DeFi’s yield farming returns: Sustainable for everyone?

After months of hype and activity, the DeFi space is finally facing some tough questions. This, after the space noted major price corrections over the past week, with the top ten DeFi assets sustaining an average loss of 23.4% and losing an average value of 27.44% over the past month.

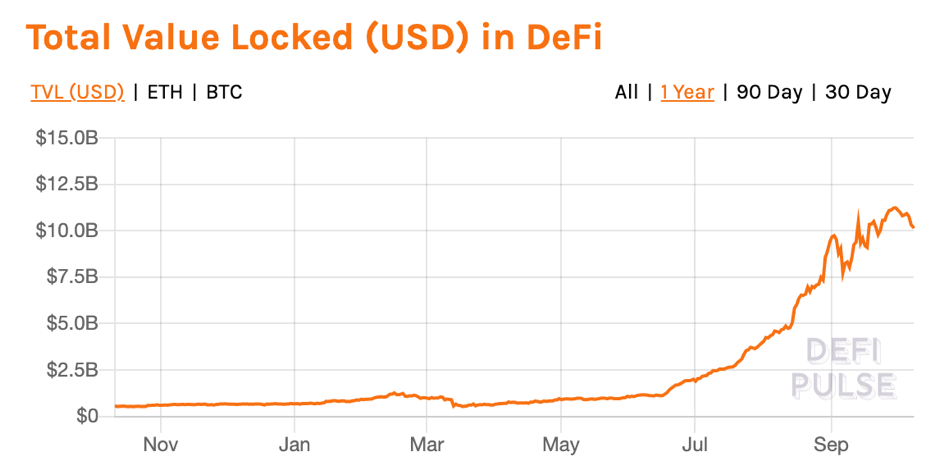

Here, it should be noted that DeFi gained immense traction and popularity earlier this year, driven almost exclusively by high yields offered by the practice of yield farming. In light of this week’s sell-off, many have raised questions as to whether this is “the end” for DeFi and its supreme short-term returns.

As it happens, such concerns are being aired not only by users but by prominent voices in the cryptocurrency community as well.

Finder’s latest update to its Cryptocurrency Predictions Report found that 73% of the panelists believe that excessive hype and market manipulation will challenge DeFi’s growth.

That being said, Jason Lau, COO of OKCoin, noted that,

“With banks and other traditional saving vehicles offering near-zero yields, protocols that deliver sustainable returns on staked assets will draw attention from investors.”

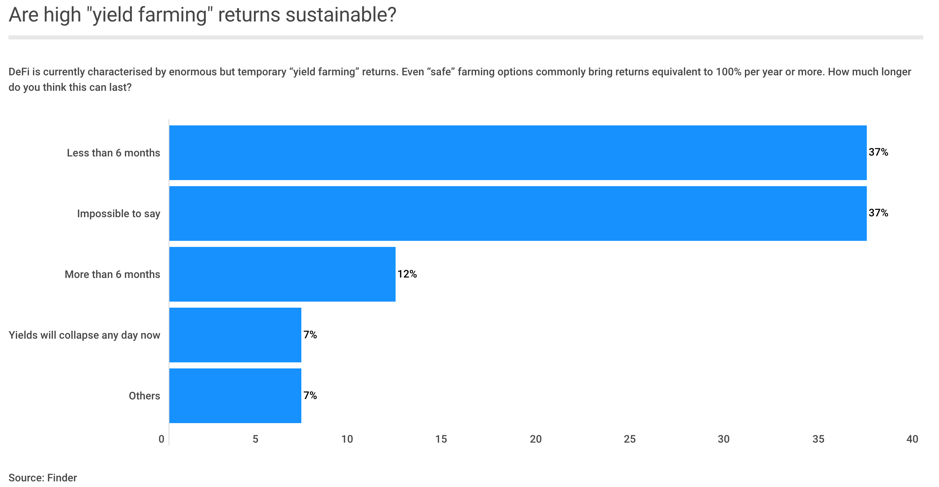

This is a crucial argument, especially since a recent report suggested that even “safe” farming options commonly earn returns equivalent to 100% a year or more.

Thus, the question arises – How much longer can these returns last? When asked this question, 44% of the panelists said that they believe these returns would drop off in the next six months, with 7% of them saying it could happen any day now.

There are also concerns that the returns promised by such projects will fall as the degree of risk falls, if and when they become more established. This was a sentiment echoed by Gavin Smith, Managing Partner at Panxora DeFi Hedge Fund, who said,

“The reason for the high returns is the underlying risk of a collateralized loan pyramid. As the products become more established, the risks will fall along with the returns.”

Despite serious questions about the sustainability of massive DeFi yield farming returns in the near future, 64% of the panel surveyed said that they believe DeFi will grow even more over the next 12 months.

Such confidence in the space was highlighted by Pantera Capital’s recent announcement to double down on the DeFi space, joining Andreessen Horowitz and other firms that are already doing so. This is interesting since this show of confidence is in sharp contrast to the hesitance of retail investors.

Many of the same people who are pushing these DeFi scams are the same people who were pushing the ICO scams.

They took your money then and they’re going to take your money now.

Proceed accordingly.

— Pomp ? (@APompliano) October 8, 2020

While popular crypto-influencers have been taking to Twitter to recommend caution about investing in the DeFi space, the continued resilience of crypto-hedge Funds leaves us with an important takeaway.

Despite the recent price correction in the DeFi space, the long-term outlook for projects with strong fundamentals remains steady. If anything, what recent performances highlight more than anything is the importance of DYOR to identify worthy projects to invest in.