Cardano: Why a decline looks imminent for ADA

- ADA key indicator has hinted at the possibility of a bear cycle.

- The bulls, however, continue to drive coin accumulation.

Cardano’s [ADA] price may be poised for a decline as its TD Sequential indicator observed on a weekly chart has presented a sell signal.

This indicator measures the exact time of trend exhaustion and potential price reversals over a specified period. It works by tracking the price action of an asset over a series of nine candlesticks.

A buy signal is generated when the indicator reaches nine on a downtrend. Conversely, a sell signal is generated when the indicator reaches nine on an uptrend.

AMBCrypto found that ADA’s TD Sequential indicator reclaimed nine on an uptrend last week. Since then, coin accumulation has lost some momentum.

ADA bulls stand strong

Although there has been a minor decline in ADA accumulation due to recent increased profit-taking activity, the bulls continue to have market control.

ADA’s Directional Movement Index (DMI) indicator, which tracks the strength and direction of price movements, showed that ADA buyers overpowered the coin sellers on a weekly chart.

Readings from the coin’s DMI put its positive directional index (green) solidly above its negative directional index (red).

When an asset’s DMI is set up in this manner, it suggests that the upward price movements are stronger than the downward price movements. ADA’s positive directional index was 29.20 at press time, while its negative directional index was 12.22.

In addition, ADA’s key momentum indicators show that coin accumulation significantly exceeds its distribution. For context, ADA’s Money Flow Index (MFI) was 82.56, indicating that the altcoin was overbought at press time.

Its Relative Strength Index (RSI), on the other hand, maintained a modest value of 61.56.

Likewise, the coin’s Chaikin Money Flow (CMF) resting above its zero line and positioned in an uptrend signals increased liquidity flow into ADA’s spot market.

Although there has been some coin-selling activity, a CMF value of 0.22 suggests moderate buying pressure persists in the market.

Read Cardano’s [ADA] Price Prediction 2024-2025

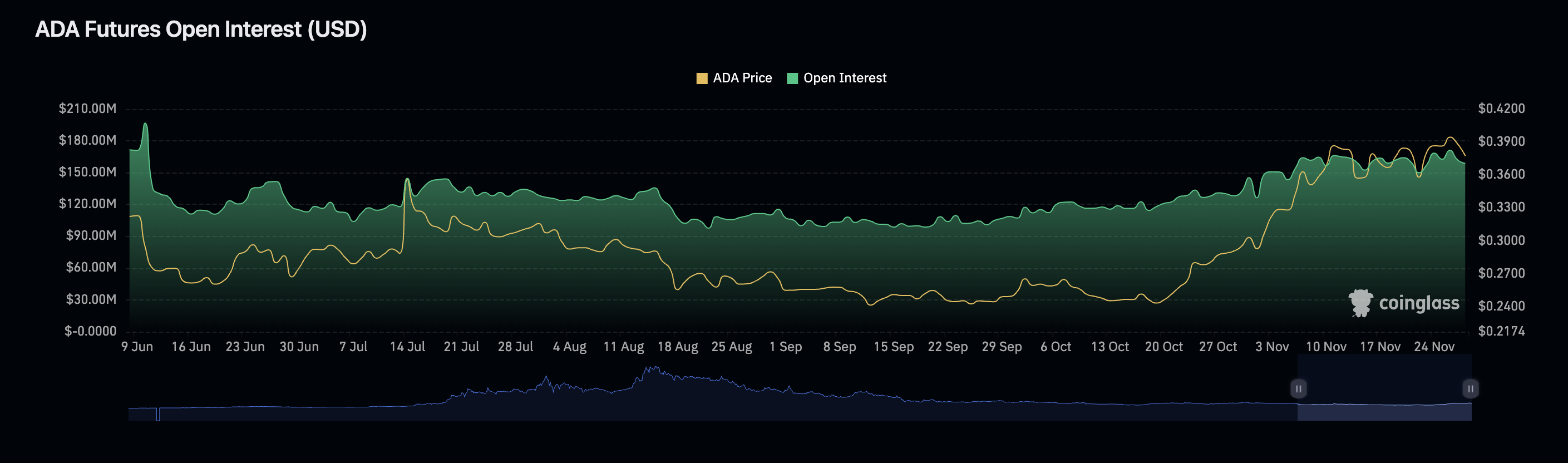

The surge in ADA’s open interest in its futures market lends further confirmation to the presence of bullish sentiments among coin holders.

Data sourced from Coinglass showed that ADA’s open interest has climbed by 25% since the beginning of the month.