Crypto funds record largest inflow streak in over two years

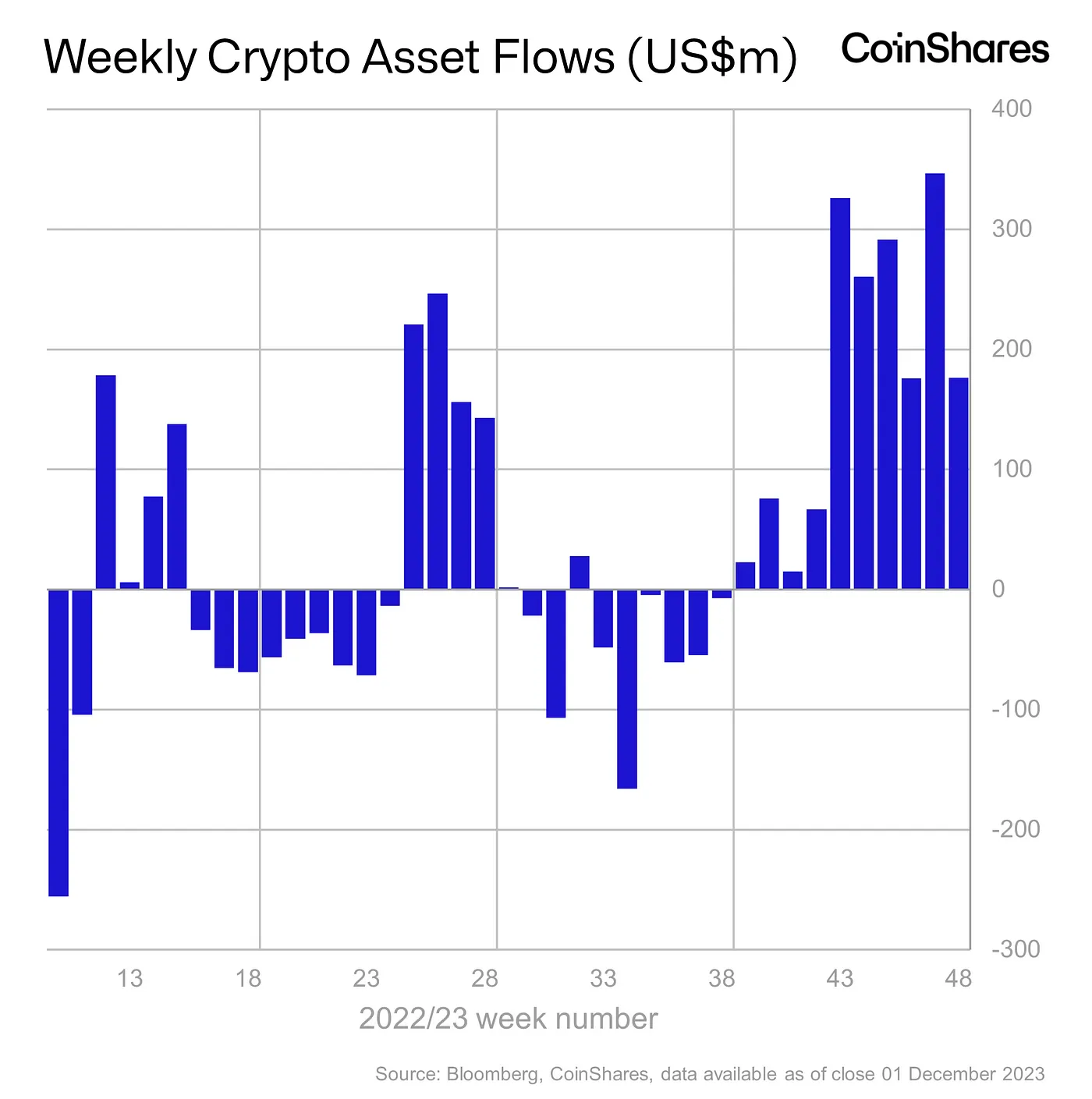

- The latest run of inflows was the largest since October 2021.

- Bitcoin saw capital infusion of over $132 million.

Digital asset investment products extended their winning streak to record the 10th consecutive week of inflows, according to the latest report by crypto asset management firm CoinShares.

Big investors bullish on the crypto market

Last week, institutional investors poured $176 million into cryptocurrencies, taking the 10-week total to a whopping $1.76 billion.

This streak of inflows was the largest since October 2021, which saw the launch of the futures-based exchange-traded fund (ETF) in the U.S.

This time around, the enthusiasm was driven by spot ETFs. Indeed, a dozen-odd applications for a Bitcoin ETF are pending for approval by the U.S. Securities and Exchange Commission (SEC).

Moreover, at least seven applications for a spot Ether ETF have been submitted by the some of the biggest asset managers of the world.

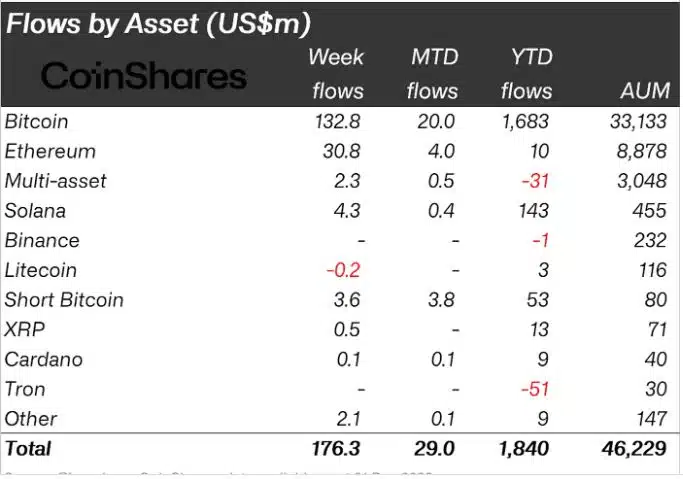

With the latest run, the total assets under management (AuM) increased to $46.2 billion, marking a 107% leap since the start of the year.

On expected lines, the majority of inflows centered around world’s largest crypto asset Bitcoin [BTC], totaling over $132 million. On a YTD basis, the aggregated capital inflows into Bitcoin reached a whopping $1.6 billion.

The king of the cryptos has been leading the ongoing bull run. The coin reached levels last seen before the bear market began. Bitcoin recently reclaimed the $41,000-mark after 18 months and looked set to push further to the north.

Ethereum’s late-year boom

Ethereum [ETH], the second-most popular cryptocurrency, also witnessed net buying from the institutional side. With the latest $31 million in inflows, Ethereum’s 5-week run surged to $134 million.

Moreover, for the first time in 2023, ETH’s yearly net flows turned positive at $10 million.

This was significant as Ethereum was snubbed by investors for a long time in 2023. In fact, not too long ago, Coinshares itself referred to it as the “least-loved altcoin.”

Institutional investors’ appetite for cryptocurrencies was bound to increase as the final deadline for ARK 21Shares Bitcoin ETF approval approaches in January 2024.

According to a recent report by crypto exchange Bybit, these investors held more than 50% of their assets in BTC and ETH as of September 2023. Furthermore, their portfolio’s allocation to BTC increased significantly in September.