Ethereum at $600 in 2018 & 2020, what’s the difference?

ETH has finally hit $600 after a long wait that started in 2019. ETH was trading above $400 since November 6. The altcoin finally crossed $500 on November 20, 2020. Over the weekend, trading momentum was sustained and the weekly return is 28.60% based on data from CoinMarketCap.

Though the current price rally has echoes of the 2018 bull-run, there is a stark contrast between the two. In 2018, ETH maximalists and whales were mostly the only active ones. Both the number of users and the demand was low, relative to 2020. ETH 2.0 wasn’t even conceptualized and DeFi’s DAI had just launched in late 2017. The market capitalization of ETH was $129 Billion.

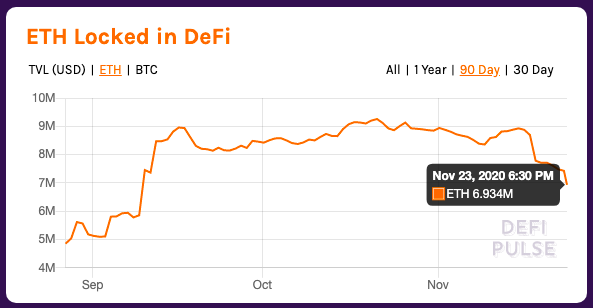

After the third halving, in 2020, we are closer to the launch of ETH 2.0, than we were, ever before. ETH has become the poster boy for DeFi with over 6.93 Million ETH locked in DeFi. Gas usage is at an ATH and so is the transaction fee. Nearly $14 Billion worth of ETH is parked in top DeFi projects and ETH 2.0’s deposits have closed.

Source: Twitter

Though the market capitalization in 2020 is nowhere close to the 2018 level, Ethereum has more real users and real users. If there was a fear of ETH turning into a zombie chain, it was now when ETH 2.0 launch was getting delayed nearly every month and the network was more congested with the increasing transaction volume. With the launch of ETH 2.0 closing in, ETH maxis are expecting a sustained price rally, closing above $600 on launch. Additionally, DeFi Projects like Curve, AAVE, and Sushiswap have offered two-digit, three-digit returns to users who have parked funds in them. This wasn’t anticipated after the bloodbath of September 2020.

ETH TVL in DeFi || Source: DeFiPulse

Locking ETH in DeFi may have played a significant role in the price rally, as it created a supply shortage. ETH reserves on spot exchanges are dropping just as they are for BTC. ETH’s correlation with BTC has remained at 0.8 for most of Bitcoin’s price rally and this has helped DeFi. Since DeFi is known for its inverse correlation with BTC and its bloodbath of September 2020.

2020 is more bullish for ETH than other altcoins, and this time around the Bullrun is supported by stronger fundamentals and support from DeFi.