Bitcoin: CME Options surge past Bakkt just 24 hours after launch

The CME Group launched its Bitcoin Options product for trading yesterday, a direct competitor to rival Intercontinental Exchange’s Bakkt. According to preliminary estimates from the crypto-derivatives data analytics platform, Skew, CME facilitated the trade of 55 contracts in the 24 hours since its launch, worth $2.3 million in BTC.

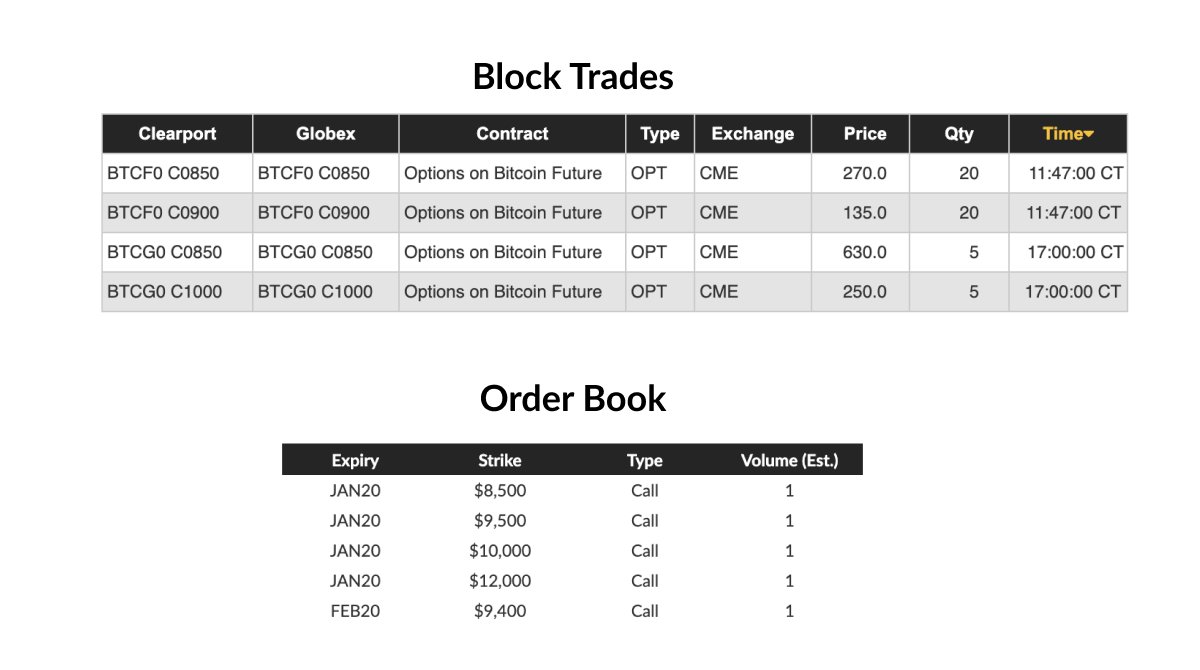

Source: Skew

Skew also noted, however, that 100% of the contracts traded on the exchange were calls. Options are derivatives contracts which give the buyer the right to buy or sell the underlying asset at a predetermined value before a certain date in the future. Buying a BTC option call contract allows the holder of the contract to buy Bitcoin at the spot price at a time in the future when the price goes up, if predicted correctly.

This could mean that institutional crypto-investors are bullish on the asset and are likely predicting a price movement upward in January and February. Bakkt’s December-launched Options product, till date, has only traded $1.1 million worth of BTC through its contracts, less than half the volume seen by CME in one day, despite having more than a month of a head-start against it.

Skew’s metrics also showed that the volume of Bitcoin Options traded on the Bakkt exchange has been $0 since 10 January. The FTX exchange saw around 1700 BTC of Options traded over the last 24 hours, becoming the crypto-options exchange with the second-highest volume, just behind Deribit.