Ethereum at crossroads: 11% surge Vs. multiple bearish scenarios

Ethereum, like Bitcoin, is stuck with its price trying to decide which way to move. The brutal sell-off that began on February 24 ended with most altcoins dead in the water. ETH rose 126% since 2020, however, it shed 23% of that surge in under 14 days.

Similar to most altcoins, Ethereum is undergoing sideways movement deciding whether to surge or drop.

Four-Hour Chart

Source: ETH/USD TradingView

At press time, ETH was worth $222 and was moving in a pennant formation. The breakout from this pattern has two obvious directions to go, surge or drop. However, at press time, the bearish drop seems likely. The On-Balance Volume for Ethereum was on a decline since February 24 indicating that money is moving out of the ETH market.

Simultaneously, MACD indicator, also stuck below the zero-line, looks feeble and almost ready for another bearish crossover. With receding green histograms, it looks like a possible outcome, supporting bearish breakout.

Assuming a bearish breakout, there are three possible scenarios on where ETH might end up. The first level is 7% away from its current price at $204, the second at $192, 12% away. Finally, the most bearish scenario is $178 which is 19% away from its current price.

A bullish case for ETH

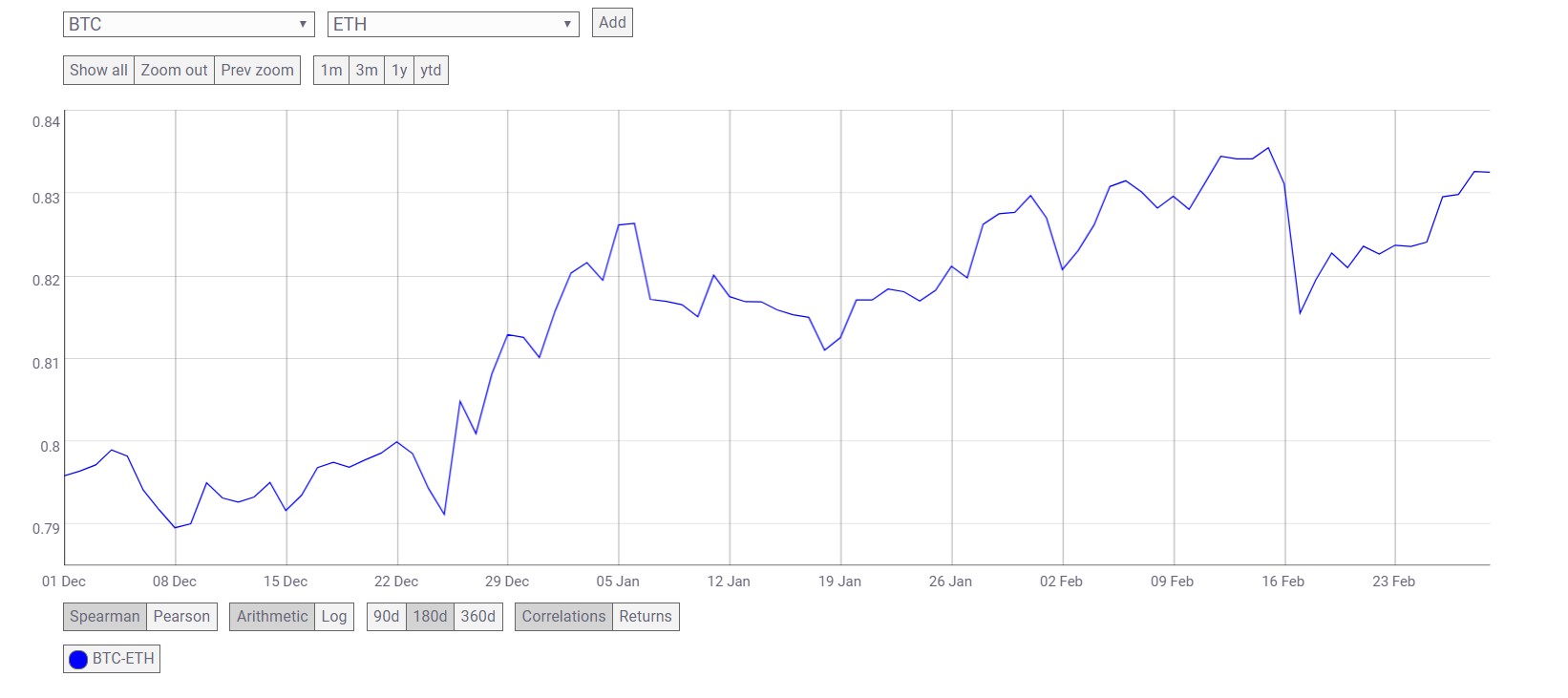

Source: Coinmetrics

Due to the staggering correlation that exists between BTC and ETH, a surge in the former would translate to a surge for ETH. Hence, a breach from the pennant would also cause the price to push to $244.69 which would be an 11% surge from ETH’s current price.

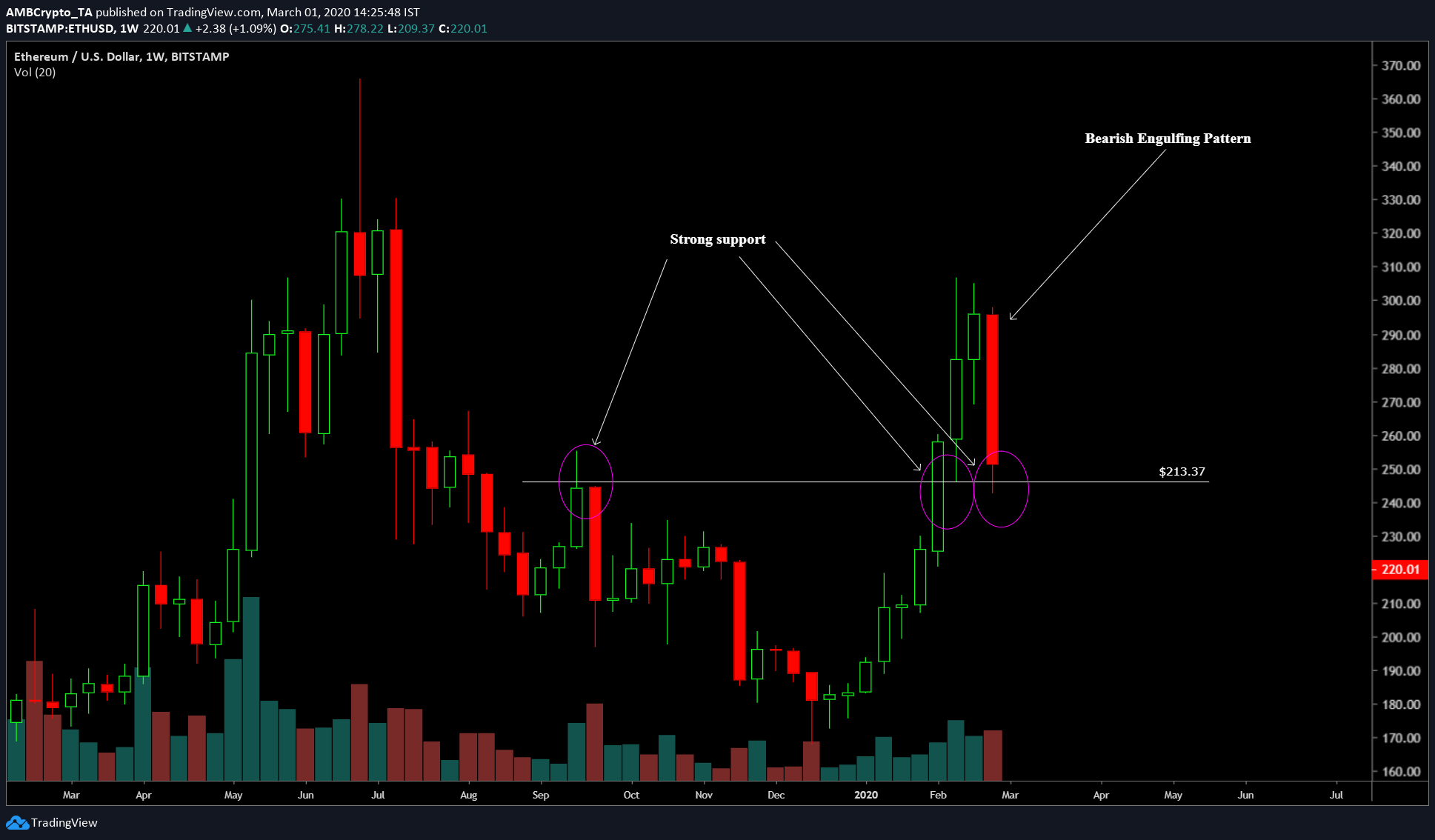

Weekly

Source: ETH/USD TradingView

With the weekly candle coming to an end tonight, the price of Ethereum looks as bad as it can. The weekly candle is a bearish engulfing candle but what makes it worse is that the bearish engulfing candle engulfs two candles. This means that the price has undone the last two weeks’ rallies.

Put it simply, ETH’s weekly candle has undone 35% of price surge that spanned over two weeks in less than a week.

Further, the only bullish thing in the weekly time frame is that the price was rejected by strong support at $213.37 which was tested by three weekly candles. Largely, ETH looks fine, however, considering the support, the price could still drop to the support.