Can projects like Yearn.finance bring back the DeFi mania?

As the spot market once again began to consolidate, the decentralized finance [DeFi] sector has been witnessing a surge after bottoming out last week. Year.finance [YFI] has been a popular DeFi project that has been witnessing a great surge in the market over the past couple of weeks.

Ever since it bottomed at $7,452.49 on 5 November, the token has managed to surge by 124% within 4 days. This pushed its price close to $18.9k. Witnessing this on-going surge in the value of the token and its demand among users, Bitfinex has announced Margin trading for yearn.finance.

According to Bitfinex’s announcement yearn.finance pairs like [YFI/USD] and [YFI/USDt] have been added to their margin trading products. It added:

“From 11/11/20 at 10:00 AM UTC, YFI pairs can be traded with a maximum leverage of 3.3x, an initial equity of 30% and a maintenance margin of 15%.”

This could prove to be an important feature for the exchange to drive more traders to its platform, as traders could borrow funds to increase leverage which offered the potential for larger profits compared to traditional trading.

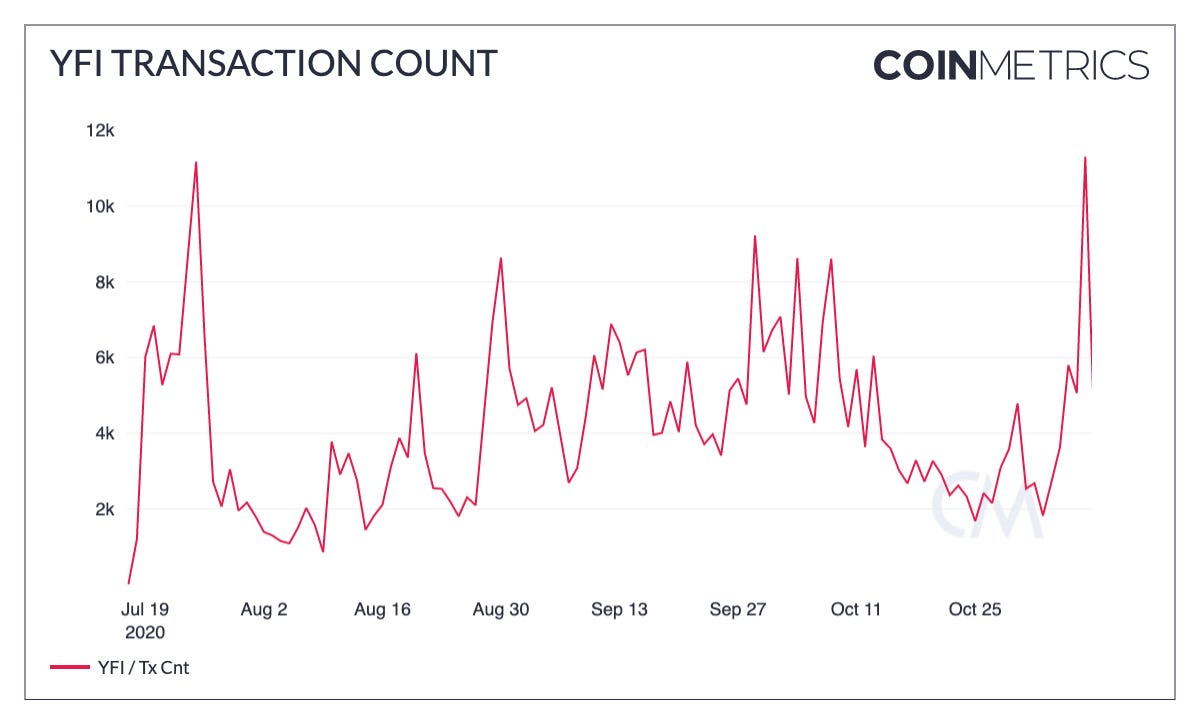

The heat is rising in the YFI market as within a couple of days after price bottomed, yearn.finance’s transaction count hit a new all-time high of 11,300. A recent report by CoinMetrics highlighted this ATH and stated that the increased activity could be a sign of DeFi resurgence.

Source: CoinMetrics

As the spot market catches a breath, the DeFi market has been posing to capitalize on this. The total value locked in Defi was also laying flat at $11.317 billion on 5 November but has now reached to $13.03 Billion on 11 November, which is also an all-time high value. Other projects like Synthetix has been noting a 13.48% growth in the past 24-hours, while Maker noted a 4.64% surge. The chances of a DeFi Mania to be rekindled is scanty, but cannot be entirely ruled out considering the current state of the market.