Altcoins

BNB Chain: Here’s the aftermath of CZ’s departure

Even as BNB‘s price dropped over the last seven days, a whale used this opportunity to increase accumulation.

- BNB Chain’s network activity declined alongside its price.

- Most market indicators remained bearish on the BNB Chain.

BNB Chain [BNB] was recently thrust into the limelight as its CEO, Changpeng Zhao (CZ), submitted his resignation as part of the $4 billion settlement between United States regulators.

This episode triggered a price decline, causing BNB to shed a lot of its value. However, whales used the opportunity to increase their accumulation.

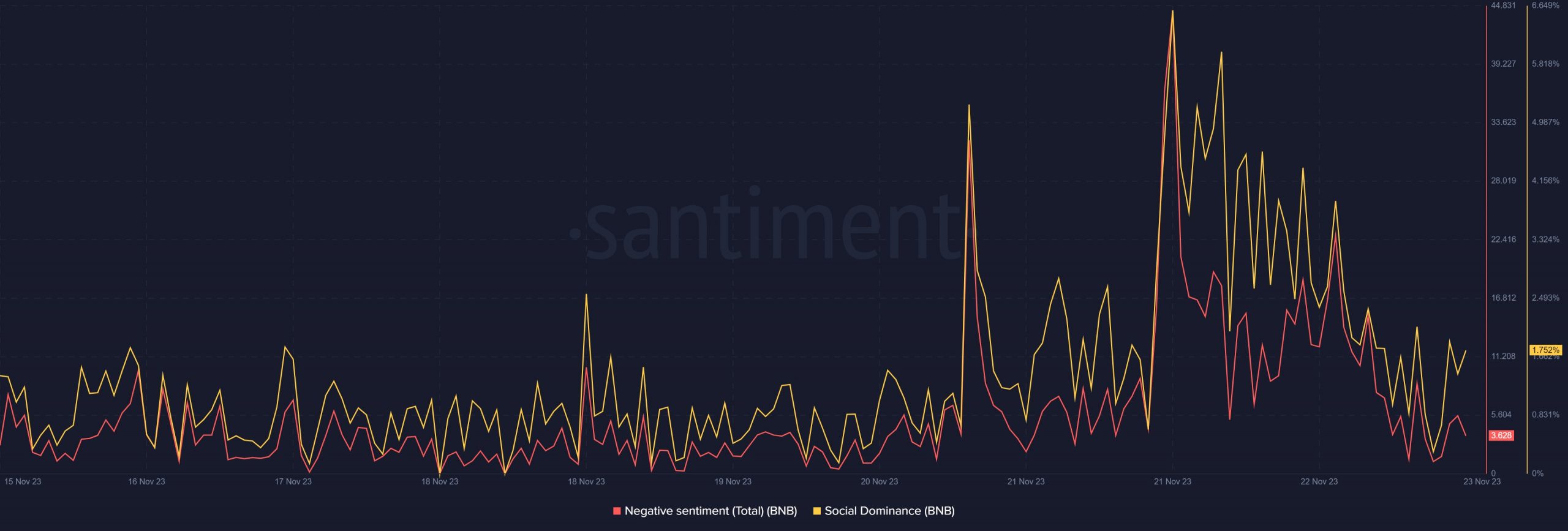

Moreover, as per AMBCrypto’s analysis of Santiment’s chart, this incident made BNB a topic of discussion in the crypto community, evident from its spike in Social Dominance. But most mentions were not in BNB’s favor, as its negative sentiment increased.

BNB Chain in a crisis?

The blockchain’s network activity also took a blow after this incident. AMBCrypto’s also assessed Artemis’ data and found that BNB Chain’s Daily Active Addresses and Daily Transactions dropped over the last few days.

Its performance in the DeFi space also declined, as its TVL fell in the recent past.

BNB also witnessed a price drop. As per CoinMarketCap, the token was down by more than 7% over the last seven days. At the time of writing, BNB was trading at $235.57 with a market capitalization of over $35 billion.

Is there an opportunity worth grabbing?

Though the above metrics looked concerning, big players in the crypto market used this opportunity to accumulate BNB at a lower price. Notably, Lookonchain highlighted some interesting whale activity on the 22nd of November.

As per the tweet, a whale that usually buys BNB at lower prices recently accumulated more than 2,700 BNB, worth over $646k. The whale has accumulated a total of 17,152 BNB, worth $4.06 million at an average price of $253, since the 10th of May.

This clearly hinted at the whale’s confidence in BNB.

After #Binance settled with the U.S. Department of Justice, the whale who was good at accumulating $BNB at price lows accumulated 2,732 $BNB($646K) again.

The whale accumulated a total of 17,152 $BNB($4.06M) at an average price of $253 since May 10. https://t.co/zTxq1uQbrm pic.twitter.com/fh1crsADMC

— Lookonchain (@lookonchain) November 22, 2023

Read BNB Chain’s [BNB] Price Prediction 2023-24

AMBCrypto then took a look at BNB’s daily chart to better understand whether its price would rise in the near term. The MACD and Chaikin Money Flow (CMF) metrics registered downticks, and the latter headed further southward from the neutral mark of 0 at press time.

Nonetheless, the Money Flow Index (MFI) looked slightly bullish as it hovered near the oversold zone during the same period. This was an indication of increased buying pressure on BNB and, in turn, could lift its price over the coming days.