ETH options trading may increase after ETH volatility spread is less than BTC

Over the past month, trading sentiment for Bitcoin and Ethereum has been rather bleak. After a recent phase of consolidation and the flash crash on 25th October, the two largest assets were currently trying to resist a bearish pullback in order to maintain a higher buy volume.

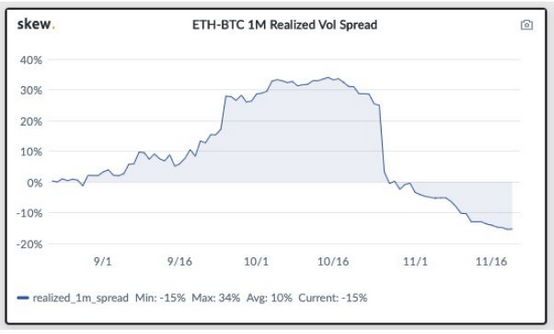

According to recent data from skew.com, it was observed that the ETH-BTC 1-month realized volatility spread was at a monthly low of -15 percent. On October 19th, the realized volatility spread of ETH was priced at 32 percent above BTC, which indicated that buying into ETH options was more expensive.

Source: Skew markets

At press time, drop in ETH/BTC realized volatility spread indicated that ETH options were posed to indicated better yields to buyers than BTC options. ETH volatility is currently less than BTC, which a trend that was unconventional by market standards.

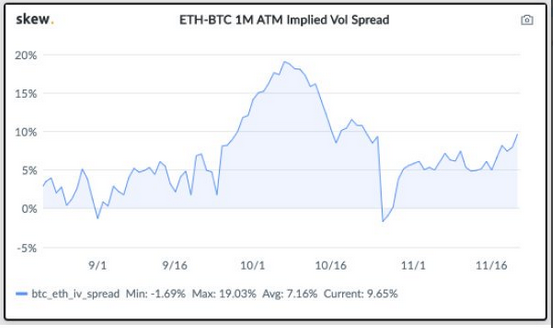

Source: Skew market

However, it was observed that despite the drop in realized volatility spread, ETH’s implied volatility was priced 10 percent above BTC implied volatility over the past month. The above chart indicated that the relative value on carry trade was more attractive for Ethereum holders, and the buy volume of BTC with ETH was higher.

The purchase of ETH options may increase over the next few weeks before the ETH volatility spikes up against BTC volatility again.