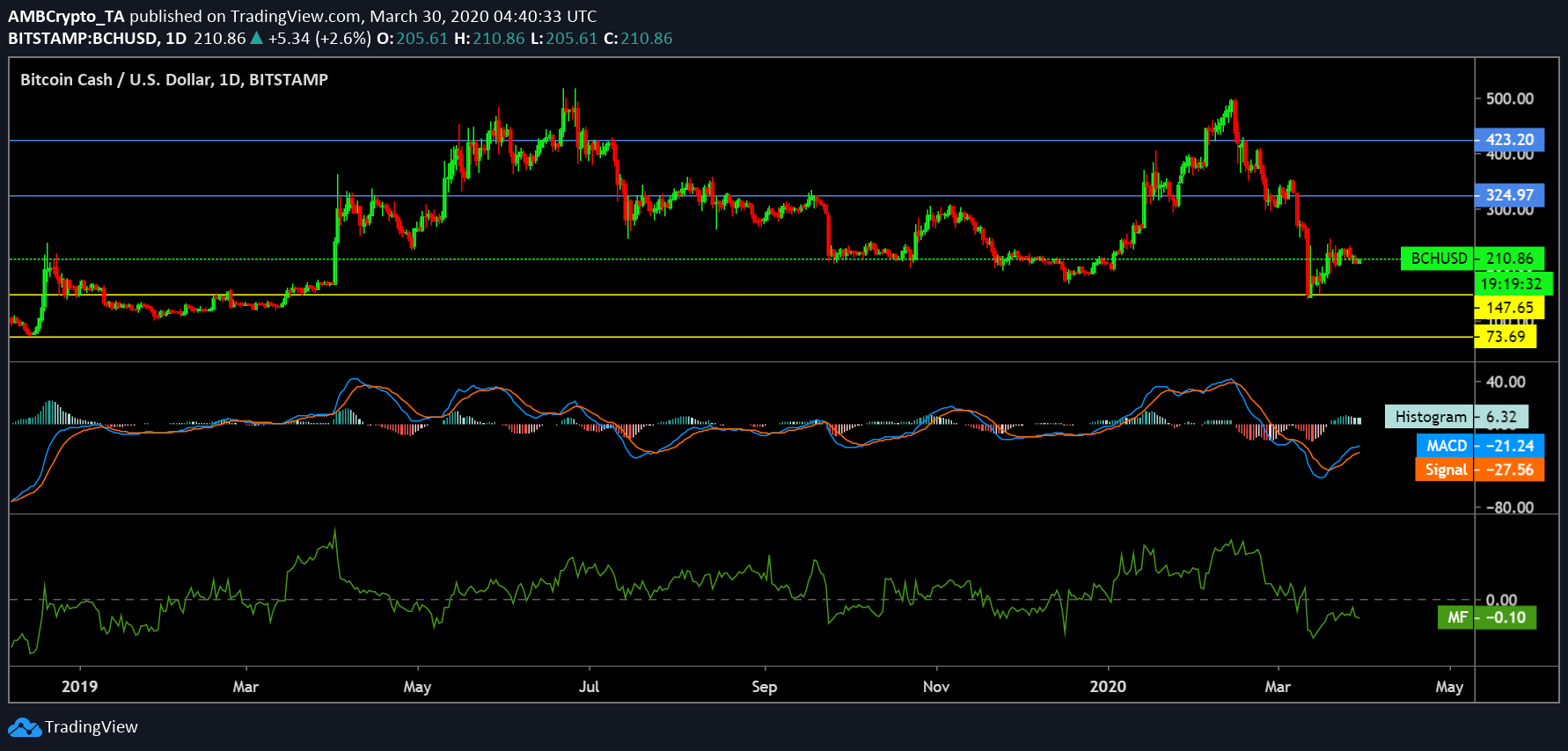

Bitcoin Cash

Source: BCH/USD on TradingView

As Bitcoin Cash traders are eyeing the halving event set to take place in April this year, not everyone was bullish for the aftermath price action of this fork coin. The falling hash rate and difficulty reignited concerns pertaining to the miners abandoning BCH for its big brother, Bitcoin.

On its price side, after weeks of consolidating in the upward direction, BCH sustained major losses briefly falling below the crucial support of $200.

MACD: MACD indicator predicted a bullish phase for BCH in the near future.

CMF: CMF indicator appeared to be heading towards the bullish zone.

Resistance: $324.9, $423.2

Support: $147.6, $73.69

At press time, BCH was priced at $210.04 after a decline of 1.68% as it held a market cap of $3.85 billion and a 24-hour trading volume of $2.77 billion.

Ethereum Classic [ETC]:

Source: ETC/USD on TradingView

Ethereum Classic successfully completed ‘Agharta’ hard fork in January this year, following a similar backward-incompatible upgrade dubbed ‘Atlantis’ in September 2019.

Despite network developments, the coin’s price fell close to the December 2019 losses after rallying above $12.00 in the first two months of 2020.

Parabolic SAR: The dotted markers below the ETC price candles depicted a bullish picture for the coin.

Awesome Oscillator: AO indicator also aligned with the bullish projection with its green closing bars.

Resistance: $6.98, $9.83

Support: $3.44

ETC was up by a minor 0.85% as its value stood at $4.87. Additionally, the coin registered a market cap of $566.1 million and a trading volume of $1.40 million over the last 24-hours.

MAKER:

Source: MKR/USD on TradingView

Maker Foundation recently announced the transfer of the control of MKR tokens to the Maker governance community. Despite its attempts to bring in the ecosystem closer to complete system decentralization, its price has failed to respond positively. However, key indicators have a different story to say.

Klinger Oscillator: KO indicator underwent a bullish crossover.

RSI: The RSI indicator was also heading towards the neutral zone.

Resistance: $655.8, $771.3

Support: $199.05

At press time, MKR was valued at $293.3 as it held a market cap at $295.04 million. The coin recorded a trading volume of $3.74 million after a significant drop of 5.01% over the last 24-hours.