Cardano bulls could see minor losses soon, here’s why

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Cardano noted bullish sentiment over the past two days.

- The liquidity to the south could be visited before another move higher.

Cardano [ADA] displayed short-term momentum over the past two days to climb from $0.355 to $0.398. This bounce measured 12% but ADA bulls continued to fight an uphill battle in the lower timeframe charts.

In other news, Charles Hoskinson, the founder of Cardano, had an interesting proposition for one of the biggest names in the tech industry right now. Could this foster bullish sentiment behind ADA?

The current outlook favors a bearish bias until a key resistance level is broken

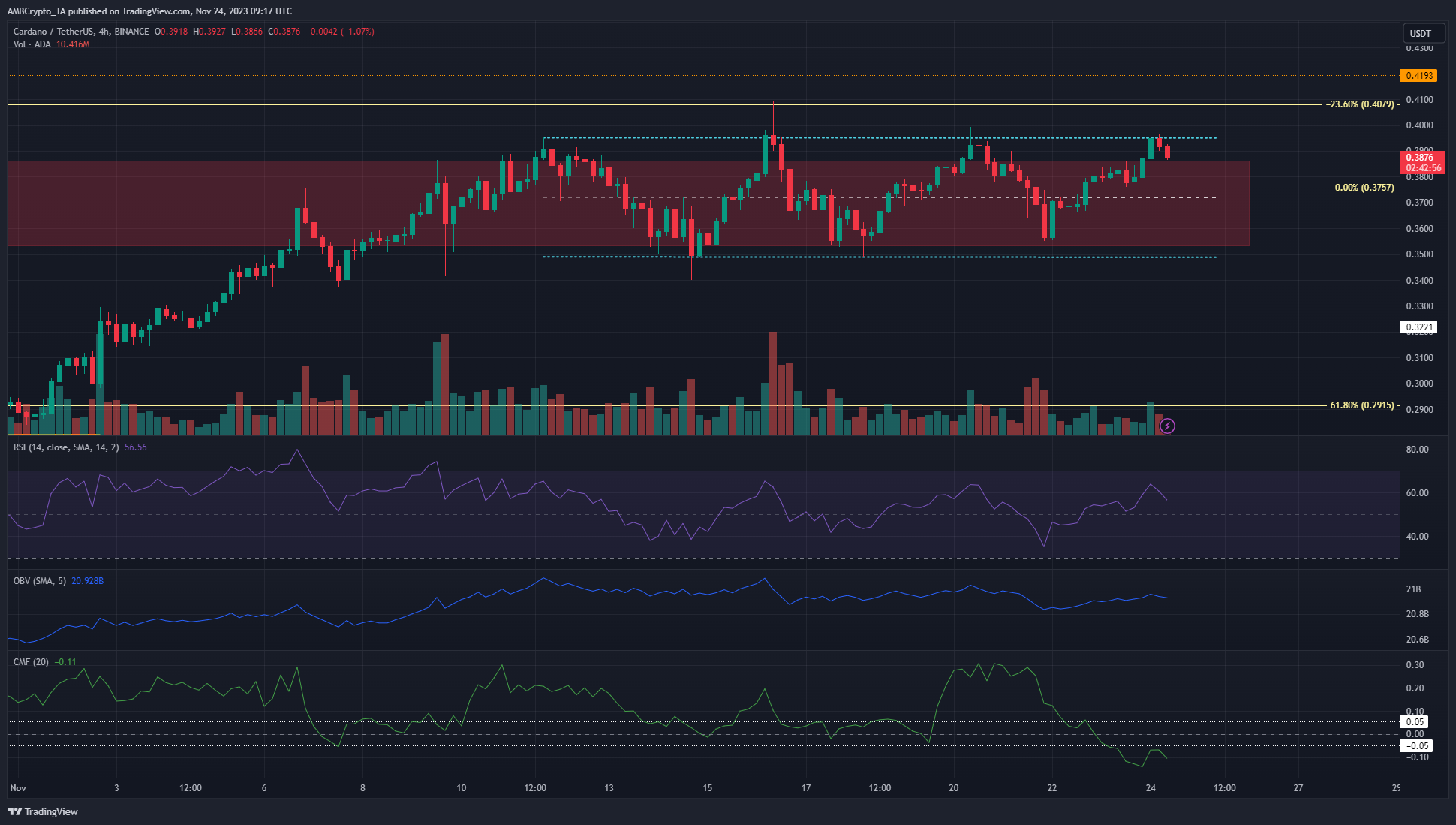

In the past two weeks, ADA has traded within a range (dotted cyan) that extended from $0.349 to $0.395. Moreover, a weekly bearish order block (red) lay just below the $0.4 mark, which hampered the bulls’ progress.

During this time the market structure of the token has shifted multiple times on the four-hour chart. This was also encapsulated by the meandering RSI that fluctuated from the 60 to 40 reading and back again.

The volume indicators did not showcase a strong trend either.

The On-Balance Volume (OBV) has trended downward in the past ten days to show that the selling pressure has been slightly greater. The Chaikin Money Flow (CMF) was below -0.05 to signal a large capital outflow from the ADA market.

Therefore, a move to the mid-range support at $0.372 or the range lows was a likelihood. An examination of the liquidation data could provide more clues about where prices could go next.

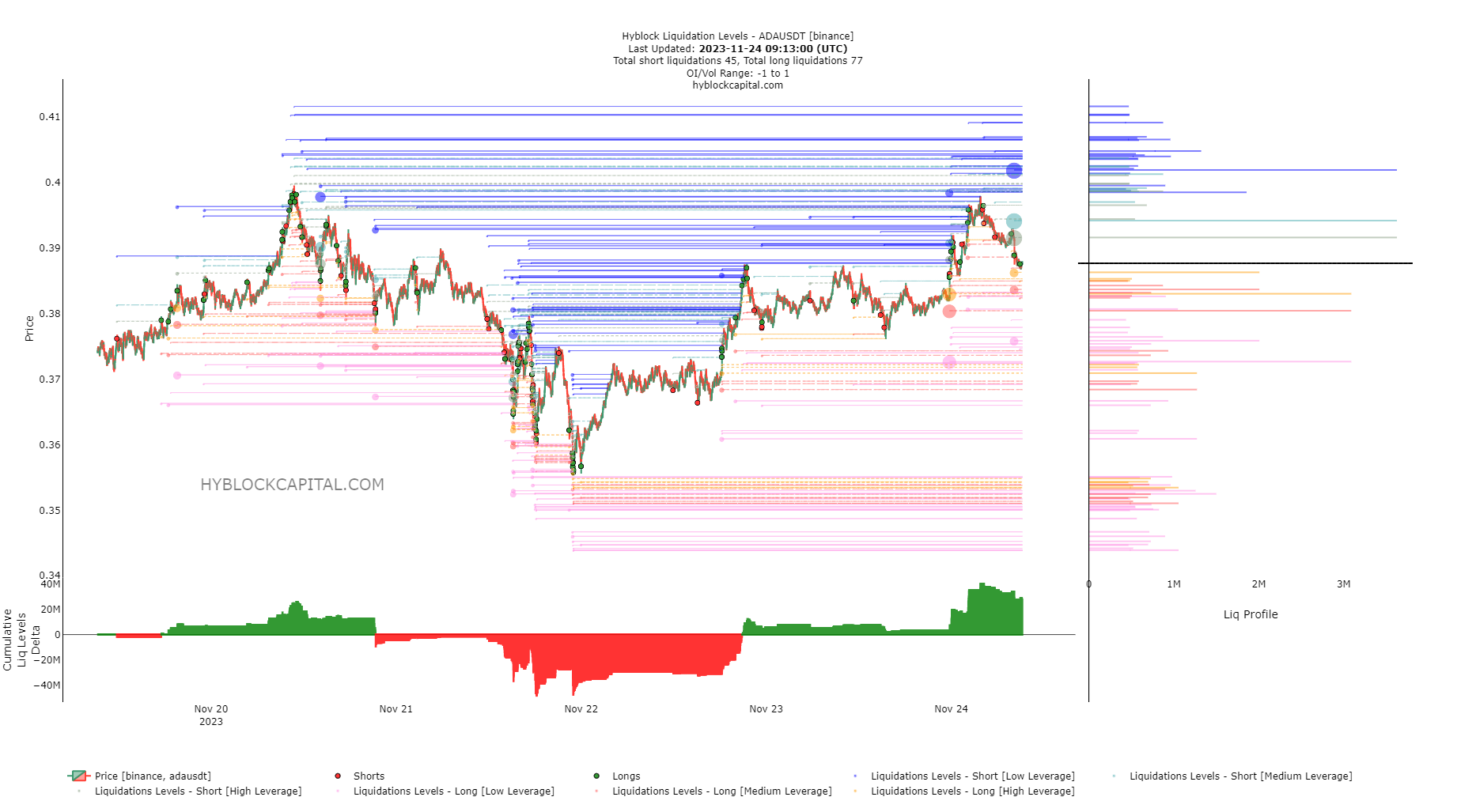

Hyblock data gave an actionable trading plan for the lower timeframes

Source: Hyblock

AMBCrypto’s analysis of the liquidation levels data from Hyblock noted that bulls could stand to profit soon. At press time, the Cumulative Liq Levels Delta was highly positive and showed that long positions stand to lose more should prices move against them.

Hence, a move southward in search of liquidity could occur soon. The $0.383, $0.38, and $0.372 levels each had a liquidation profile close to $3 million, apart from smaller values scattered in between.

Read Cardano’s [ADA] Price Prediction 2023-24

This meant that a move to these levels could cause substantial long liquidations. The $0.372 level lined up with the mid-range support.

Hence, a drop to this area would present a buying opportunity targeting the range highs and even the next substantial liquidity pool at $0.4.