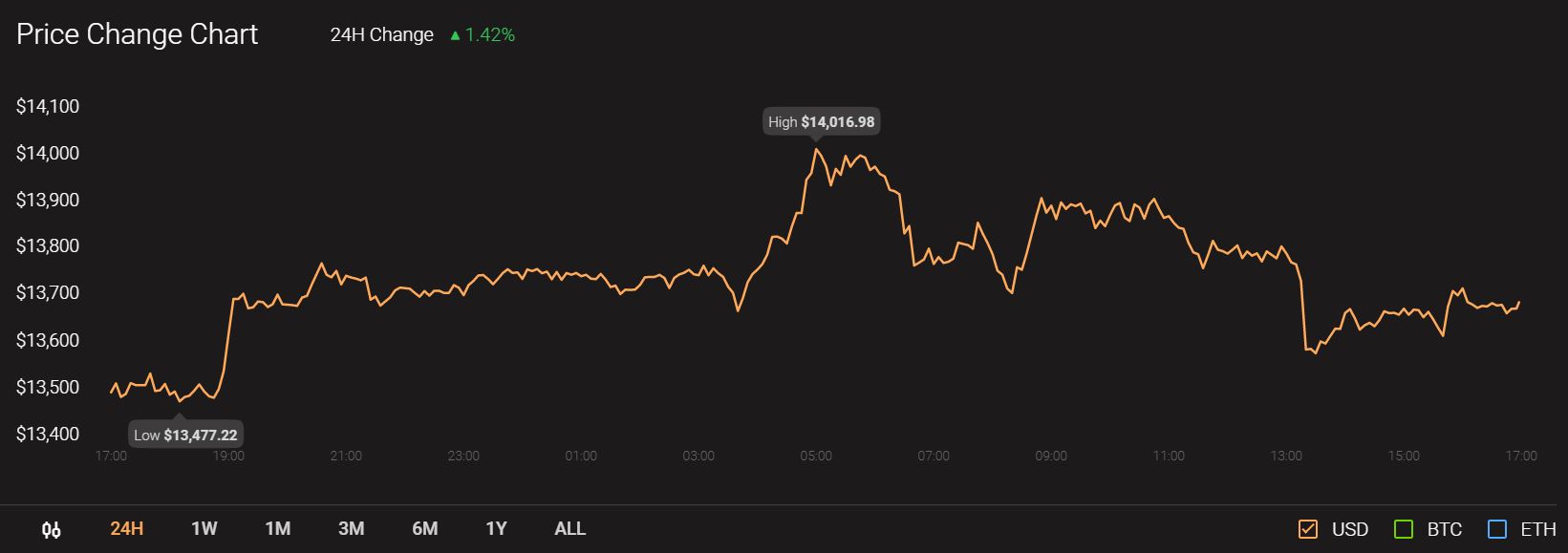

Cardano, Tron, Basic Attention Token: 06 November

The current market can be described as volatile and a race to join the bullish market for many altcoins. The altcoin market appeared to be largely unaffected by the massive rally in the Bitcoin market. At press time Bitcoin was being traded at $15,503 with a 24-hour trading volume of $35.4 billion.

Source: CoinStats

Most major altcoins have been waiting for the positive volatility to hit markets, but although the market has been volatile the price was still restricted. Although projects like Cardano [ADA] released developments and updates for its community, the price has still remained low.

Cardano [ADA]

Source: ADA/USD on TradingView

The price of Cardano noted a local peak at $0.1244 on 21 October, but the price was not supported by volume. The value of the asset has been slashed since and reached a low close to the support at $0.0864. However, the price has recovered from the sudden sell-off and was valued at $0.1036, at the time of writing.

The volatility in the market is about to increase as the Bollinger Bands were growing apart. This volatility may result in a trend change in the market as even the signal line was moving lower, indicating an appreciating price.

Tron [TRX]

Source: TRX/USD on TradingView

The Tron market did not see much volume for the digital asset. The value of the asset has remained close to its resistance at $0.0289 and has not breached it since mid-September. As it traded at $0.02540, the price was moving downward and contributing to the bearishness.

This bearishness was affirmed by the 50 moving average that remained above the price for quite some time now. The Awesome Oscillator also noted the increase in short-term selling as the value of the indicator entered the negative range and was at -0.0015.

Basic Attention Token [BAT]

Source: BAT/USD on TradingView

Basic Attention Token has just slipped under its long-standing support at $0.1977 and has been trying to breach above it. Even as the coin tried, the selling pressure was preventing the asset to move higher. The markers of the Parabolic SAR were above the candlesticks to highlight the price moving lower, but MACD may be indicative of a trend reversal.

The MACD line has been at an important junction and may crossover the signal line. A crossover will mean the demand for the asset was increasing and may change the current trend to a bullish one. However, volume still escapes the BAT market.