Celestia falls back on Ethereum for data security as TIA jumps

- The project integrated OP Stack and Arbitrum Nitro to help with data security.

- TIA reached a new ATH and its volume increased.

Modular consensus and data network Celestia [TIA] has introduced an L2 system called the “Ethereum fallback.” Celestia described the Ethereum [ETH] fallback mechanism as one that backs up data availability if there is any downtime on the Celestia mainnet.

2FA for the Celestia camp

According to the project, two L2s are involved in the development— Arbitrum [ARB] and Optimism [OP]. Celestia revealed that its choice of Optimism’s OP Stack was because the blockchain can back up rollup blocks and posts to Ethereum.

In the case of Arbitrum Nitro, Celestia wants it to engage its advanced calldata compression. This is to ensure that it stores on-chain data if primary data availability fails. Regarding both concepts, Celestia noted that:

“These two functions work together to ensure that the Ethereum fallback mechanism operates correctly, allowing the rollup to continue functioning even during periods of downtime on Celestia.”

As a result of this disclosure, AMBCrypto proceeded to assess Celestia’s development activity. At press, the development activity was down to 1.06. This metric tracks the work done in a project’s public GitHub repository.

So, the decrease means that there has been a lot of activity related to polishing the network.

As for the TIA price, it reached a new All-Time High (ATH) of $7.35. In a previous article, AMBCrypto discussed TIA as one of the new projects maintaining a good price action.

TIA’s uptrend resumes

But of late, the token was at the mercy of a 30% slump. As of this writing, the TIA/USD H4 chart has reclaimed its bullish market structure. However, it seems that the uptick was starting to get overheated.

If so, the price action might retrace from the northward direction. One of the reasons for this assumption is the Relative Strength Index (RSI). At press time, the RSI was 71.75 which is considered overbought.

Like the RSI, the Bollinger Bands (BB) also reinforced the notion that TIA was overbought. This was because the upper band of the BB touched TIA at $7.30. If the lower band had hit the price, TIA would have been tagged oversold.

Therefore, there is a chance for TIA to drop. Also, if the 26-day EMA (orange) becomes at par with the 12-day EMA (blue), the token value may retrace. However, there seems to be support around $6.32. Should the price reverse, it might not go below $6.50 in the short term.Two other metrics to look at when analyzing Celestia are social dominance and volume.

Realistic or not, here’s TIA’s market cap in ETH terms

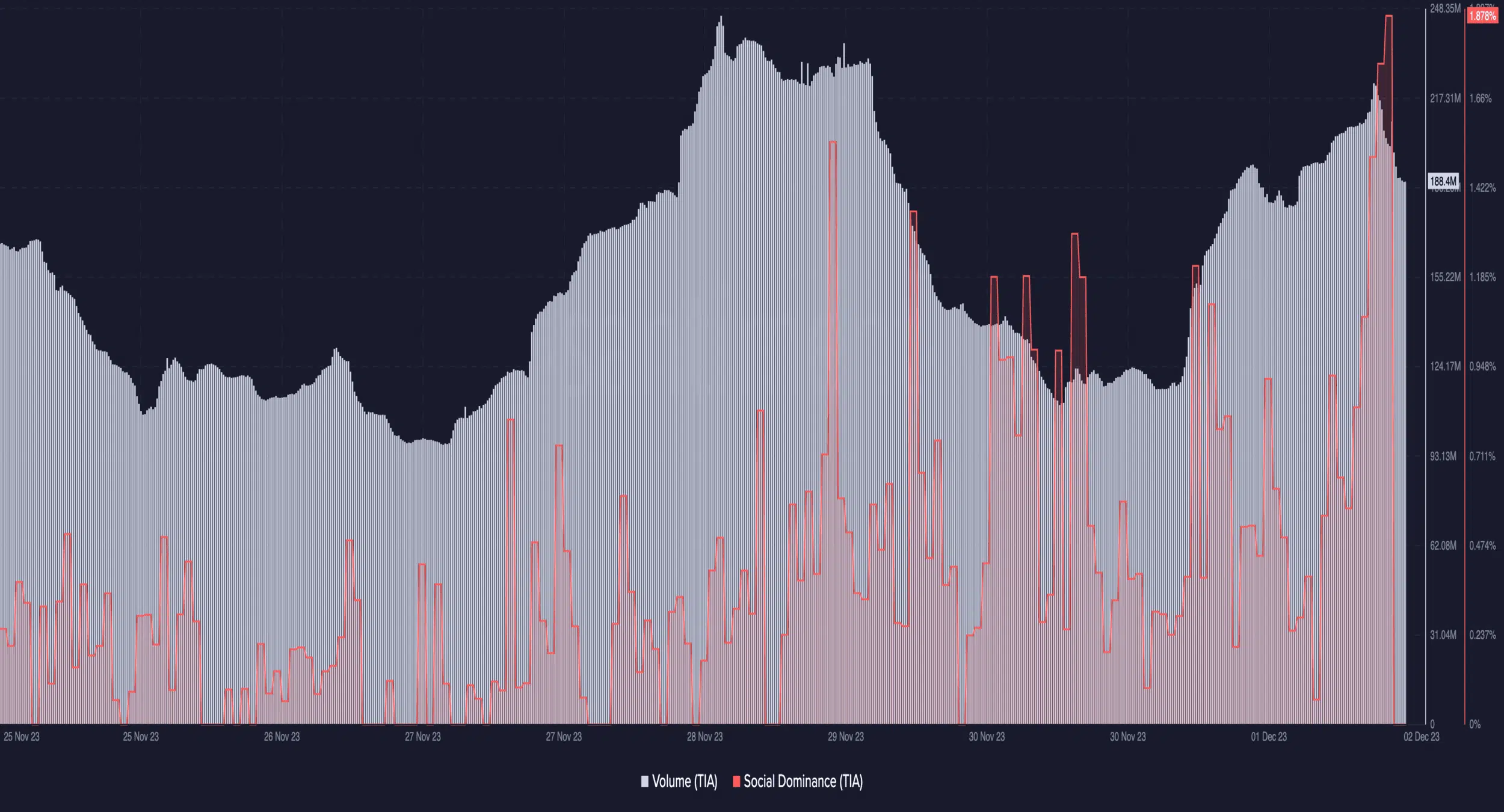

At the time of writing, TIA’s volume was 188.40 million— a slight decrease from the 221.80 million peak. This means that there have been many TIA tokens exchanging hands lately.

So, it was not surprising that the social dominance rose to 1.878%, indicating an increase in discussion around the project.

![Celestia [TIA] price analysis](https://engamb.b-cdn.net/wp-content/uploads/2023/12/TIAUSD_2023-12-02_06-33-59.png.webp)

![Celestai [TIA] news](https://engamb.b-cdn.net/wp-content/uploads/2023/11/Celestia__1200x900-400x240.webp)