Bitcoin’s rally causes a split in trader behavior

- Hedge funds and asset managers took different approaches to BTC’s rally.

- Bitcoin’s Implied Volatility and MVRV ratio grew along with its price.

Bitcoin’s [BTC] rally has caused many liquidations of short positions over the last few months. Due to this sudden surge in price, there has been a split in terms of decision-making among traders.

A difference in opinion

Asset managers were going long on Bitcoin at press time, hitting all-time highs. This suggested strong confidence, potentially signaling a positive outlook.

Asset managers usually have a long-term approach to investing. Their need to show returns is on a long-term basis, and they can take hits in the short term.

On the flip side, hedge funds are betting against BTC at record levels. Behavior like this indicated skepticism or an expectation of a market correction.

Hedge funds typically have to show quarter-on-quarter growth for their investors. Due to this, they take a short-term approach to investing.

Massive short positions taken against BTC by these funds may show that they don’t have much faith in BTC rallying going forward.

The clash in sentiments within CME Bitcoin Futures could lead to increased market volatility, with potential impacts on Bitcoin’s price dynamics.

Interesting behavior happening within CME #Bitcoin Futures.

– Asset Managers longs on $BTC at ATHs

-Hedge funds shorts against $BTC at ATHs pic.twitter.com/fQcIV3HWPt— Emperor Osmo? (@Flowslikeosmo) December 3, 2023

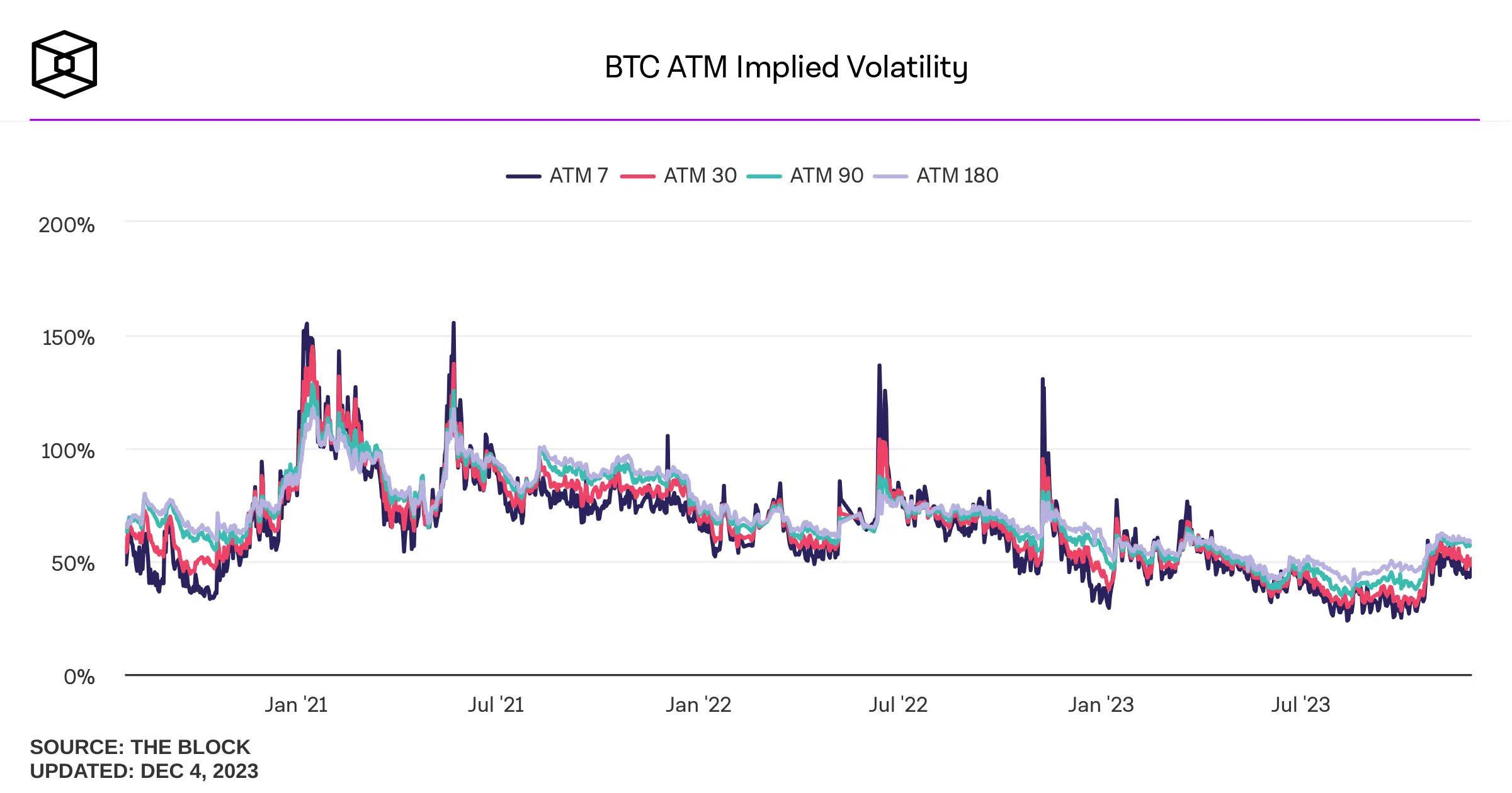

Bitcoin IV on the rise

The Implied Volatility (IV) for Bitcoin also grew. This implied increased uncertainty about the king coin’s future price and also indicated potential market swings.

Traders may thus face more risk and may require careful strategy adjustments to navigate the evolving Bitcoin landscape.

Analyzing IV is a common strategy. Hedge funds often use it to assess BTC’s future price. When IV is high, these hedge funds anticipate a price decrease.

So, by shorting BTC, they aim to profit from a more predictable market.

Only time will tell if hedge funds or asset managers come out swinging in this sector.

Is your portfolio green? Check out the BTC Profit Calculator

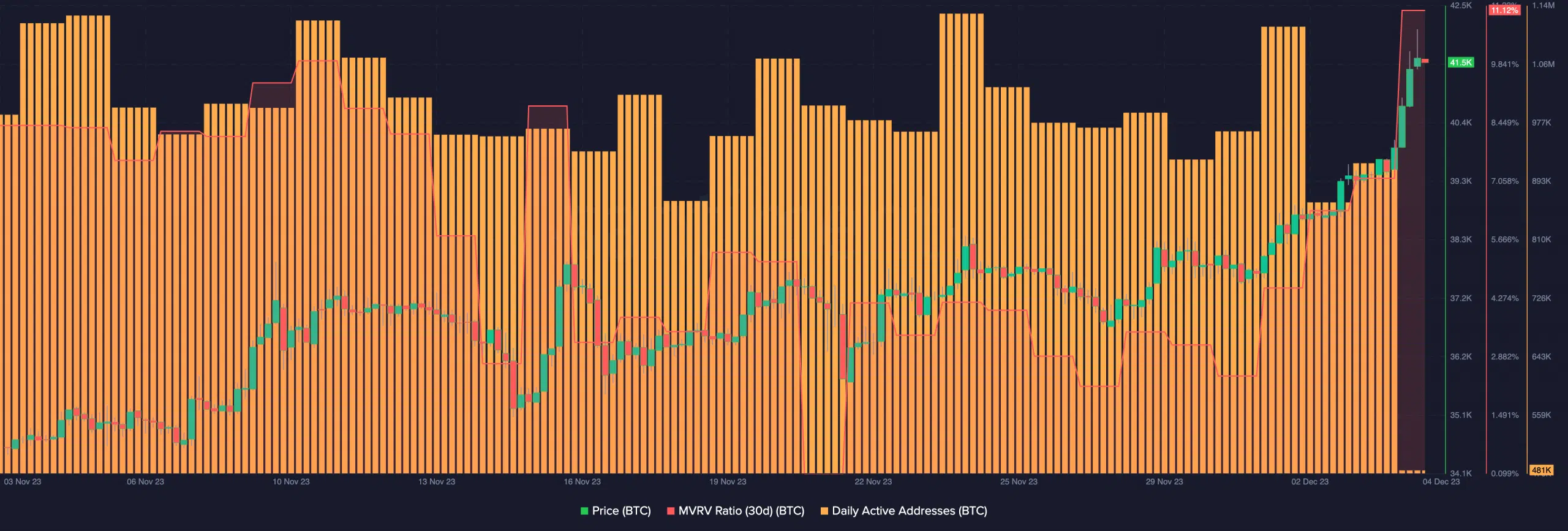

At press time, BTC was trading at $41,554.47, growing by 5.33% in the last 24 hours. However, the number of Daily Active Addresses fell during this period.

Moreover, BTC’s MVRV ratio grew. This meant that the number of addresses in profit had risen at press time.