Bitcoin’s rigid supply curve and demand follow different market basics

Bitcoin’s halving is right around the corner and anticipation is surging among many of the market’s speculators.

In a recent market recap presented by Jeff Dorman, Chief Investment Officer at Arca, the CIO highlighted an interesting comparison between Corporate Bonds and Equity v. the Bitcoin halving.

Dorman suggested that the record monetary and fiscal stimulus during the COVID-19 pandemic has been the perfect macro-backdrop for Bitcoin. However, he also hinted that Bitcoin’s strong performance after ‘Black Thursday’ has actually been ‘underwhelming,’ given its track record in the past.

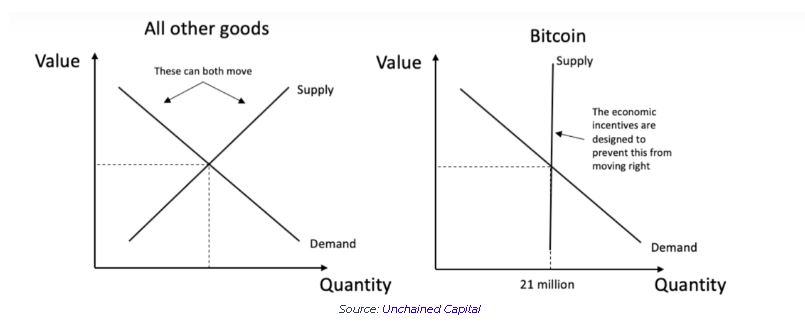

Highlighting Bitcoin’s supply and demand, the Arca CIO suggested that the BTC halving, while registering record interest according to Google trends, is not exactly monumental because it is a known event, in terms of supply of BTC. The community already knows that 21 million BTC will exist unless there is a code update in the future, something that makes its supply curve completely vertical rather than one that is declining.

Source: Arca

Now, since the supply curve is completely rigid, Dorman pointed out that the valuation of Bitcoin can only change due to a shift in the demand curve. So, instead of reduced supply after the halving, it is more important to focus on the demand curve which is usually dedicated by attributes such as income, trends, price of related goods, market expectations, and the size and composition of consumers.

The blog added,

“That said, there is still reason to believe that the price of Bitcoin will move higher as a result of the halving, for one simple reason: The amount of newly issued Bitcoin is minuscule relative to the number of investment dollars.”

Taking an example of the corporate bond monthly issuance in March 2020, corporate bond issuance rose to $260 billion and in April, it was supposed to around $285 billion. It was mentioned that before the spike, the world average issuance lay somewhere around the $100-$120 billion range.

In short, there is plenty of demand from investors and equity new issues and Dorman believes such interest would translate into Bitcoin as well, and Bitcoin’s supply will not satisfy new investor demand.

Bitcoin does not need extra supply

Now, the core fundamental missed in this context is the fact that Bitcoin operates differently than the equities or bonds market. Their asset issuance keeps on increasing and hence, that’s why there is an inherent increase in the invested capital every term or period because these bonds keep getting de-valued on their own.

On the contrary, Bitcoin has anti-inflationary properties which help it secure its value, while also preventing its de-valuation to a limitless supply. Now, its intrinsic value is much more unique than other assets since it is evaluated every time and it steadily increases with demand as well.

But, what will happen once all 21 million BTC is minted?

Although it will be very difficult to pinpoint what might happen in the far future, considering the fact that the last BTC will be mined in 2140, once all BTC are mined, miners would be the most affected because there would not be any Bitcoin left to mine.

However, it is important to note that the mining process for successful verification of blocks will be sustained because then, the transaction fee attached to a BTC transaction will be very high. At the moment, it is a few hundred dollars per block, but it will range around thousand of dollars once the price of Bitcoin crosses meteoric levels.

Ultimately, it will function like a closed economy where transaction fees are assessed much like taxes.

Hence, the supply conundrum for Bitcoin is not exactly relatable with the traditional asset class because the behavioral pattern and its properties are completely different in the ecosystem.