Bitcoin’s volatility now aligning with nearly all crypto-assets

Geopolitical tensions have been on the rise across the world. However, many are surprised by the swing in Bitcoin’s price such tensions have caused. Alas, this is not the first time Bitcoin‘s price has reacted to global events. The same happened during the U.S- China trade war, a time when Bitcoin’s inverse correlation with Yuan climbed up, according to a report.

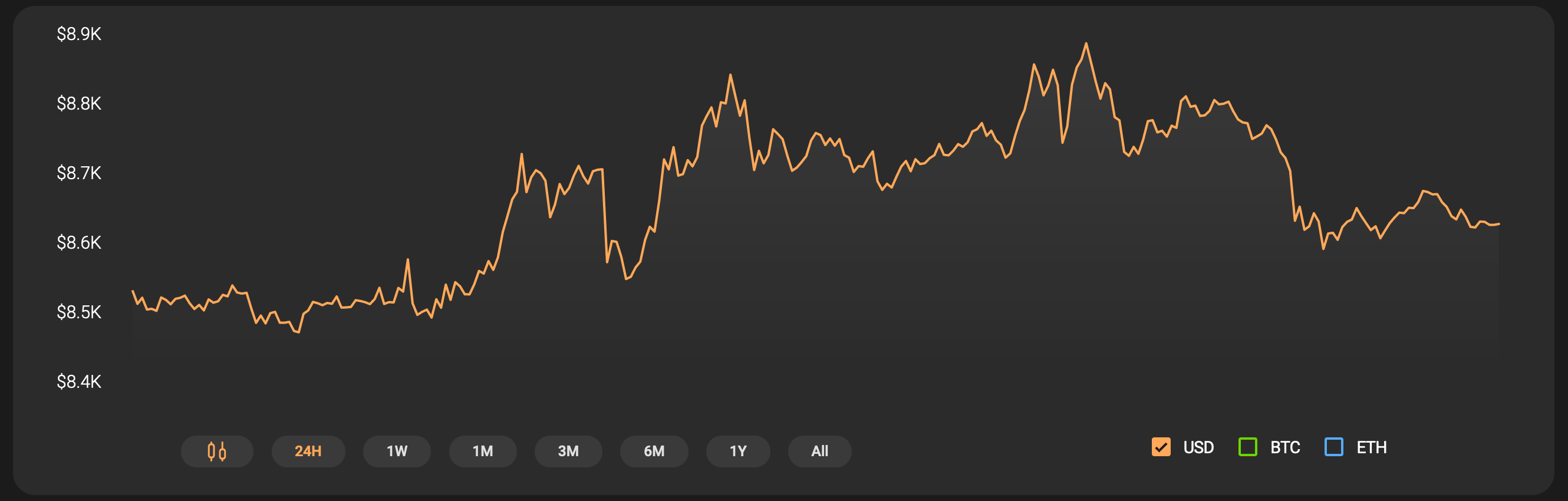

At press time, Bitcoin was priced at $8656, with a 24-hour trading volume of $20.6 billion.

Source: Coinstats

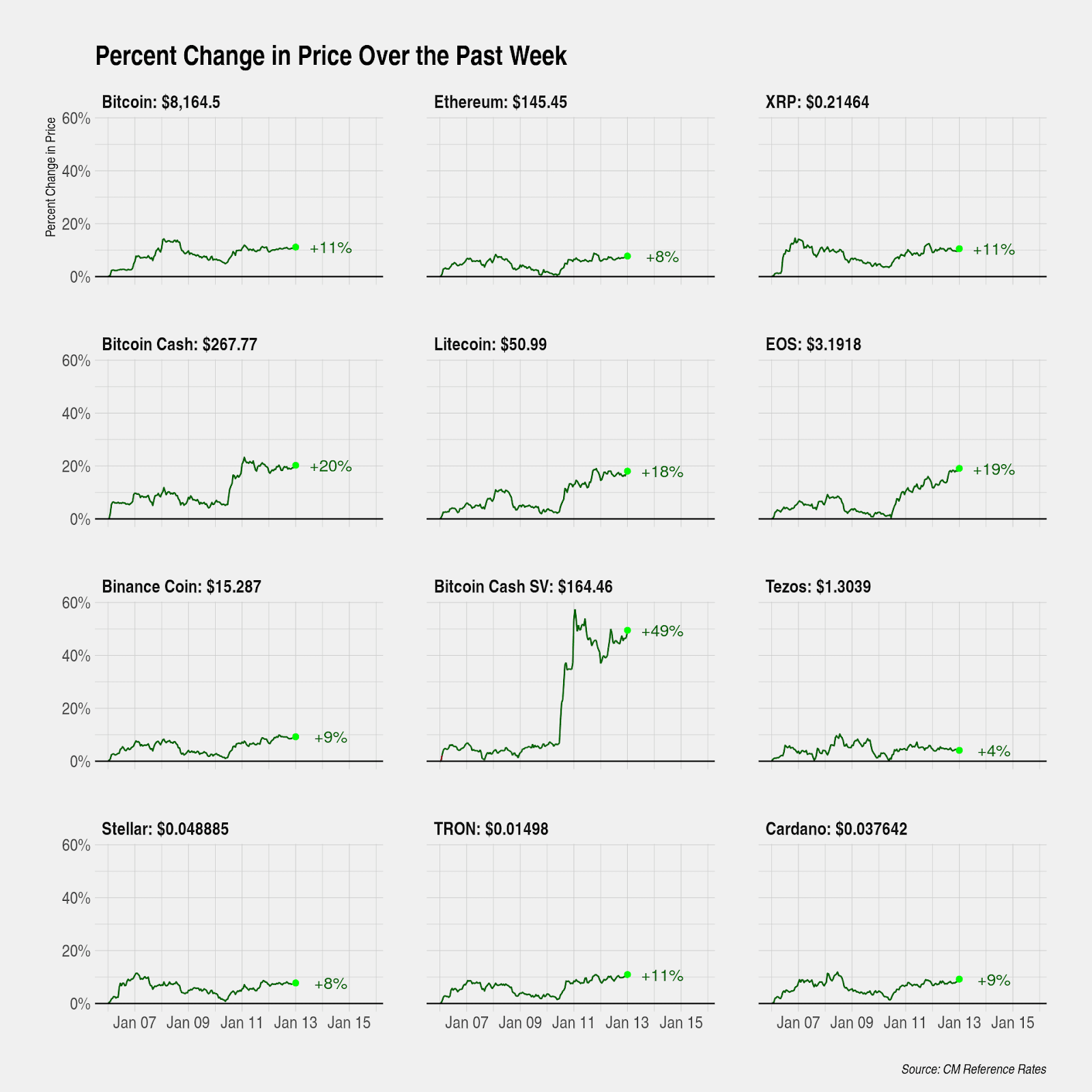

At the time of writing, Bitcoin had noted an 11% spike over the week, outpacing most smaller crypto-assets. And while Bitcoin’s rally did cause a ripple effect in the cryptocurrency market, there were some isolated instances of extreme price movement.

Bitcoin Cash SV [BSV] started its climb on 13 January and it has since, managed to record a triple-digit pump of 120.92%. This leap in price made BSV the strongest performer among major crypto-assets, with BSV now the fourth-largest cryptocurrency on CoinMarketCap. According to a report by Coin Metrics, the rise in the price could be “due to speculations about positive developments surrounding the legal developments of Craig Wright, a vocal proponent of Bitcoin Cash SV.”

Following BSV’s lead, the other forked coin, Bitcoin Cash [BCH], grew by almost 24%, while Litecoin [LTC] registered a rise of 13%, reporting the largest gains over the week.

Source: Coin Metrics

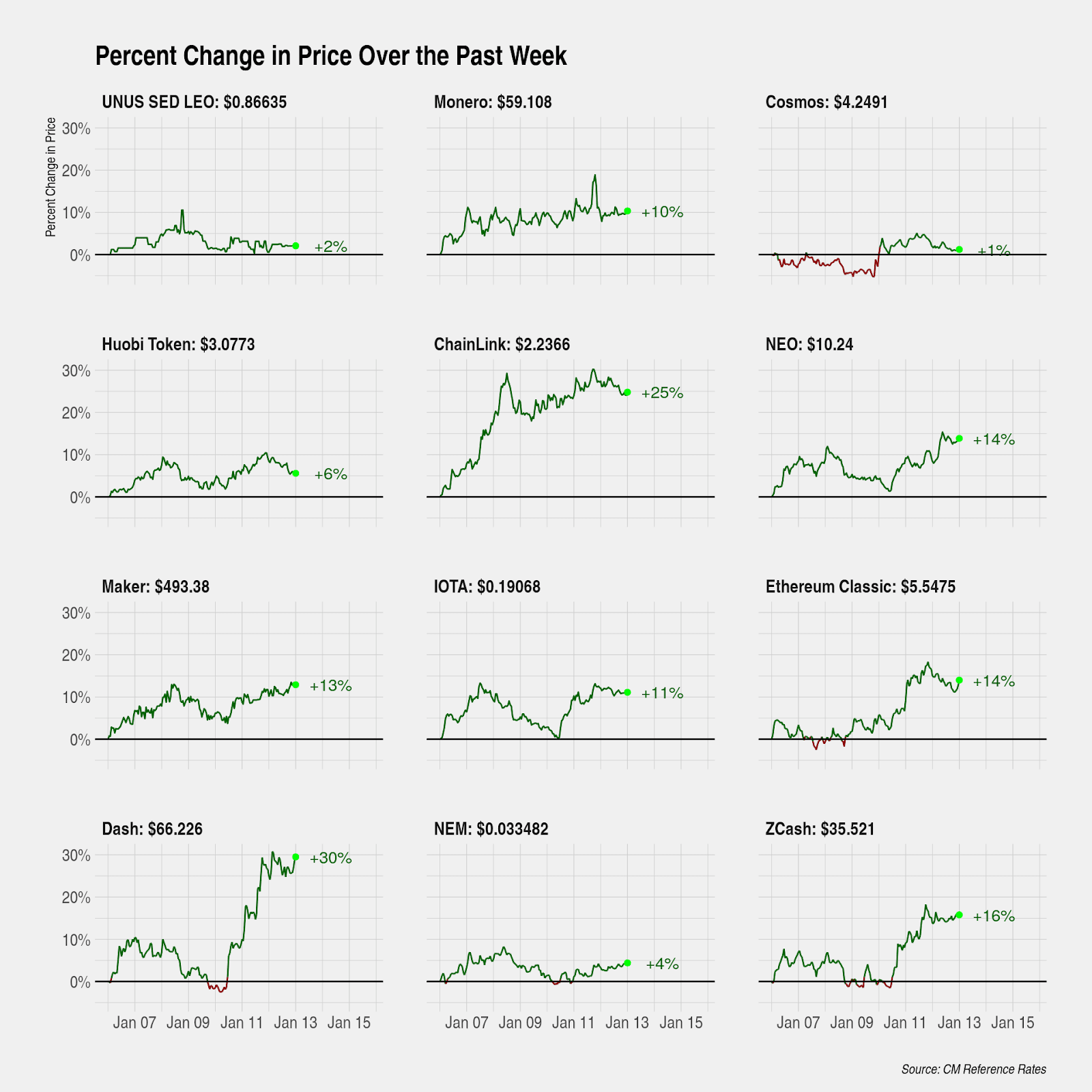

The uptick was not just limited to major cryptocurrencies, however, as mid-cap crypto-assets like Dash and ChainLink pumped by over 30% and 25%, respectively. On the other hand, the mid-cap has been ruled by two strong performers for several weeks now, Ethereum Classic [ETC] and ZCash [ZEC]. ETC noted a growth of 14% while ZEC rose by 16%.

Source: Coin Metrics

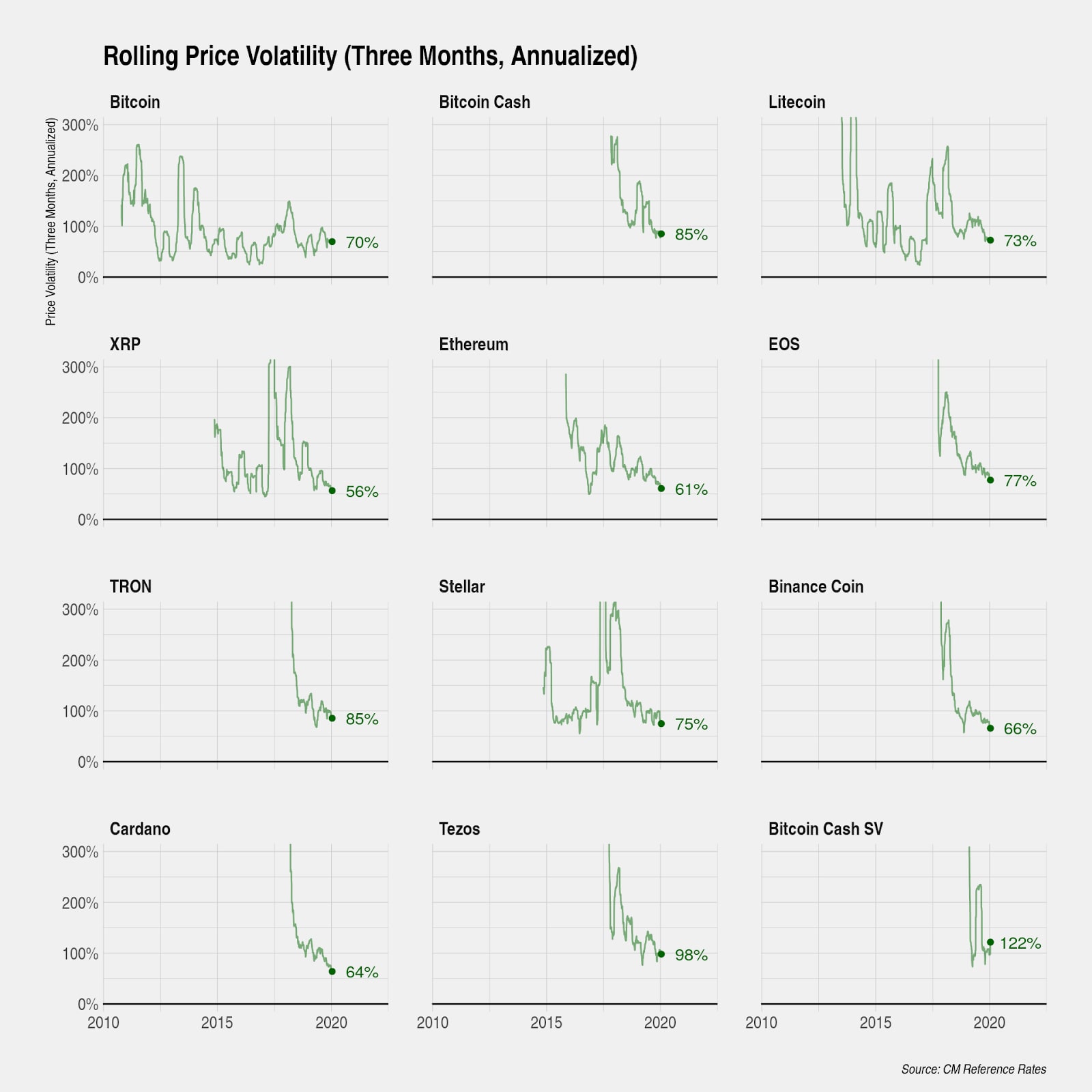

However, on a three-month rolling basis, most coins were at or were approaching all-time lows; most coins apart from Bitcoin, as its volatility appeared to stabilize and might have been trending upwards. The report attributed this to,

“This reflects the proliferation of leveraged products and how investor interest has become increasingly concentrated in Bitcoin. Volatility for nearly all cryptoassets are now inline with Bitcoin’s.”

Source: Coin Metrics