Cryptocurrency’s future may lie in Asia, and not the US, claims SEC’s Hester Peirce

Hester Peirce, popularly known as ‘crypto mom’ among crypto-enthusiasts, is in the news after she said that Singapore’s regulatory authorities were more open towards engaging and having discussions with the community. Here, Peirce cited her previous visits to Singapore, during which she got more hands-on knowledge about the rapidly booming crypto-environment in the city-state.

Highlighting the bigger picture, the libertarian regulator, in an exclusive interview with Longhash, stated that the future of crypto might be in Asia, and not in the US. With growing bans on trading on crypto-exchanges within American borders, Asia is emerging as the focal point for cryptocurrency exchanges and mining activities.

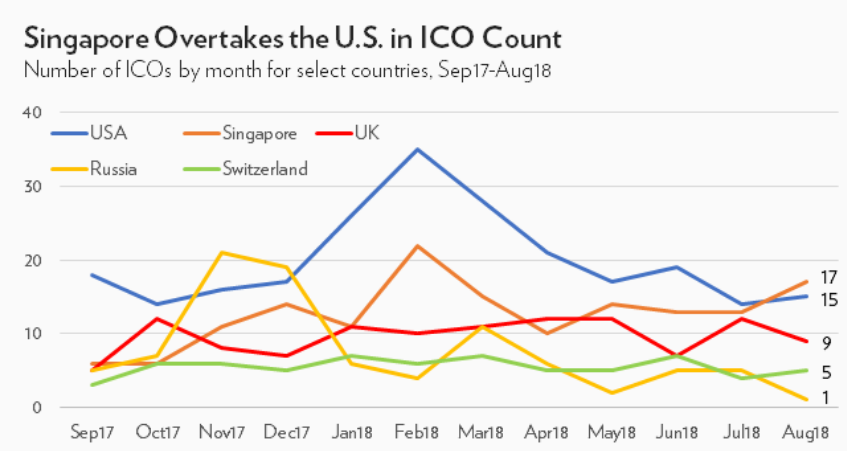

Moreover, major economic hubs of Asia already have regulatory advantages, cryptocurrency talent and investments to boost the crypto-economy. Clarity in rules and regulations make Singapore a favorite destination for crypto-hobbyists and traders. In fact, Singapore has already hosted more Initial Coin Offerings than the US.

Singapore was the base for over 40% of all smart contract platform projects from the 2017-2018 token sales. This can be attributed to the fact that Singapore openly embraced the same, an attitude that was diametrically opposite to the actions of other jurisdictions.

Source: Long Hash

It is evident from the graph that ICO projects are a popular fundraising method for cryptocurrency startups, and these are declining in the United States and elliptically surging in Asia’s economic capital. European nations, Switzerland and UK stand third and fourth, with Russia at the bottom of the list. Pierce also shared that the governments in Asian markets are viewing cryptocurrency as an opportunity, rather than as a threat. Peirce added,

“What we’re really trying to get to is a world where [ICOs] are utility tokens or payment tokens and this is where I think Singapore has thought through the issues a little bit more clearly than we have. And if you’re trying to get to that point, I’m not sure you can apply the securities law framework in the way that we’ve been applying it.”