Despite price woes, Bitcoin dominates cryptocurrency market by 90%

With the speculation of global recession setting in, Bitcoin is on the path of becoming a safe-haven asset

The Bitcoin community has been down to biting its nails when it comes to the price of the market’s largest crypto. The crests and troughs in the price of the coin indicated high volatility in the market, something not new for the community. However, the market has recently been talking about the impact a global financial crisis could have on the king coin.

Spencer Bogart, a partner at Blockchain Capital, thinks that Bitcoin’s price could struggle if such an event were to transpire.

Bogart told Bloomberg in an interview,

“…when you think about really severe crisis taking place like a liquidity crunch or another global financial crisis, I think that Bitcoin will struggle to do very well from a price perspective. Now, I think it will continue to do well from a utility perspective. Bitcoin can withstand bank closures, etc. and can still continue to function very well. But again in longer-term, it is going to continue to evolve into that Safe have asset. “

Bogart believes that the price of BTC could shoot up and would be a lot more valuable than it is today, hinting at the price trajectory that took place two years back in 2017. As the price of Bitcoin struggles, it is merely an indicator of its success and a research report by Arcane suggests that the dominance of Bitcoin has been way higher than what has been traditionally reported.

Bitcoin, as a project, has been a success and the price of the coin has been indicative of its value and dominance above other coins in the market. However, according to the aforementioned research, focusing just on its price is a flawed measure and “actually underestimates the relative strength of Bitcoin in terms of relative valuation.”

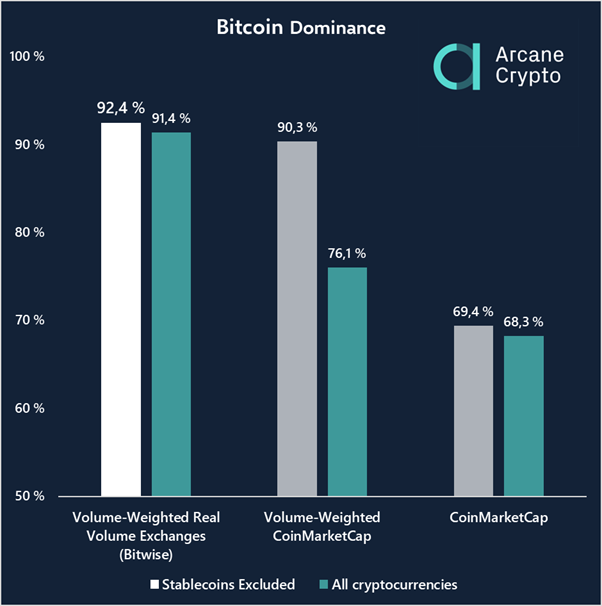

While CoinMarketCap reflects BTC’s dominance over other cryptos as 70%, Arcane’s research says that liquidity of the coin is something that hasn’t been considered, a metric which plays an important role in identifying dominance.

“One might be able to sell one token for 3 dollars, but what happens if you want to sell 1 million? Without accounting for liquidity, market capitalization becomes a meaningless measure.”

Due to Bitcoin’s higher liquidity, Arcane’s dominance calculation with its liquidity gives a figure closer to 90%, which stands true without stablecoins, or on the 10 exchanges identified by Bitwise to have “real” volume.

Source: Arcane research

As the research says that Bitcoin is well-positioned to become the money of the Internet, Spencer thinks that it will work towards becoming a safe-haven asset in the longer term.