Here’s why DeFi may be down, but not quite knocked out

Genesis lending has been an industry leader when it comes to loans/borrowing and lending on both retail and institutional levels. In its recent Q3 report, quite a few interesting developments came to the fore.

Loans

Source: Genesis

For starters, the loan originations increased by more than half in Q3 of 2020, when compared to Q2 of 2020. The total originations were observed to be worth $5.52 billion.

Reason: Starting mid-2020, the DeFi hype contributed to a lot of lending/borrowing on DeFi platforms. However, it would seem that the point of origin for most loans might have come from Genesis.

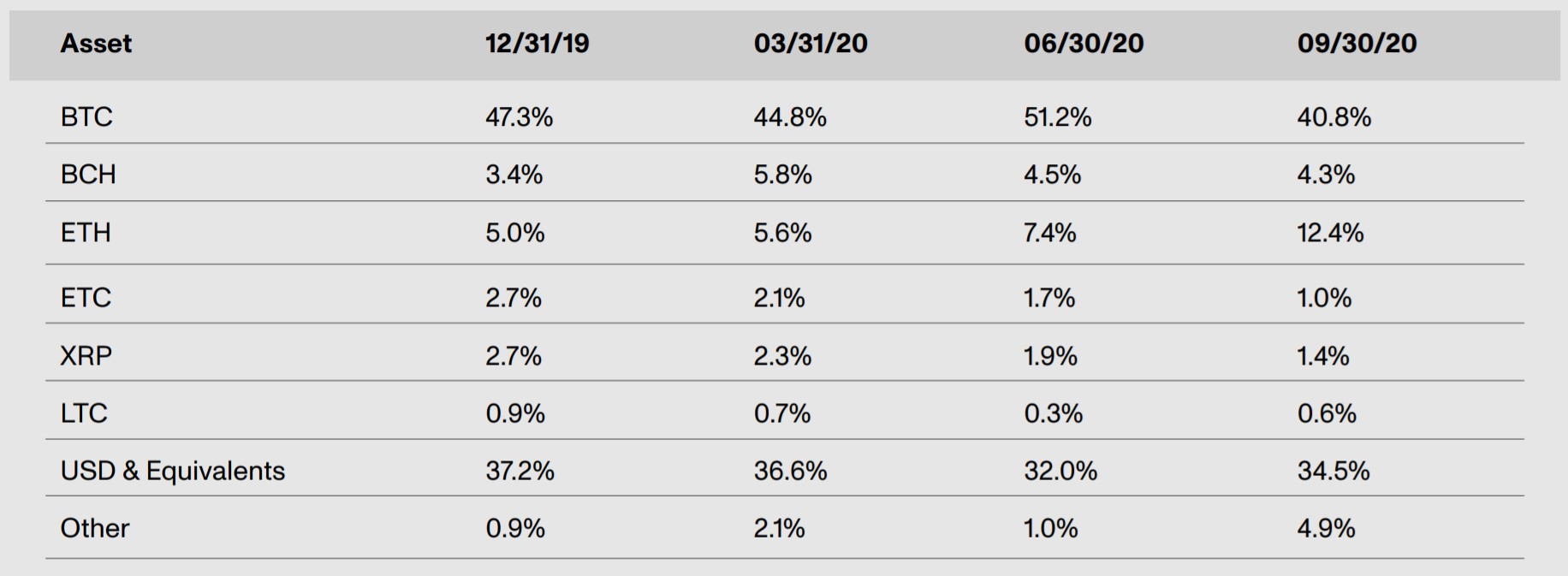

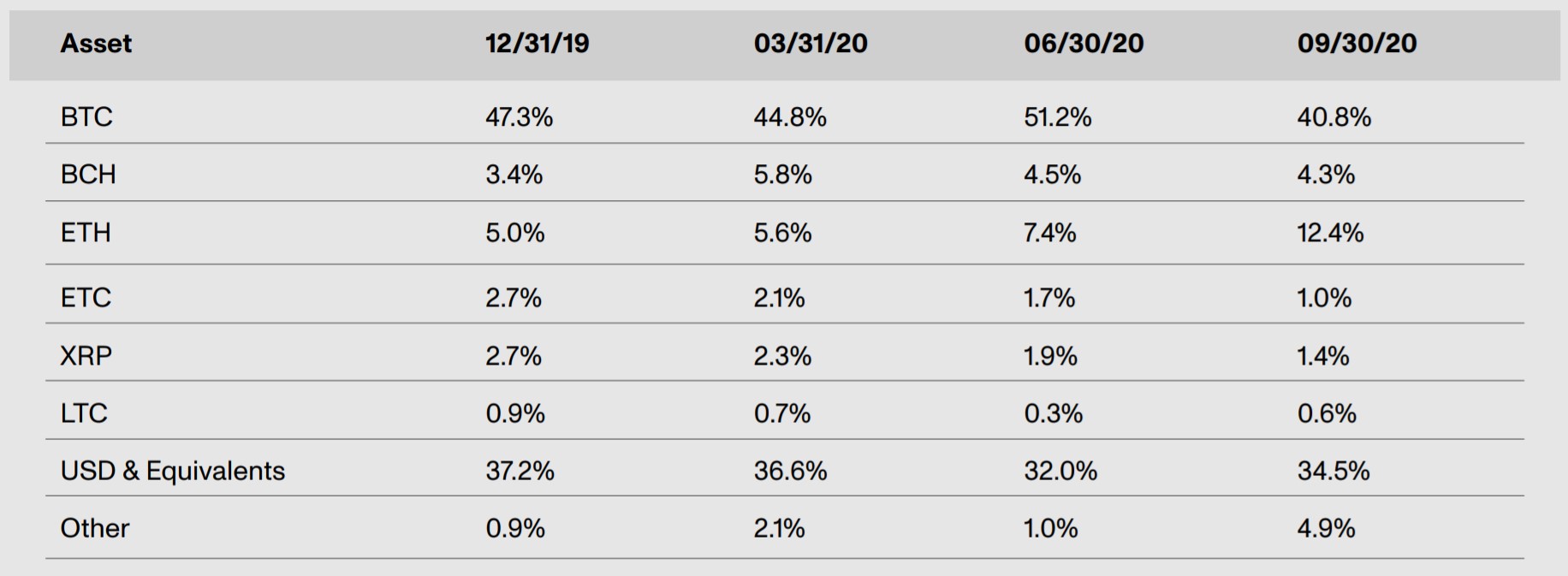

Composition

Diving deeper into the report’s findings, we can see that like always, the most borrowed asset was BTC. However, it should be noted that this was the case despite a drastic collapse from it being at 51.2% to 40.8%.

Source: Genesis

While it still remains the largest, Bitcoin’s demand fell due to the DeFi hype. Assets like USD, ETH, and other cash equivalents were more preferred for liquidity/yield farming/mining. The report added,

“ETH, USD and Equivalents and “other” altcoins drove the increase in book size in Q3. ETH loans outstanding jumped to 12.4% of the overall book, USD increased to 34.5%, and other altcoins jumped to almost 5.0%.”

Clearly, the DeFi hype has died down right now. And yet, we can expect this growth to continue at some rate due to one simple reason – Bitcoin.

Bitcoin recently tapped the $14,000-level after 1000+ days, having also broken out of a major bearish pattern on the higher time frame. While DeFi helped cement the initial surge, Bitcoin will propagate higher by itself, thus keep this trend alive.

As for the DeFi market, it will make a comeback, one that won’t be dissimilar to what altcoins do in the alt season. Additionally, DeFi still has more than $10 billion in value locked, despite the hype dying down, a figure that underlines real potential and people’s interest. However, it still has a long way to go from where it stands, with hype, buggy smart contracts, and scams, stopping it from onboarding institutions.