Bitcoin

BitMEX Bitcoin Futures spread chokes out competitors

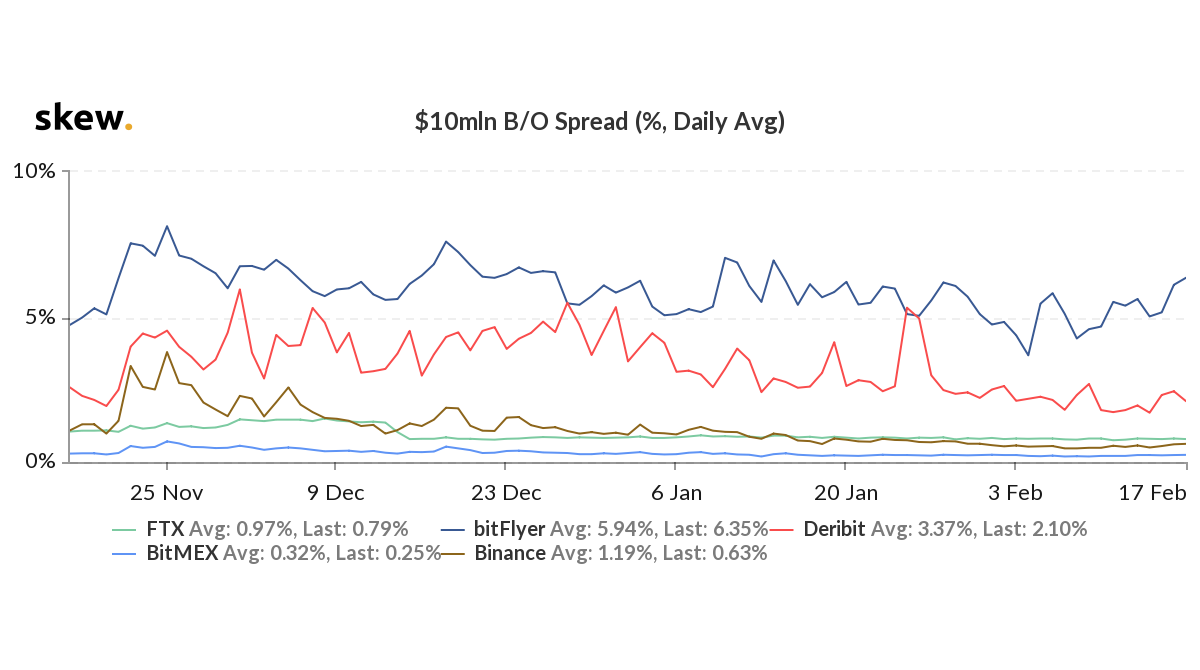

While BitMEX has been a dominating force in Bitcoin perpetual futures for a long time now, platforms such as BitFlyer have also exhibited signs of rising liquidity.

The Futures spread on the Tokyo-based cryptocurrency exchange appeared to show signs of narrowing in the first week of February. The daily average B/O spread for contracts worth $10 million dropped to 3.68% on the Skew chart on 4th February. However, there has been a reversal in this trend.

BitFlyer has seen significant volatility in terms of its Bid and Offer [B/O] spread over the past three months, notably, the spread on BitFyler contracts has been gradually increasing since the 15th February 2019.

Liquidity of the futures contract plays an important role in determining its bid/offer spread, meaning smaller the spread, higher the liquidity. Hence, for BitFlyer, Skew’s chart indicated a decline in terms of liquidity for its BTC futures contracts.

Source: Skew

On 17th February, the Bid and Offer spread of Bitcoin for $10 million quote size on BitFlyer was 6.34% which essentially translated to a lesser liquid market. Deribit, on the other hand, noted a gradual narrowing down of its B/O spread for the same quote size over the past three months.

Source: Skew

Interestingly, this is not the only pattern that has seen a reversal. Earlier, Bitcoin Futures on Binance appeared to be nearing the B/O spread level of BitMEX, a platform that emerged as the most liquid in terms of BTC Futures for a long time. But liquidity on Binance’s platform has shown greater spread since 14th February. Binance noted a daily average of 0.61% on its B/O spread while BitMEX stood at 0.24%.