Bitcoin’s scarcity value gives it an edge over gold

Bitcoin is on the verge of its third block reward halving, a monumental event for the world’s largest cryptocurrency. While many speculate what the crypto-ecosystem will be like after the halving, it is also important to view Bitcoin and the halving’s implications within the larger framework of finance. To understand Bitcoin’s value proposition as a form of storing value and a medium to transact in, the coin’s performance over the past decade may help paint a better picture.

During a recent episode of the What Bitcoin Did podcast, Robert Breedlove – Founder and CEO of Parallax Digital, highlighted how Bitcoin is well-suited to be the most dominant form of currency in the coming years and how it has triggered immense disruption when it comes to understanding what money means. Breedlove highlighted that across time and in terms of the larger history of money, a few characteristics have had to be fulfilled. He noted,

“I would say money has to be divisible, durable, portable, recognizable, and very importantly, scarce.”

Bitcoin, according to Breedlove, does fulfill this criterion and historically, precious monetary metals like gold have attained their value because of the same reasons. However, when it comes to fiat currencies, Breedlove argued that “Fiat currency is a pyramid scheme that’s been constructed on top of gold.”

Breedlove also noted that the concept of money was created and adopted owing to its ability to move value across time and space.

“The same is true of money, the entire purpose is to just move value across space and time. And we’ve used many different things to fulfill that function over time, whether seashells, salt, cattle, gold, government paper, and now Bitcoin.”

However, when it comes to the previously mentioned traits for money, it can be seen that Bitcoin is the only form of currency that has been able to maximize those functions.

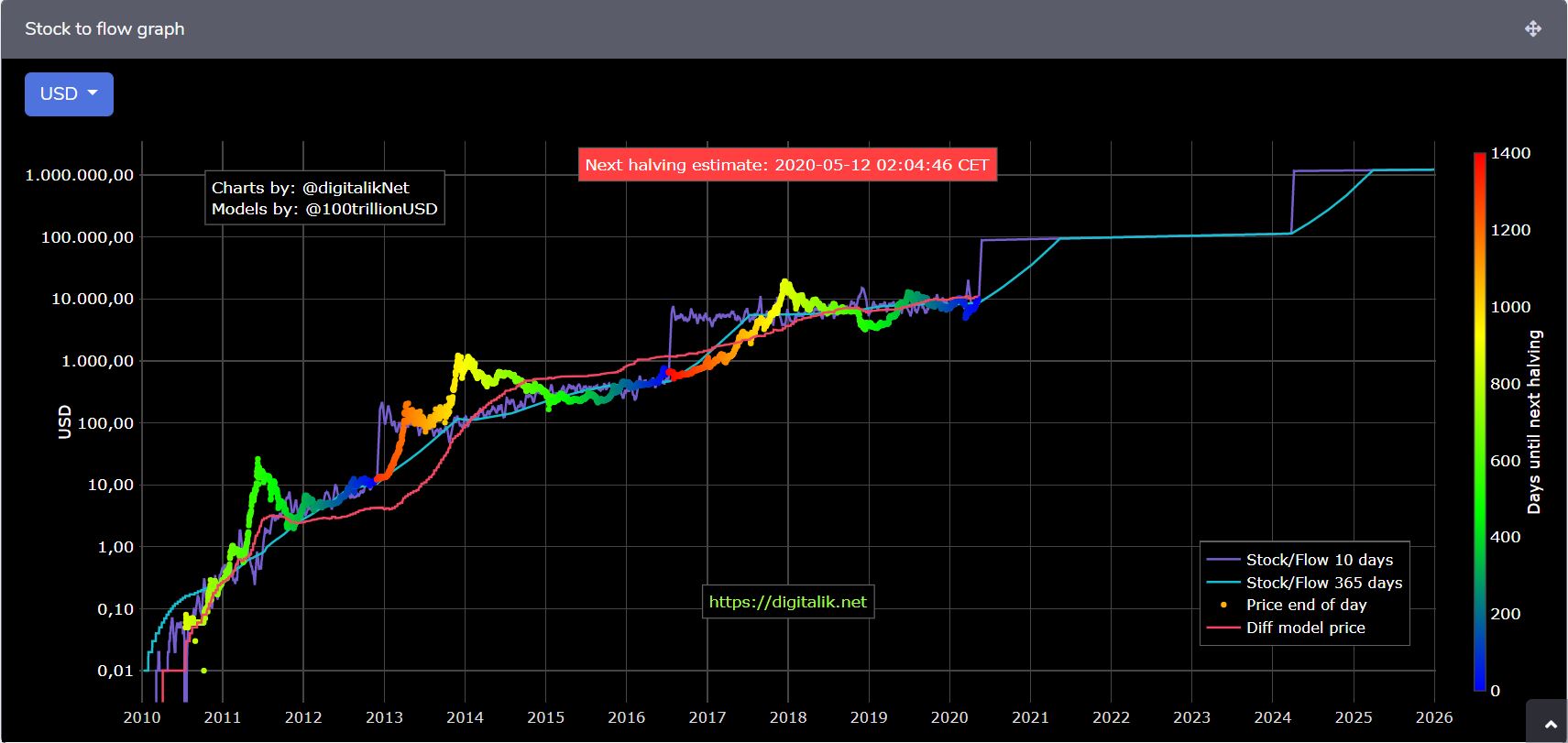

With the third block reward halving taking place in over two days’ time, the Bitcoin scarcity narrative seems to be further emboldened. With price models like the Stock-to-flow predicting a monumental increase in Bitcoin’s price as it nears the 21-million supply hard cap, interest in the world’s most dominant crypto is only likely to go up.

Source: Digitalik.net

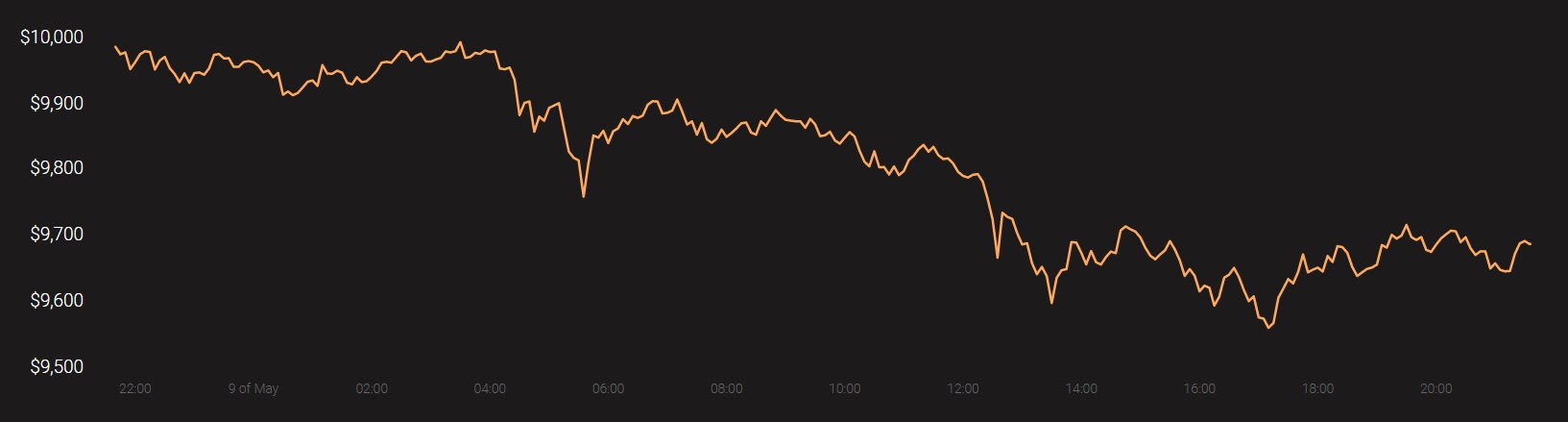

In the days leading up to the halving, the price of Bitcoin has been on a bull rally over the past week, making it clear that many investors and traders want in on Bitcoin.

At the time of writing, Bitcoin was trading at $9,692 with a 24-hr trading volume of $24.1 billion.

Source: Coinstats