DeFi’s bright summer is putting crypto-assets in the shade

The cryptocurrency market has been stuck in a rut for quite some time now, with most of its major cryptos choosing to consolidate their positions. In fact, Bitcoin, the world’s largest cryptocurrency, has been noting a kangaroo market of sorts, one wherein it has been jumping between its immediate resistance and support.

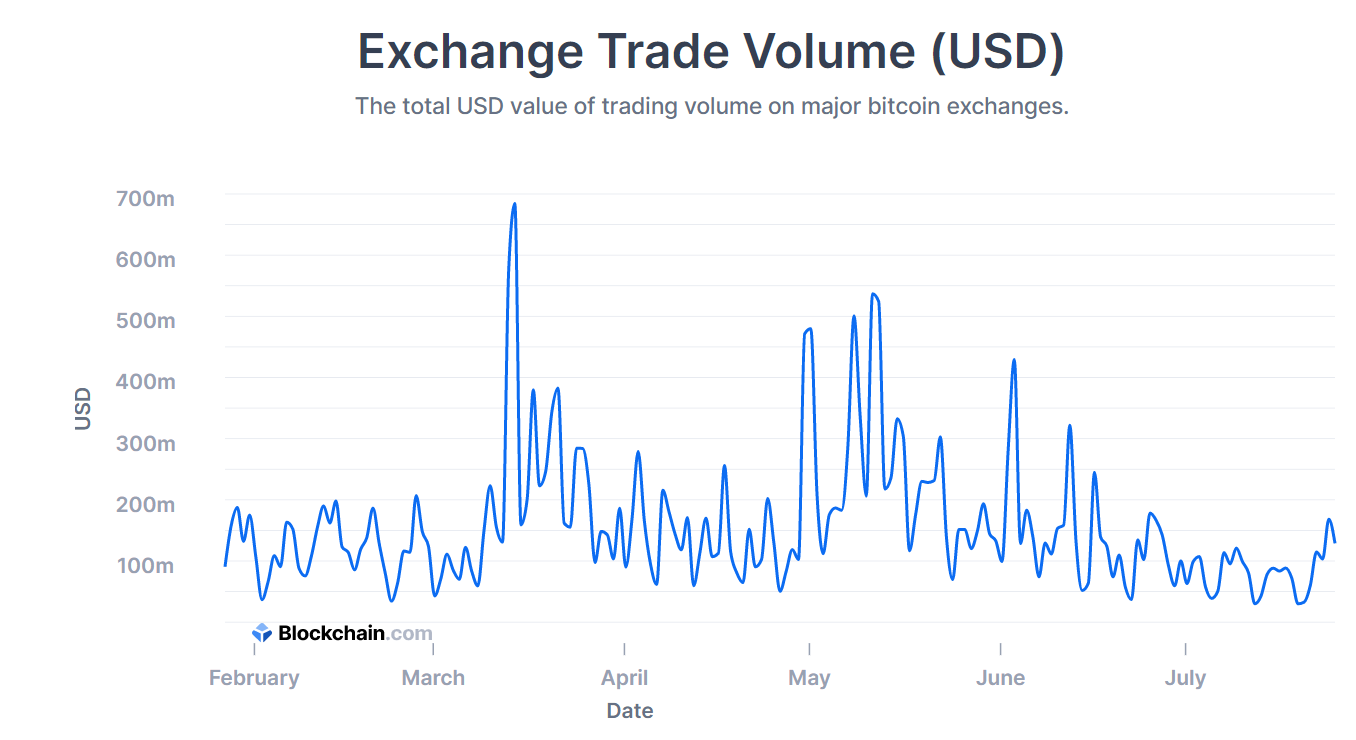

This trend in the Bitcoin, and by extension, the larger crypto-market, became visible after Bitcoin’s halving in May. According to data collated by Santiment Network, the trading volume of Bitcoin declined by a whopping 75% from $106 billion to $26 billion.

Source: Blockchain.com

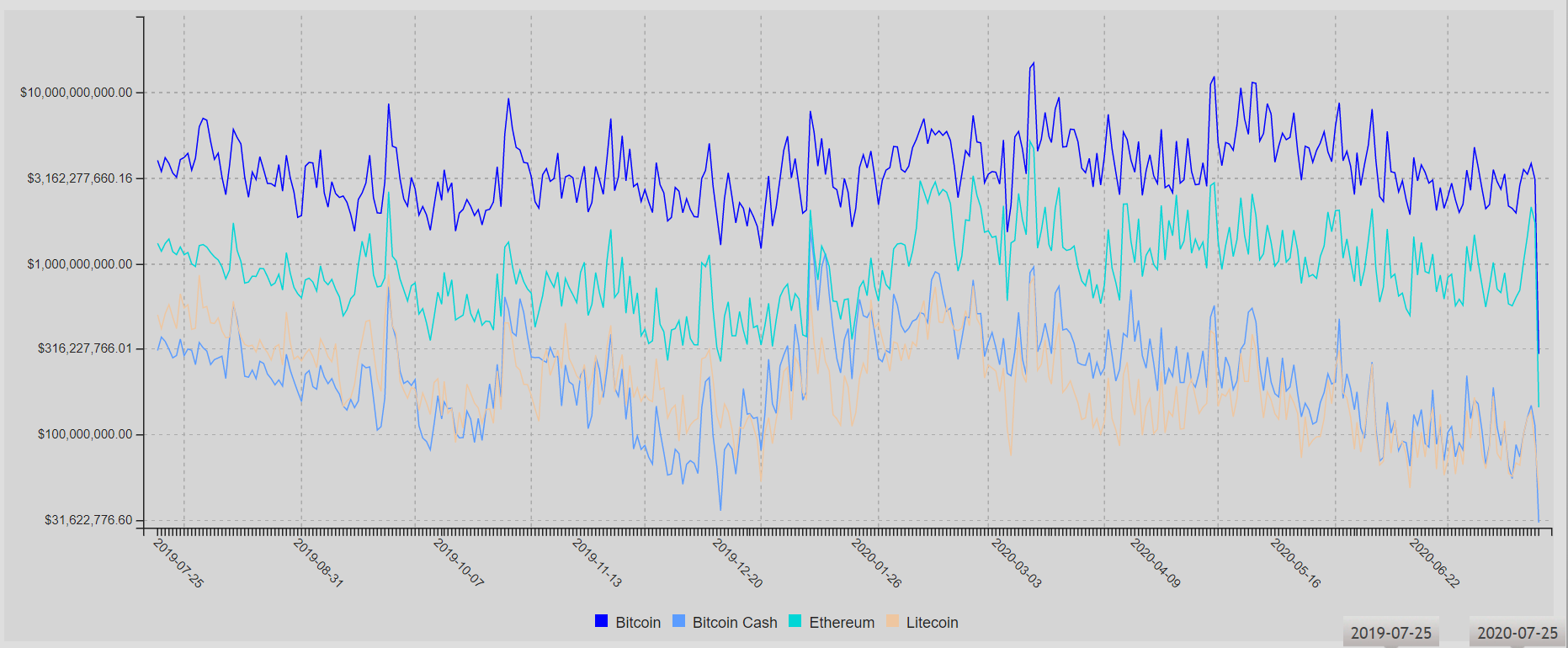

The fall in on-chain metrics was not just visible in Bitcoin, but other prominent large-cap cryptos like Ethereum [ETH], Bitcoin fork-Bitcoin Cash [BCH], and Litecoin [LTC] as well, with all of them noting a falling trading volume.

Source: CryptocurrencyChart.com

After taking the past month’s values into account, it can be observed that the crypto-ecosystem lost 24% of the trading volume.

On the contrary, for DeFi, it seems like summer is around the corner.

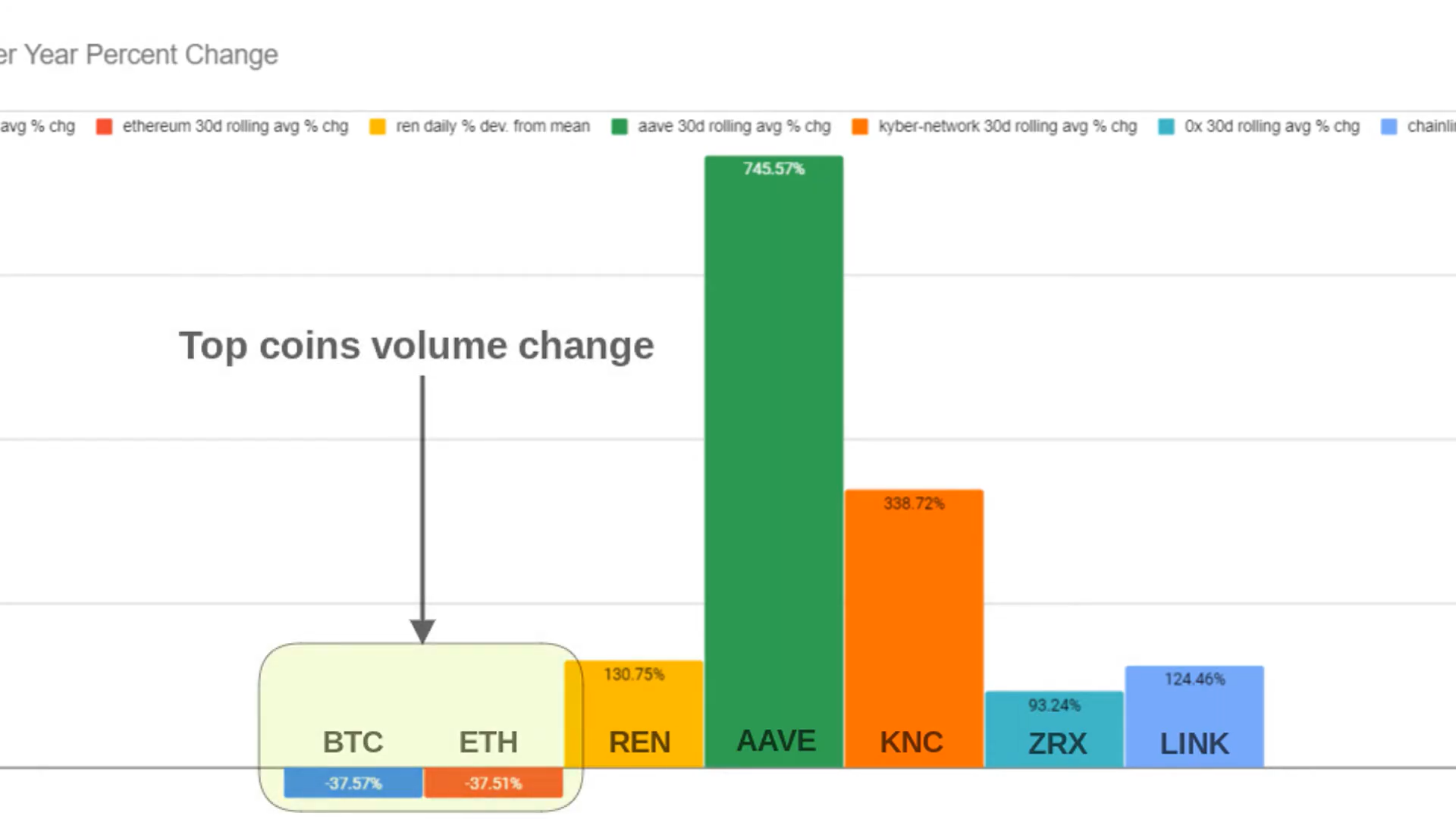

The Decentralized Finance [DeFi] space has been built on Ethereum, so the crypto has been lucky to share the growth via its extended Ethereum ecosystem. According to data, over the past month, DeFi tokens’ trading volume has surged by 98%. With the crypto-market devoid of much volatility, all roads seem to be leading to DeFi.

Here, it is interesting to note that this shift in interest took place in two waves – one happening in May and the second one following in early-June.

The DeFi summer has 38 tokens, all of which have contributed greatly to the progress noted by the space this year. Projects like RenBTC [REN], Bancor Network Token [BNT], EthLendToken [LEND], Synthetix [SNX], KAVA, etc. have been especially notable for their contribution towards reversing the prevailing trend in the DeFi space.

Source: Santiment Network

Another interesting observation is that DeFi’s growth isn’t based on speculation. These DeFi tokens’ exponential growth was supported by strong fundamentals, suggesting that the growth was organic.

However, might this just be a phase for traders to cash in their profits, as they did during the ICO craze? Here, it is important to note that the growth in new addresses on DeFi did not stem from any increase in the coins’ utility. In fact, there have been doubts within the crypto-community about the creation of a DeFi bubble. Alas, it cannot be said with any certainty how the platform will evolve in the future.

Right now, the crypto-market may have to wait for volatility to creep in and shake up the dull market. Until then, the traders seem to have found some relief in DeFi.