A closer look at Ethereum’s market moves post CPI report

- Inflation has increased by 3.5%.

- Ethereum has seen over 2% increase in the last 24 hours.

Ethereum [ETH] experienced a positive response following the release of the latest CPI report. This report garnered significant attention and discussions among traders, with many expressing a greater inclination towards crypto assets in light of the findings.

CPI shows 3.5% inflation increase

The CPI for March surpassed expectations, rising by 0.4% compared to the anticipated 0.3% and February’s 0.4%. On a year-over-year basis, CPI increased by 3.5%, slightly higher than the expected 3.4% and February’s 3.2%.

Year-over-year core CPI saw a slight uptick to 3.8%, slightly surpassing the expected 3.7% and remaining unchanged from February’s figure. This data suggests that a rate cut is unlikely soon.

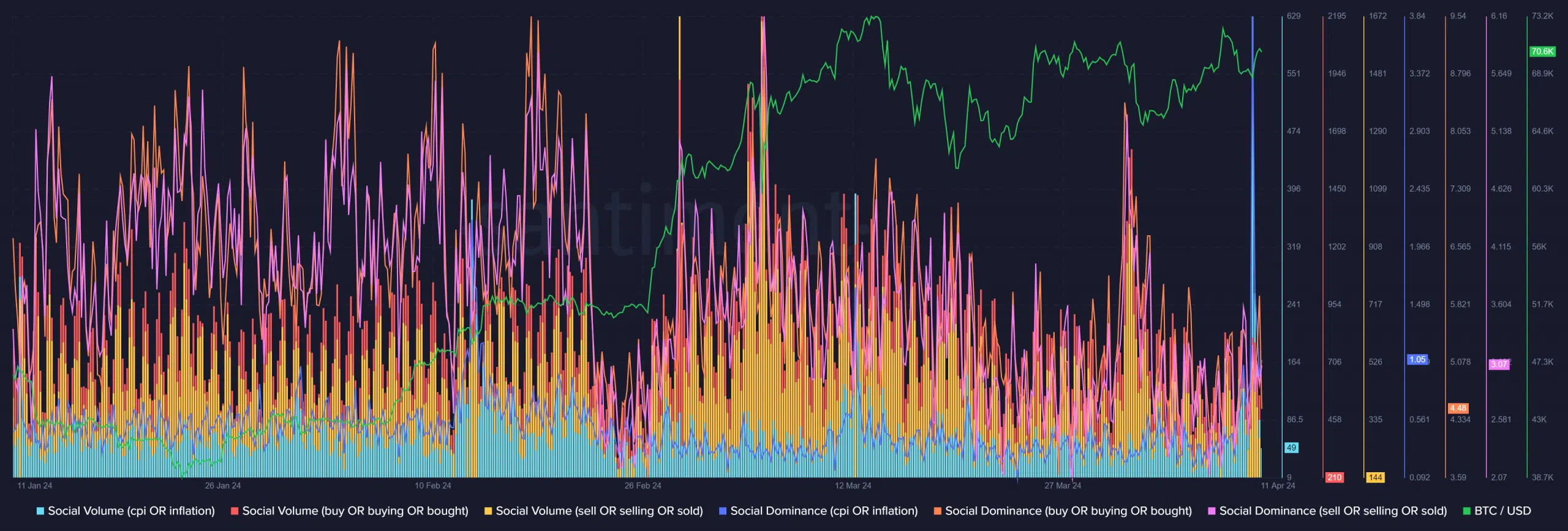

According to Santiment data, this month’s CPI report generated significant attention, evidenced by the highest number of mentions in social discussions. The social volume spiked to over 257, with social dominance reaching around 1.58%.

At the time of this writing, social volume had decreased to 49, while social dominance stood at 1.05%. The implications of this report have led to increased interest in crypto assets like Ethereum.

Buy calls put Ethereum in a favorable position

The CPI report wasn’t the sole topic driving increased interaction; discussions around buy and sell calls also saw heightened engagement. According to Santiment data, on 10th April, the social volume for buy calls reached 814, with a social dominance of 4.97%.

Conversely, the social volume for sell calls was 533, with a social dominance of 3.25%.

At the time of this writing, the buy social volume had decreased to 210, while the sell social volume was 144. Additionally, the buy social dominance stood at 4.48%, while the sell dominance was 3.07%.

These figures indicate a stronger inclination towards buying among traders, a sentiment reflected in Ethereum outflows.

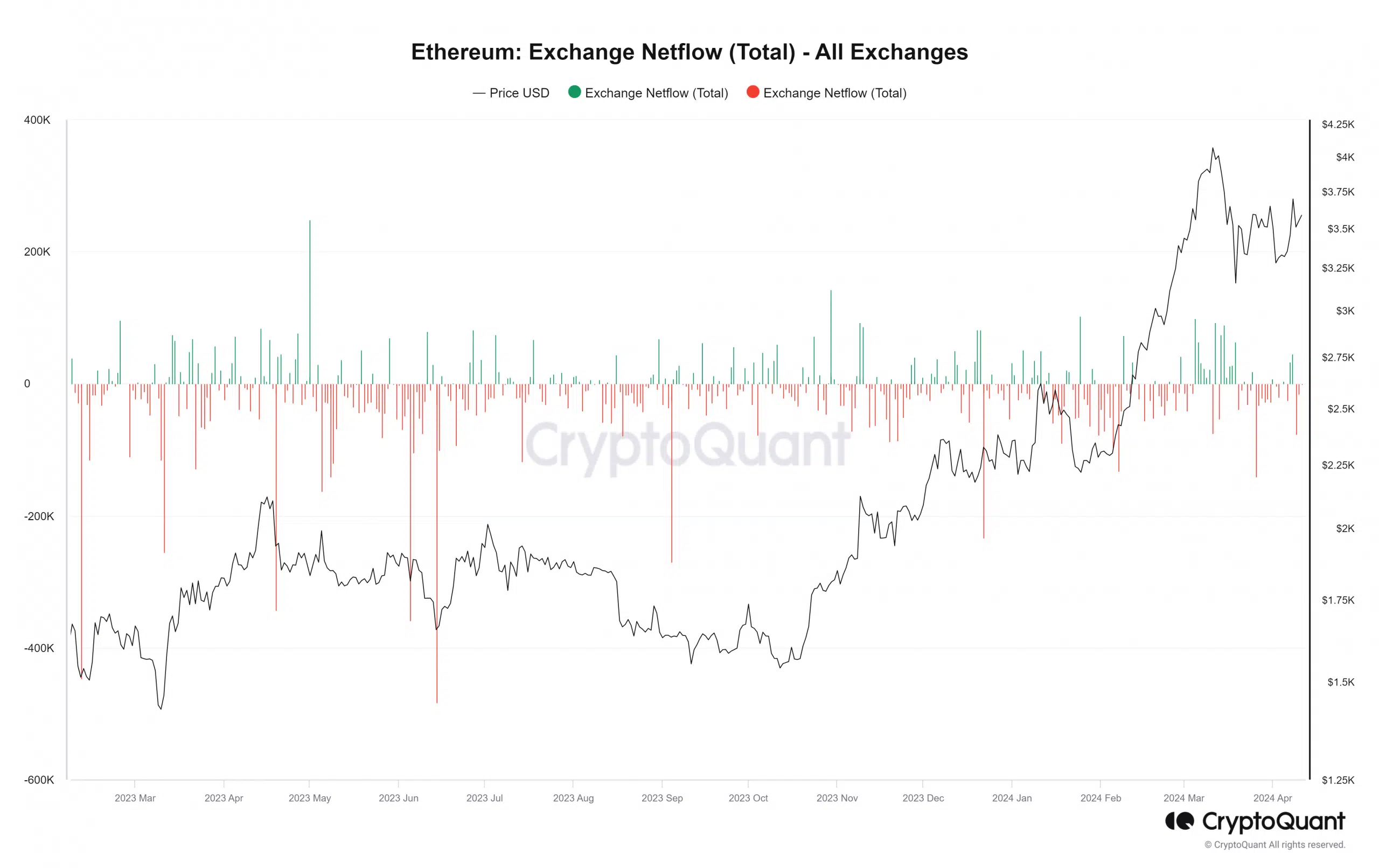

Ethereum sees more exchange outflow

Analysis of Ethereum’s exchange netflow reveals that the increase in buy calls following the CPI report is mirrored in its exchange flow. Data showed that outflow dominated ETH exchange flow, with over 15,800 ETH leaving various exchanges on 10th April.

As of this writing, outflow continued to dominate, with over 800 ETH already withdrawn from exchanges. This suggests heightened activity in ETH buying and selling post-CPI report.

Read Ethereum (ETH) Price Prediction 2023-24

Ethereum continues to climb post-CPI

The daily timeframe chart showed that Ethereum closed with a gain on 10th April, suggesting that the CPI report did not have a negative effect.

Analysis of the chart revealed that ETH closed with over a 1% increase, trading at around $3,400. As of the latest data, the increase has persisted, with ETH trading at around $3,580, reflecting a further over 1% increase.