Ethereum, Algorand, BitTorrent Price Analysis: 17 October

The entire digital assets market lately has been a sort of rollercoaster ride over the last week. The largest altcoin Ethereum noting successive drops over the last few days could finally be in for a bull run.

The Algorand market displayed mixed signals of buying and selling sentiment. While expectations around a bullish break out could clear out the choppiness in the BitTorrent market.

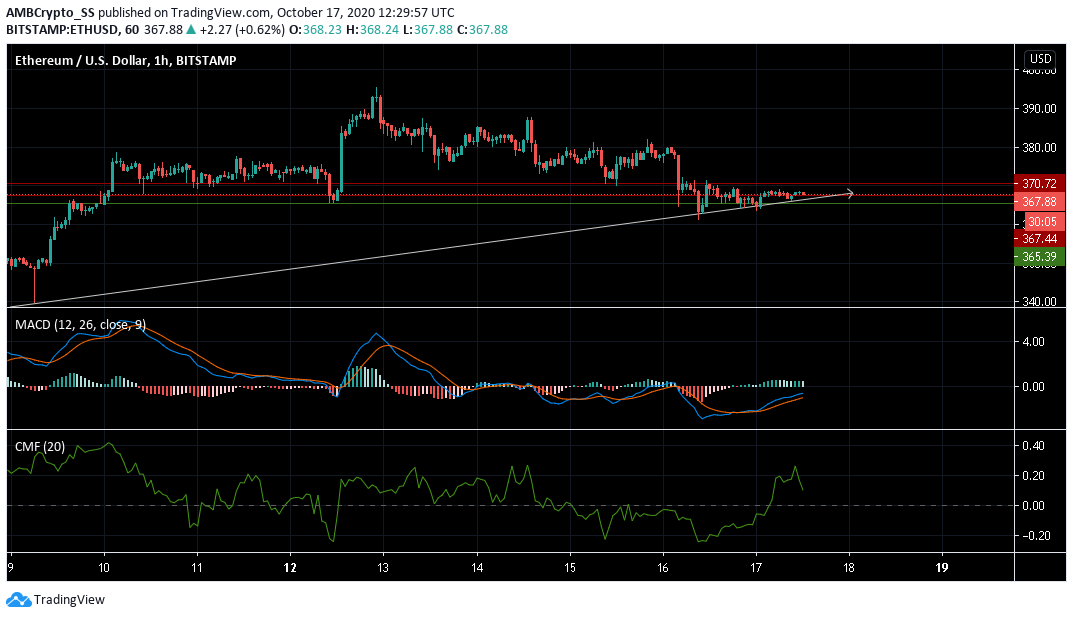

Ethereum [ETH]

Source: ETH/USD on TradingView

An overall uptrend was evident on Ethereum’s hourly chart. ETH price over the last 24 hours moved above the $365.39 level of support and towards a higher level of resistance at $367.44.

The MACD indicator continued to give a buy signal after its bullish crossover between the signal line and the MACD line, with the MACD line pointing upwards.

The Chaikin Money Flow indicator although noting a slight dive recently was still above the zero line.

This is an indication of the capital inflows still being higher than capital outflows, with a buyer’s sentiment intact in the Ethereum market.

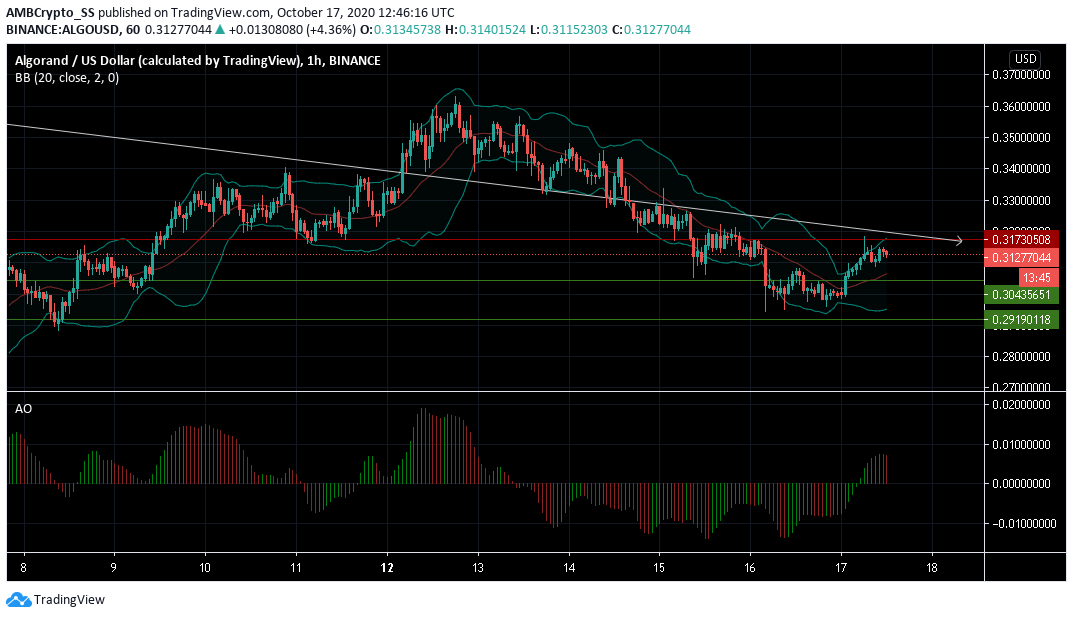

Algorand [ALGO]

Source: ALGO/USD on TradingView

The Algorand trend lines displayed a clear downtrend. However, a good buying momentum witnessed in the ALGO market resulted in a 2% price surge over the last 24 hours.

The price support for the cryptocurrency has been holding at $0.304 while the resistance at $0.317 is yet to be broken. The Bollinger bands on ALGO pointed to a clear divergence, which was indicative of the increased levels of volatility.

This further resulted, in the prices shooting towards the upper bands. The Awesome Oscillator however has taken a turn for the worse, after having witnessed a bullish crossover not long ago.

The red closing bars were indicative of a minor pull back, that could become more prominent over the next few trading sessions.

BitTorrent [BTT]

Source: BTT/USD on TradingView

BitTorrent’s price breakout could just be lurking around the corner as it remains intact in the short-term symmetrical triangle pattern (yellow lines).

Above all, the digital asset’s volume has also been extremely low during its trading session for the day, meaning a possible breakout scenario might need a few more trading sessions to gather good momentum.

Stochastic RSI witnessed a drop below the overbought territory, reflecting choppiness in the BTT market. If it can continue to stay above the 50 level, BTT investors could gain from an upward price breakout soon.