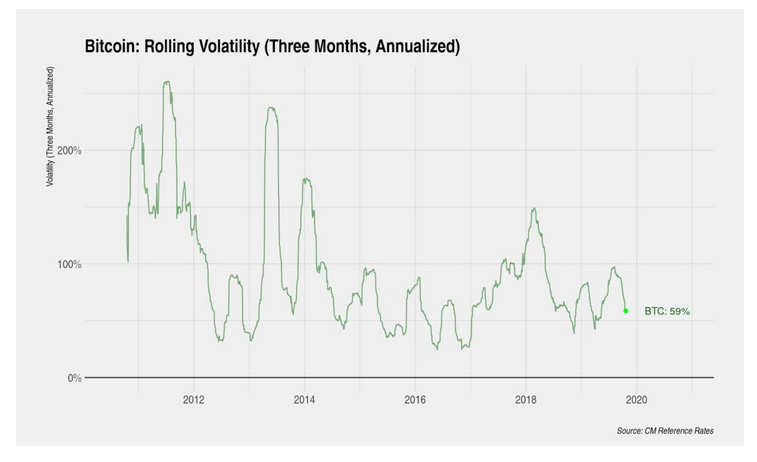

Bitcoin’s rolling volatility down to 59%

Since the cryptocurrency market’s significant fall on 24 September, many crypto-assets have failed to register significant value recoveries. However, apart from a few major tokens, a majority of them did register very small gains over the past week.

After the aforementioned price drop, Bitcoin started consolidating between $10,000 and $8,000 and the volatility measured over a rolling period of three months was again close to its three-year lows, at press time.

Source: CoinMetrics

According to a report, Bitcoin’s volatility dropped down to 59 percent as the price remained between the aforementioned range. Similar volatility drops was also recorded during November 2018 and March 2019, when Bitcoin consolidated around the $6500 and $3500 range, respectively. In both the cases, Bitcoin registered a drop below 50 percent in annualized three-month rolling volatility.

With regard to market sentiment, it is believed that an increased drop in volatility usually takes place before a massive reaction, where a price swing takes place in a major fashion. During a period of low volatility, traders tend to incentivize and build positions in the market with higher leverage on the current market valuation.

Bitcoin’s price did witness a major fall over the past 24 hours however, a fall which saw the valuation drop below $7500. The current drop in Bitcoin’s price should spike up volatility levels again after weeks of limited price movement.

It was suggested that if the valuation of Bitcoin consolidated for another long duration under the $7500 range, volatility would again decrease, and Bitcoin may be susceptible for another major price swing.

Source: Twitter

Josh Rager, a crypto-analyst, shared the same train of thought.

Rager explained that historical volatility [HV] of Bitcoin was indicative of a major price movement for Bitcoin. He said,

“With a slow sideways market, we’ll see descending HV that indicates a strong reaction in price action ahead and rise in volatility.”

Meanwhile, the rolling volatility of other major crypto-assets was also plummeting at press time, with the likes of Ethereum and XRP recording 71 percent and 67 percent, respectively.