Cosmos, DASH, Cardano Price Analysis: 20 July

Cardano, Cosmos, and Dash registered contrasting price movements over the past 24-hours, with many of the market’s altcoins continuing to note high trading volumes on their charts. In fact, owing to such a performance, a strong case for an ‘altcoin season’ was being made in the industry. However, there was not much to choose from between the aforementioned crypto-assets, at press time.

Cardano [ADA]

Source: ADA/USD on TradingView

Leading the altcoin rally from the front, Cardano’s ascent up to 6th on the chart has been impressive. However, contrary to its price performance over the past few months, the crypto-asset registered a decline of 0.23 percent over the past 24-hours. A potential breakout from the ascending triangle may reverse the trend in the near future, with the market cap steady at around $3.18 billion.

Market Indicators were rather neutral, at the time of writing. While the Relative Strength Index or RSI suggested neutrality between the buyers and sellers, the Bollinger Bands were observed to be converging on the charts, indicative of reduced volatility.

Recent reports have suggested that Cardano may launch an ERC20 converter that will allow the migration of ERC20 tokens from the Ethereum network to Cardano.

Cosmos [ATOM]

Source: COSMOS/USD on TradingView

Unlike Cardano, Cosmos noted a significant fall on the charts, dropping by 4.97 percent. At the time of writing, ATOM had a market cap of $807 million with a below-average trading volume of $179 million.

However, market indicators suggested that a bullish reversal was already taking place, with the MACD line hovering over the signal line, at the time of writing. Further, the Bollinger Bands suggested decreasing volatility, something that might suggest that the breakout would not be expansive enough to recover recent losses.

Cosmos’s role in the growth of DeFi has been critical over the past few weeks, which the asset noting a 68 percent growth as well.

DASH

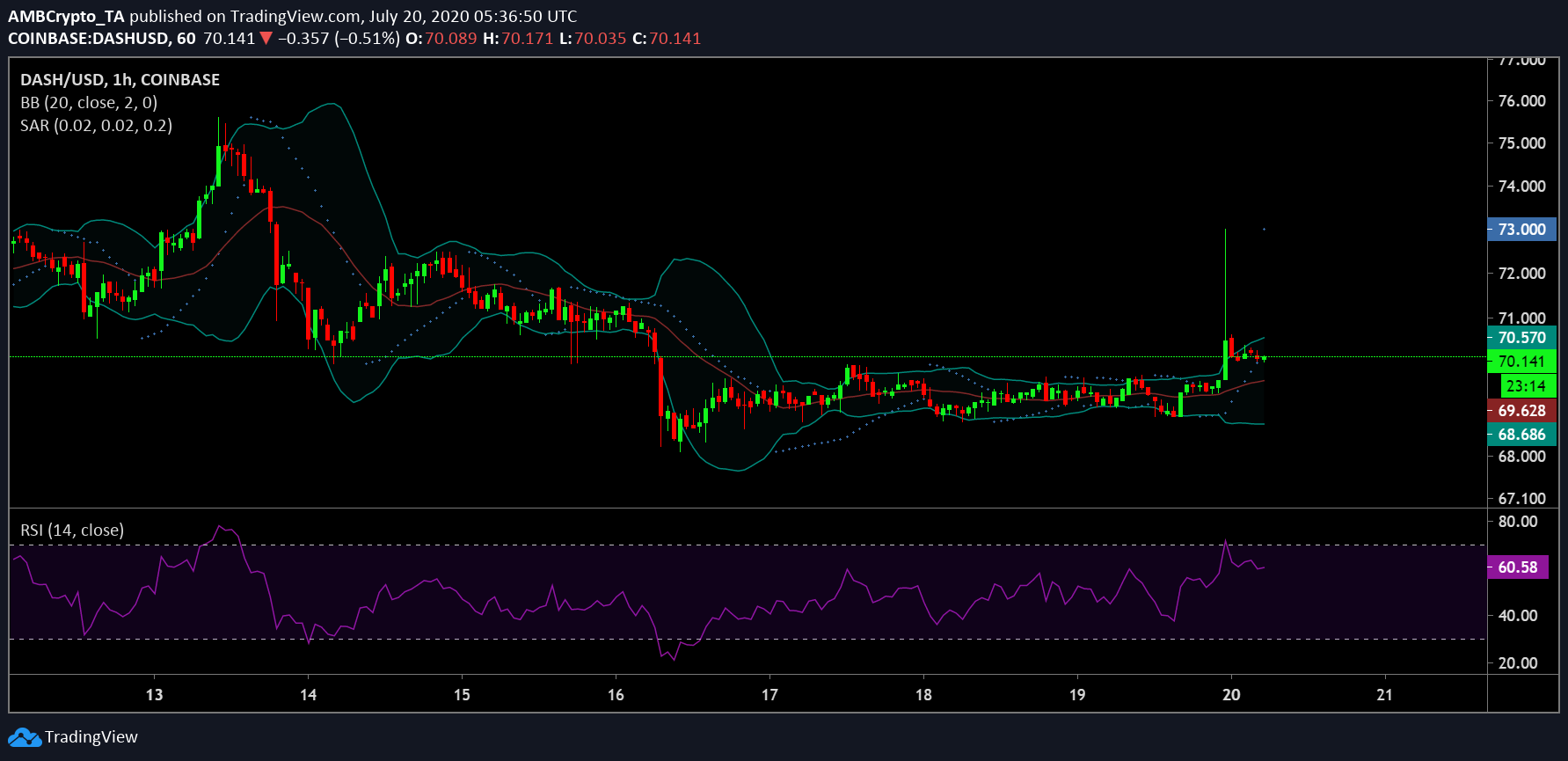

Source: DASH/USD on TradingView

Finally, 25th ranked Dash registered a minor hike of 1.11 percent over the past 24-hours, but the price did touch $73 for a brief hour. At press time, the asset was valued at $70, with a market cap of $672 million. Matching its altcoin counterpart, DASH was found to be registering a trading volume of $139.5 million.

The Relative Strength Index or RSI indicated higher buying pressure in the charts, with the Bollinger Bands expanding to suggest a volatile period in the future.

However, the Parabolic SAR had turned bearish, with the dotted markers starting to form over the candles, suggesting an immediate correction on the charts.