Can Bitcoin be viewed as a call option on inflation?

Bitcoin’s performance has dragged many of the traditional markets’ prominent traders and speculators to the crypto-market. Bitcoin’s growth is evidence of that, with the world’s largest cryptocurrency gaining in momentum and appreciating in price, while garnering interest from world investors, even as the global economic turmoil unraveled.

This turbulence in the economy and doubts about the onset of inflation have put the coin back into the safe haven category, suggesting that despite strong growth in money and credit, inflation is not a problem.

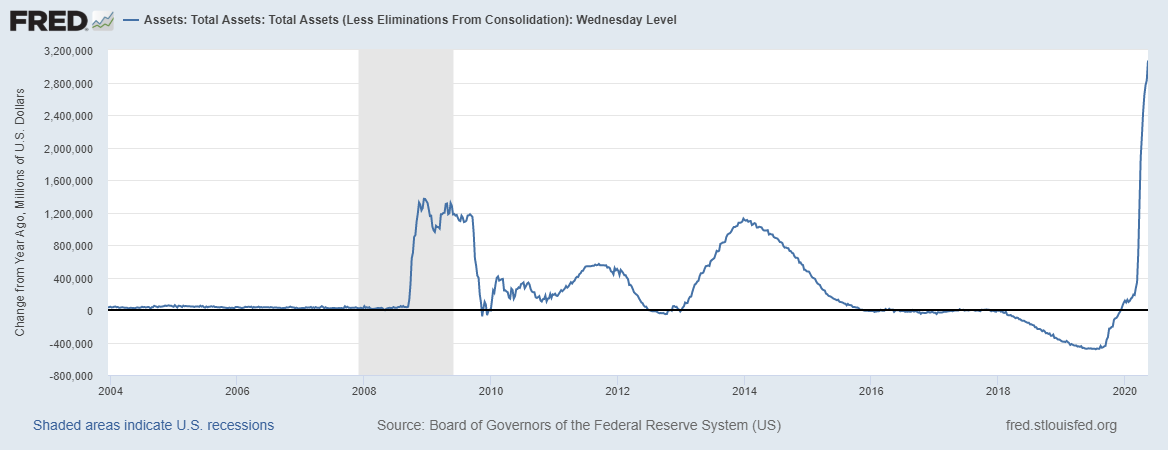

On the contrary, the same cannot be held to be true for large swathes of the U.S economy, especially the sectors that shut down due to a demand shock. According to a report by CoinMetrics, the Federal Reserve’s policy response has already exceeded the balance sheet expansions seen in the past following the 2008 financial crisis.

Source: CoinMetrics

By keeping the money printer on, the Fed’s monetary and fiscal policies have managed to get money into the hands of businesses and households. However, such steps saw a decline in the velocity of money. According to the aforementioned report,

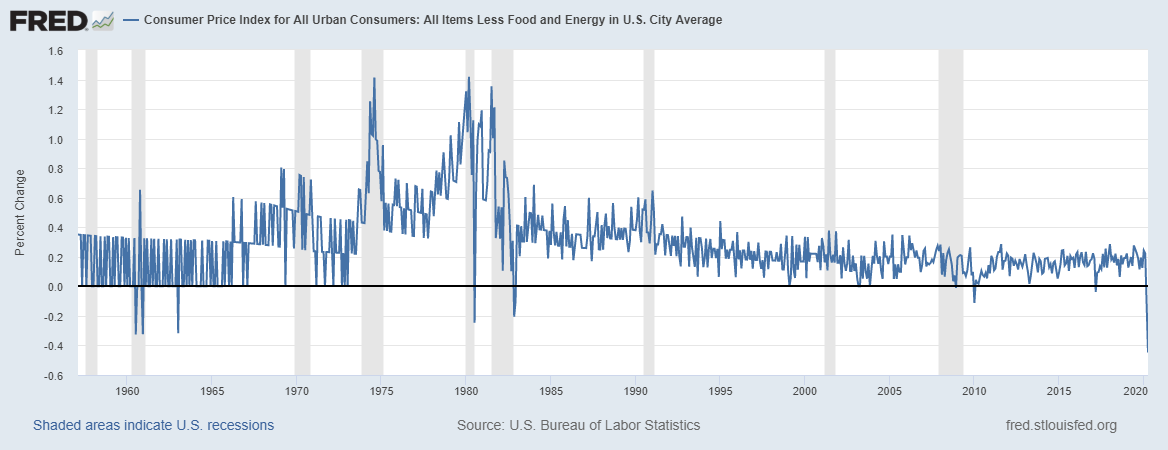

“The most recent print for the U.S’s core inflation, which excludes food and energy items, fell 0.4% over the previous month, the largest monthly decline in the history of the series, according to the Bureau of Labor Statistics.”

Source: CoinMetrics

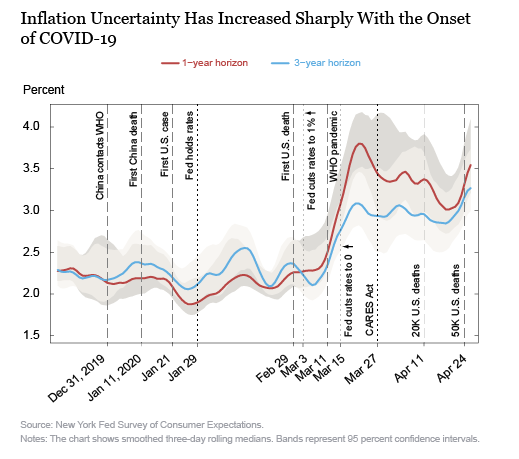

Bitcoin can emerge as a much-needed instrument for an environment fueled with inflation, with the Fed’s recent Survey of Consumer Expectations highlighting that median expectations for inflation did not substantially change following the outbreak of COVID-19. However, the same report revealed that the level of uncertainty and disagreement across respondents had noted unprecedented increases.

Source: CoinMetrics

According to researcher Karim Helmy, Bitcoin can be seen as a call option on inflation since the market saw a rise in implied volatility of future inflation, despite median expectation remaining unchanged. As per the Option price theory, increased implied volatility pushed the price of a call option. Therefore, the recent rise in the price of Bitcoin can be looked upon as an impact of rising IV of inflation, instead of the rise in the expected level of inflation.