Do DeFi shorts make sense anymore? No, says exec

Until a few months ago, DeFi was quite the rage across the ecosystem. Of late, however, the space seems to have lost some steam, with many projects failing to sustain the early gains it made. Understandably, many in the community have since become more skeptical and cautious about the space. CEO of Three Arrows Capital Su Zhu is one of them after he recently cautioned against DeFi shorts.

In fact, Zhu also claimed that they don’t have a good risk/reward ratio, compared to the U.S dollar, in a tweet.

On the other hand, a long DeFi/ETH cross would make sense, Zhu said, especially since “top tier projects are approaching levels where long-term investors would deploy fiat.” Further, the exec also expects 95% of DeFi coins to be down v. Bitcoin over the next few months.

This is an interesting prediction, especially since this further feeds into the narrative that the DeFi craze may be evaporating as Bitcoin continues to rise. It also seems that new money entering the market only wants Bitcoin, at least at this point.

No ico craze this time and Defi 2.0 turned out to be a dud firecracker so far.

— Michael (@michaelgraub) October 27, 2020

Interestingly, Su Zhu’s current prediction is also contrary to what many traders and crypto-influencers stipulated in the past. In fact, most believed that altcoins backed by DeFi projects had a degree of sophistication and would continue to rise over the new few months.

However, most of the market’s most-popular DeFi projects such as Synthetix ($SNX) and Yearn Finance (YFI) have all fallen by over 50% since touching their ATHs.

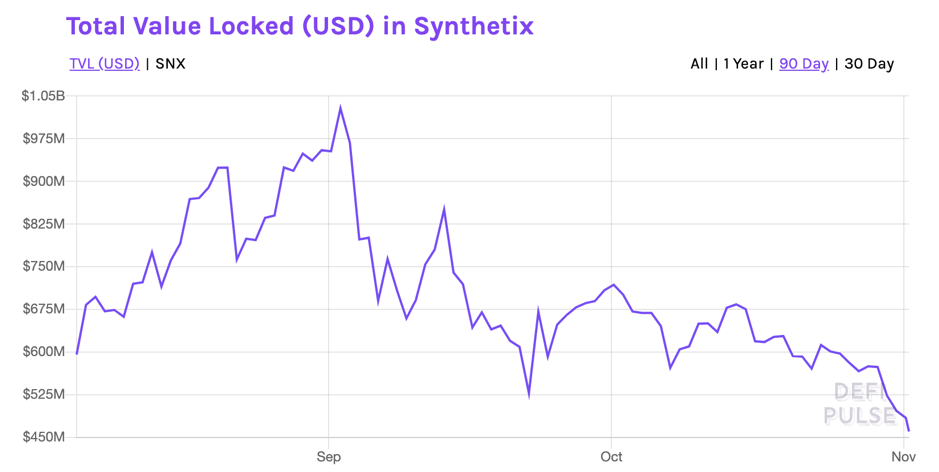

The attached chart highlights how Synthetix’s Total Value Locked (TVL) has fallen significantly from its all-time high of $1.028 billion just two months ago. What’s more interesting is that despite enormous drops in value, Synthetix and Yearn Finance are still among the top 10 projects by TVL, as listed by DeFi pulse.

These projects were expected to continue to rise over the next few months, but it would seem that the momentum has slowed of late.

As Su Zhu was quick to point out, the expectation is 95% of DeFi coins will be down compared to Bitcoin, leaving a 5% chance of earning alpha on the ‘right choice’ of a DeFi token. However, as can be seen with $SNX and $YFI, tokens that are extremely popular aren’t immune to market-wide depreciations either.

This makes identifying a DeFi token that could be in the 5% alpha bucket exceedingly difficult.