As Bitcoin crosses $41K, accumulation rises

- Wallets holding 1,000 or more BTCs have gathered almost 8 million coins.

- New addresses have increased as Bitcoin hit $40,000.

Certain Bitcoin [BTC] wallets have recently increased their accumulation, coinciding with BTC’s movement towards the $40,000 price range, generating significant discussions.

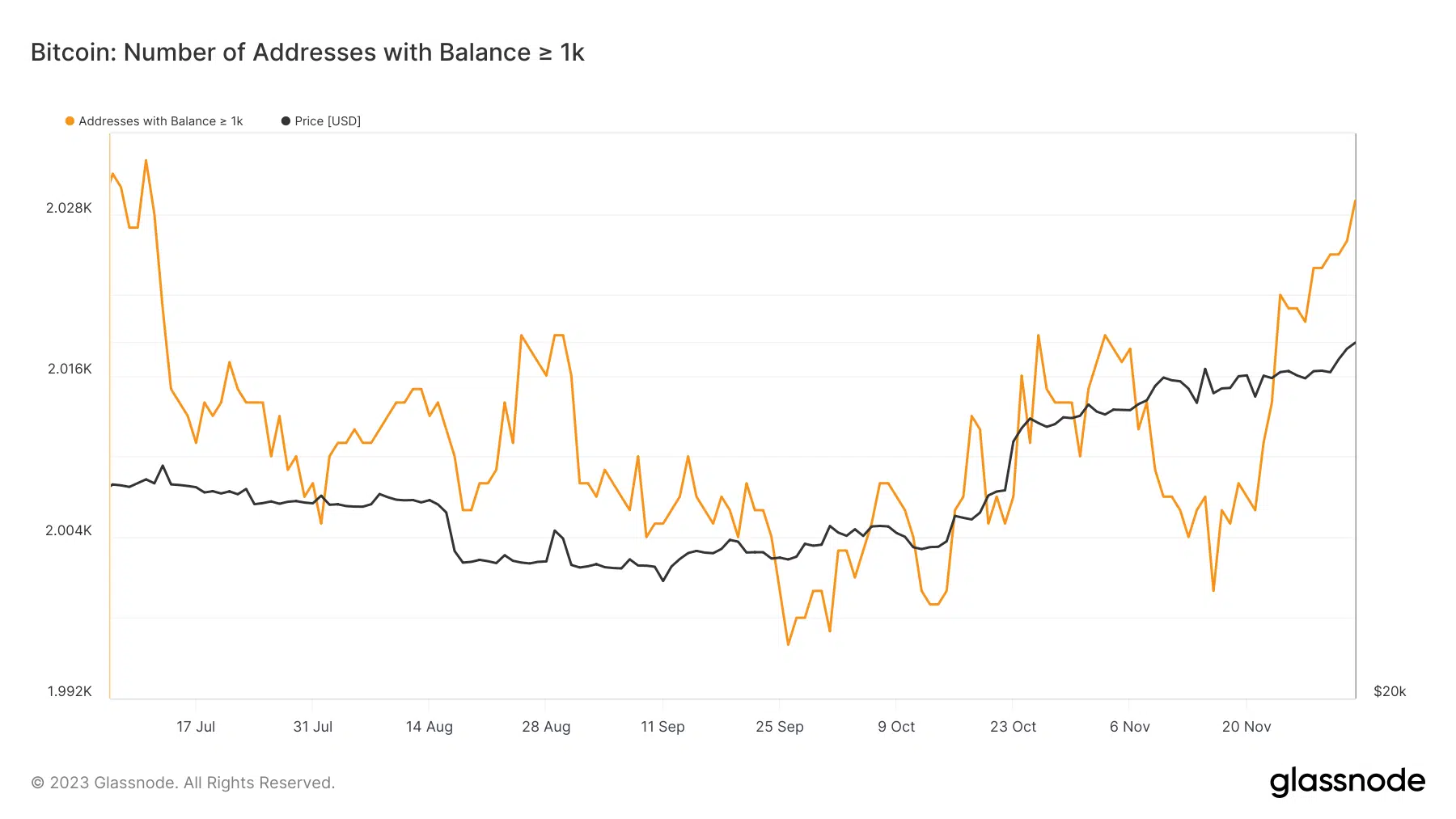

Bitcoin: 1k wallets increase their stakes

An examination of accounts holding 1,000 or more Bitcoin revealed a significant increase in the past few weeks. AMBCrypto’s analysis of Glassnode’s chart showed a continuous accumulation trend, reaching its highest point in over a year.

As of this writing, the number of these wallets stood at over 8.5 million.

The trend line of the graph also indicated a further price rise. Furthermore, data from IntoTheBlock showed a rise in the volume of BTC accumulated by these wallets.

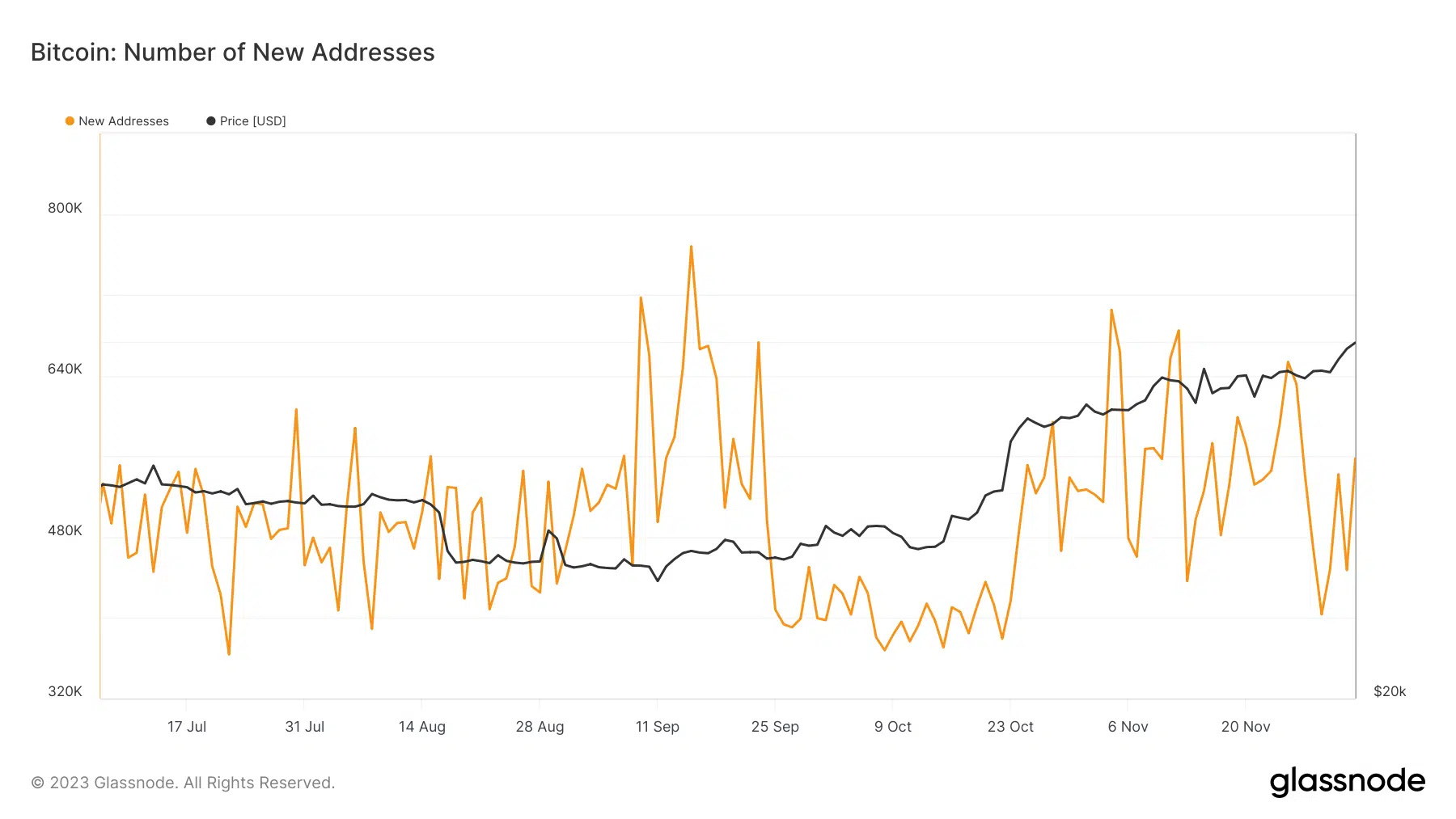

Slight uptrend in Bitcoin’s new addresses

The count of new addresses on the Bitcoin network experienced fluctuations in recent weeks as well. Nevertheless, according to data from Glassnode, there has been a notable increase in the last 24 hours.

The analysis of the figures indicated a rise from approximately 447,000 to around 557,000. While the specific wallet categories of these new addresses remained uncertain, this surge reflected robust growth in the network.

Holders and Social Dominance rises

The expansion of new addresses and the increase in wallets holding 1,000 or more Bitcoins signified notable growth within the Bitcoin network. Moreover, the total number of holders has also experienced a substantial rise in recent weeks.

According to Santiment’s chart analysis, there has been an increment of over 100,000 holders from the beginning of the month to the present.

As of the 1st of December, the holder count stood at around 50.9 million, and it surpassed 51 million at press time.

This surge in the total number of holders caused a noteworthy shift in Social Dominance. AMBCrypto’s analysis of Santiment’s Social Dominance chart revealed a spike in the last 24 hours, reaching almost 32%.

This indicated that in the last 24 hours, Bitcoin has dominated nearly 32% of cryptocurrency discussions. These growing metrics collectively suggested the emergence of a bullish trend.

Bitcoin breaks $41,000

AMBCrypto’s analysis of the daily timeframe chart provided additional insight into the primary drivers behind the positive trends. The chart revealed a noteworthy upward trajectory in the Bitcoin price over the past few days.

As of this writing, it has surged by more than 3.9%, reaching a trading value of over $41,000. This price level has not been witnessed in over a year, marking one of the most bullish trends in recent times.

Also, the ongoing uptrend implied that BTC has gained around 9% in value within the last four days.

Furthermore, the Relative Strength Index (RSI) had entered the oversold zone, as of press time. The position of the RSI further supported the bull trend narratives of the other metrics.

However, when AMBCrypto took a closer examination of the volume indicator, it showed a lack of a significant uptrend. The absence of convergence between volume and the price trend may suggest that the bull run has yet to commence.

Alternatively, it could imply a shortage of volume to sustain the upward trend in price.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The current price range might spark more excitement, which will drive up the volume in the coming days. If this happens, the bull trend will fully commence as demands rise.

However, if there is no notable change in volume, what will be witnessed is a correction in price. This is going to be due to the oversold nature of Bitcoin, as indicated by its RSI.