Ethereum can hit $3500, but only on this condition

- An analyst predicted ETH’s rise towards $2,600, and further up to $3,500.

- Holders stand to gain 7.73% if they sell their holdings at the prevailing price.

December started on a rollicking note for Ethereum [ETH]. Over the weekend, the second-largest digital asset by market cap surged nearly 10%, extending the momentum it gained over the last month.

As of this writing, ETH was exchanging hands at $2,248.11, up 3.91% in the last 24 hours, according to CoinMarketCap.

In a quote shared with AMBCrypto, Ryan Lee, Chief Analyst of Bitget Research, ascribed the latest upswing to strong expectations of interest rate cuts by the Federal Reserve in 2024.

He said:

“Given the potential for a recession in the U.S. economy, fund managers are predicting an 80% consensus level for a trend of interest rate reduction in 2024, marking the highest consensus level ever recorded. The crypto market has already factored in this positive news.”

Add to this, the enthusiasm around spot exchange-traded funds (ETFs) was reaching a fervor pitch. The number of spot Ether ETF applications submitted to the U.S. Securities and Exchange Commission (SEC) rose to seven in November.

Big expectations from ETH

It was but natural for investors to be optimistic about ETH.

In a post on X (formerly Twitter) dated the 3rd of December, crypto technical analyst Ali Martinez predicted that ETH could move to $3,500, provided the weekly candlestick closed at $2,150.

#Ethereum | If $ETH secures a sustained weekly candlestick close above $2,150, the path might be set for an exciting uptrend.

Targets in sight? We could be looking at #ETH marching towards $2,600, and possibly even soaring to $3,500! pic.twitter.com/EWg3mtZeo6

— Ali (@ali_charts) December 3, 2023

Furthermore, he emphasized the relevance of the $1,900-$2,100 range in another of his posts. Previously, as many as 5.85 million addresses bought 43.8 million ETH in this range, indicating a probable surge in purchasing in the days ahead.

Will profit-taking interrupt the flow?

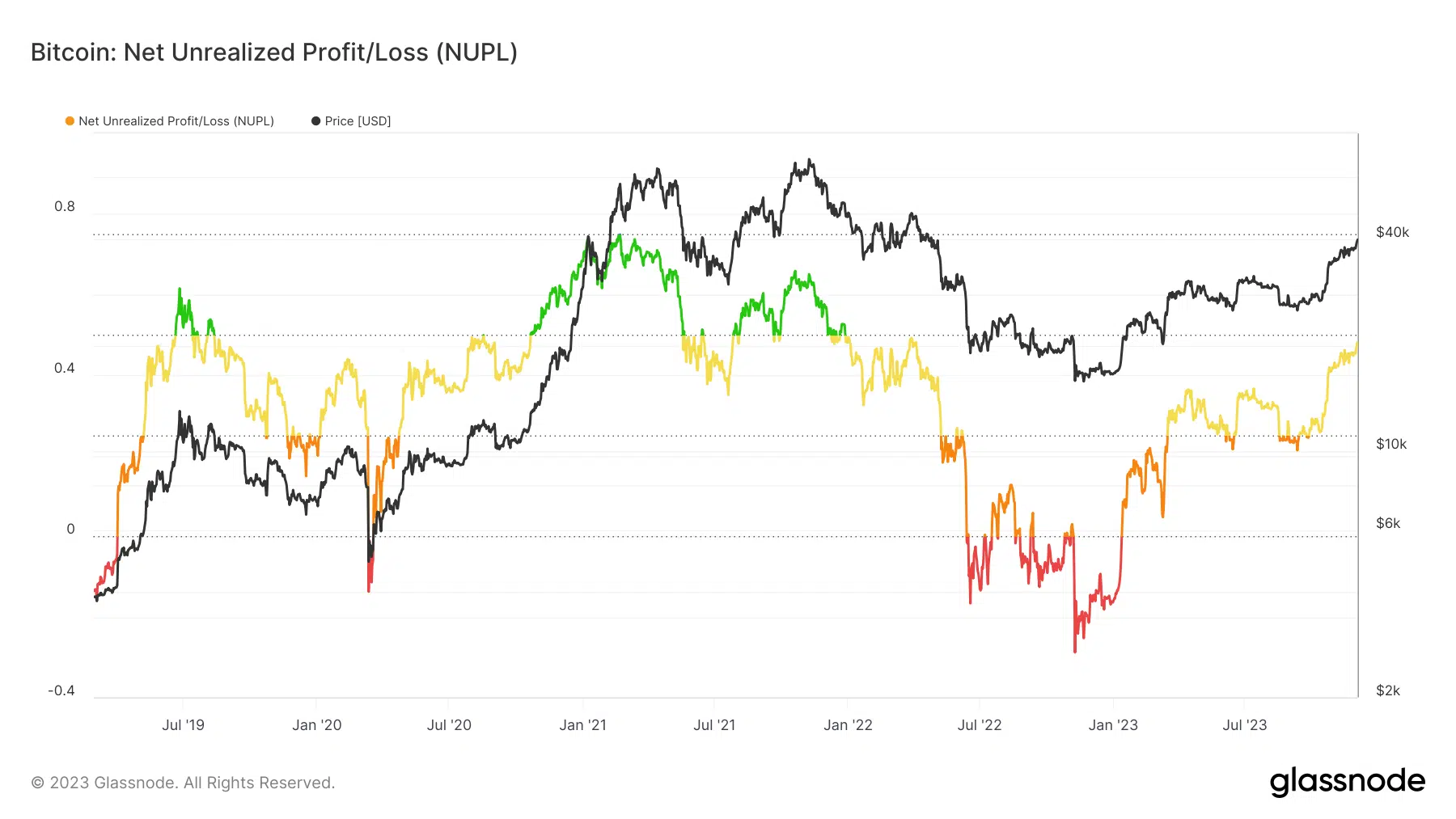

Having said that, the momentum could be stemmed if traders decide to lock in gains. According to AMBCrypto’s analysis of Glassnode’s NUPL metric, all holders would make profits if they sold their assets at the time of writing.

Realistic or not, here’s ETH’s market cap in BTC’s terms

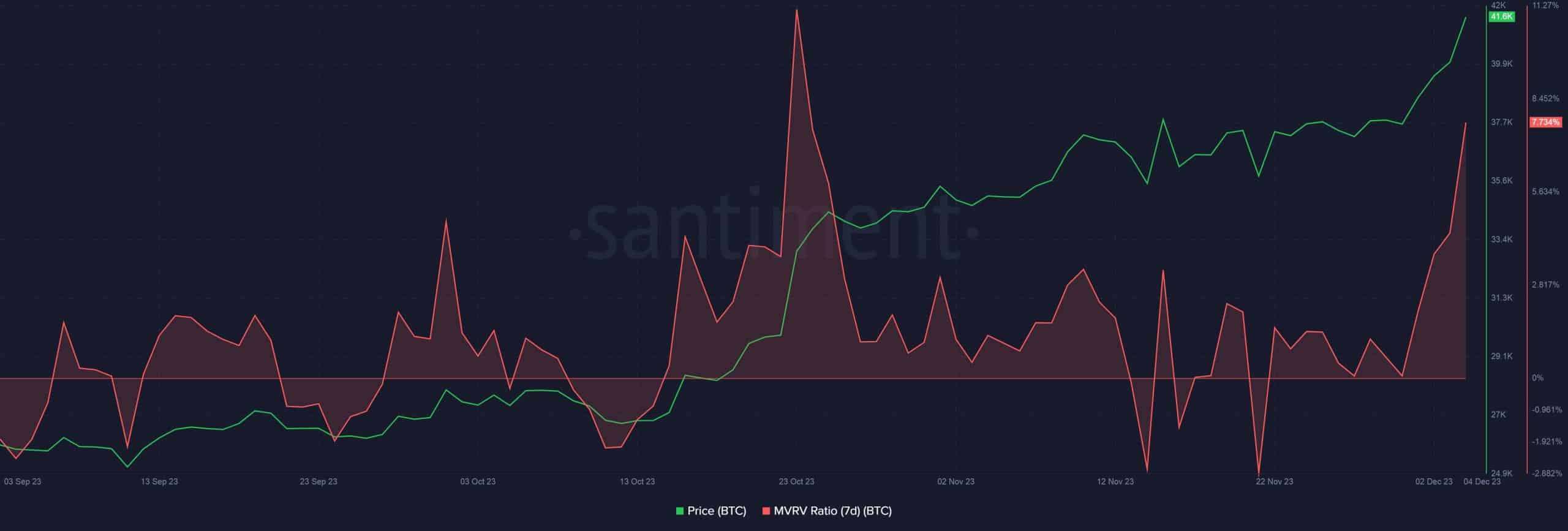

AMBCrypto digged in further using Santiment’s MVRV ratio. It came to light that all holders stand to gain 7.73% if they sell their holdings at the prevailing price.

It would be interesting to see if holders allow ETH to ascend or make some money after a challenging bear market.