Bitcoin’s ‘risk-factor’ could be appealing amidst bonds market crash

The global financial market has been unable to deal with the health crisis around the world.

The Coronavirus pandemic has become an inevitable reality at the moment, with the traditional and digital asset class failing thoroughly to sustain any form of significant recoveries.

On the latest episode of the Keiser Report, the host highlighted the current situation of the bonds market in light of the COVID-19 spread. He also discussed a chart shared by Holger Zschaepitz, Senior Business Editor at German news outlet Welt, one about how the value of global bonds had undergone a severe plunge over the past few weeks.

Global bonds, commonly deemed as ‘safe-haven assets,’ took a severe beating and its valuation dipped by a whopping $5 trillion, a figure that is equal to Japan’s GDP. The market, at the time of writing, pictured a valuation of $57.89 trillion, but investors around the world remain worried about new debt, with governments preparing fiscal stimulus plans.

It was in light of this that Keiser went on to make a bold claim. According to him, the bonds market is a bigger illusion than Bitcoin. He said,

“The biggest bubble in the world economy was not Bitcoin. It certainly wasn’t gold. It was the bond market. The sovereign bond market. The bond market, of course, will revert to the mean. It’ll restore, it’ll go back to its long-term trend of 5-6% on a 10-year sovereign bond.”

He added,

“They’re going to need massive bailouts, massive restructuring, massive layoffs, but this is the price to pay for blowing this enormous bubble. This is a bubble popping.”

Will the Bond market’s negative yield interest Bitcoin’s ‘risky’ nature?

Bonds fall under the category of low-risk, low-yield assets; hence, many have speculated that they could act as a hedge in the current market.

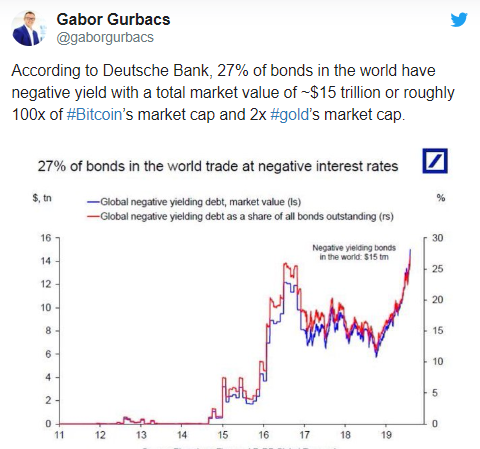

Source: Twitter

However, earlier this month, Gabor Gurbacs of VanEck had stated that according to Deutsche Bank, over 27 percent of the bonds had a negative yield, with a total market value of $15 trillion. In comparison, Bitcoin’s market cap is 100 times smaller, whereas gold’s market cap is close to half of it.

Although Bitcoin hasn’t exactly acted as a ‘safe-haven asset’ recently, with the current negative rates in the bond markets, there is a possibility that Bitcoin’s risky nature could come into play.

With several stimulus plans coming into effect, liquidity will be injected into global finance over the next few weeks, but negative interest rates would only increase the debt-based spending in the market.

Investors may continue to ply their trade with bonds, but there is a chance that certain retail investors may invest in Bitcoin since it has significant potential for higher and quick returns.