Bitcoin: Is regulations v. privacy a balancing act?

Cryptocurrencies have tried to accomplish quite a lot in the last ten years. This is evident, particularly in the case of the world’s largest and oldest cryptocurrency, Bitcoin. From being positioned as a decentralized form of cash that rivals traditional fiat to being considered as a robust store of value that gives gold a run for its money, the use cases of crypto seem to have not only diversified, but have also become a lot more accessible.

However, in light of its relative success, it is only likely that there may have been compromises made. The past few years demonstrated how scalability and decentralization are often at odds with each other, and the same can also be argued when it comes to increasing crypto-regulations and financial privacy.

On a recent episode of the What Bitcoin Did podcast, Brian Armstrong, Co-Founder & CEO at Coinbase, discussed issues pertaining to cryptocurrencies like Bitcoin becoming easier to use and the role of blockchain analytics companies, the latter of which seem to be generating extremely divisive opinions regarding whether or not they are required. Armstrong highlighted,

“There are certainly some challenges if you want to get easy payment methods hooked into crypto. Well, at least on those platforms, you’re probably gonna have to give up some privacy. If those things are gonna follow the law and stick around.”

Armstrong went on to note that when it comes to AML regulations, the basic idea is that of deterrence, adding that this could lead to quite a few operational challenges for exchanges like Coinbase. He argued,

“We’ve tried to work with regulators and even if every regulation isn’t perfect and has some unintended consequences, they do some good and we have to follow the law to kind of stay in business.”

However, one of the key differentiators for the crypto-market, as opposed to traditional finance, is the ability to have a higher standard of financial privacy. With the sudden growth of blockchain analytics companies, many feel that the differences between crypto and traditional finance from a privacy standpoint may be at risk.

However, Armstrong suggested that even though encryption is a new norm on the Internet, it should definitely be the default in finance. Highlighting the rationale behind Coinbase Analytics, Armstrong went on to say that it is primarily to limit data sharing with third parties.

Regarding third party blockchain analytic companies, he said,

“They are essentially selling data that’s publicly available. It’s just, they’re packaging it up right. They’re looking at all the public blockchains. And they’re saying, what kind of patterns do we see?”

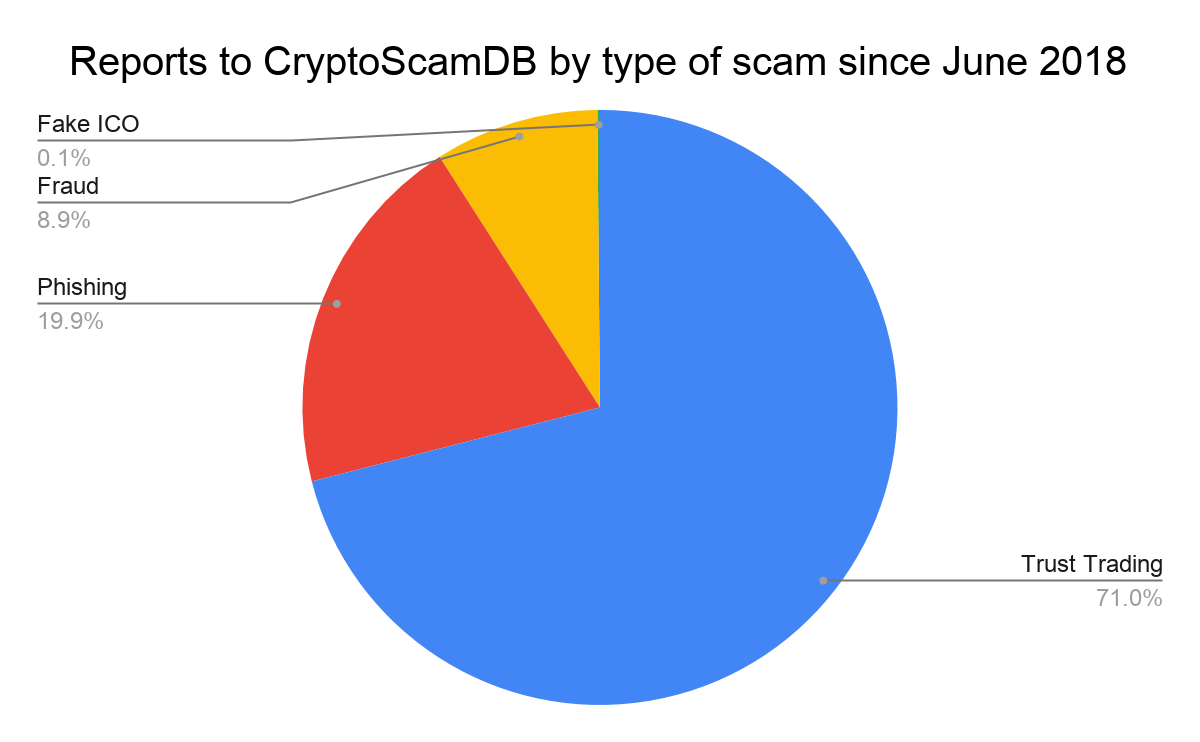

Source: CryptoScamDB

The debate over the necessity of analytics firms for the crypto-industry is likely to continue.

According to data collated by Chainalysis from CryptoScamDB, an open-source database that enables users to report scams and their associated cryptocurrency addresses, since 2018, trust trading has been responsible for over 71 percent of the reports they receive. The recent Twitter hack can be considered to be the most recent and most sophisticated.

Given the circumstances, just like how scalability has had to re-negotiate terms with decentralization, regulations and safety concerns may soon need to do the same with user privacy and reach a middle ground.