Bitcoin’s price shows ‘interesting patterns’ in response to Chinese market

Bitcoin was still trading close to its six-month low after it briefly dropped to $7,000 last week. Throughout the year, the king coin had exhibited significant volatility. Bitcoin experienced some sharp fluctuations last year, and while it’s impossible to draw conclusions on the coin’s price to a particular country’s regulatory stance; however, an interesting pattern can be seen in its price over the past couple of years.

There has been a lot of debate surrounding the inducing factor of Bitcoin surges and falls. According to the latest LongHash data, Bitcoin’s price responding to China’s market news was “remarkable”. The report stated:

“China’s market continues to exert its apparent influence on Bitcoin even in 2019”

Bitcoin lost 20% in a matter of hours back on 5th December 2013 right after China announced banning financial institutions from handling Bitcoin transactions. The coin’s price dropped 8% over the week after China’s Central Bank ordered other domestic banks to close Bitcoin trading accounts, which was reported by a Chinese magazine.

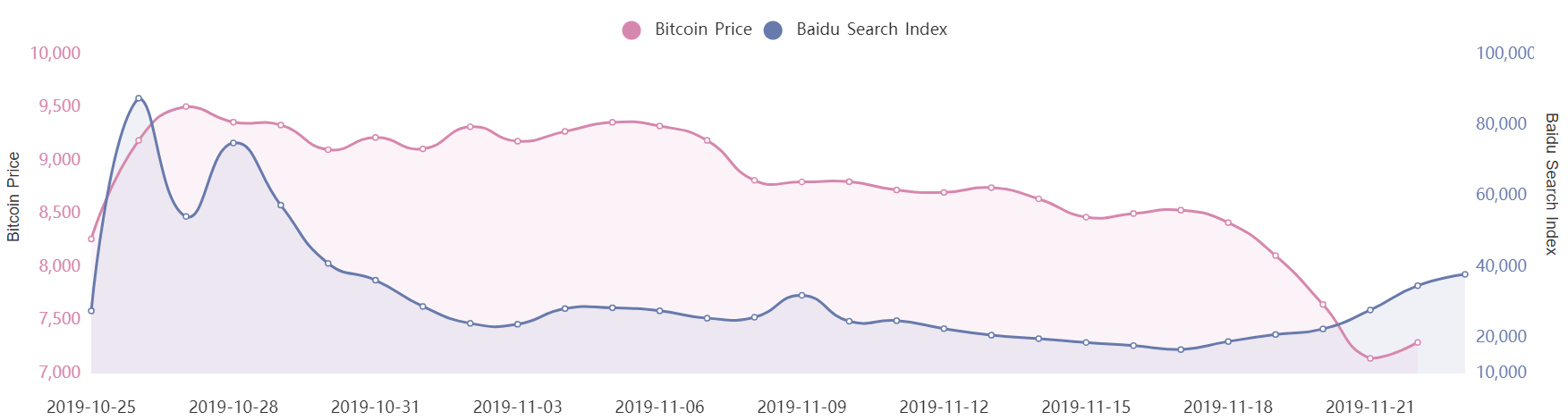

Source: LongHash | Bitcoin Price and Baidu Search Index [1 month]

More recent instances like Bitcoin’s price crashing 20% after the country’s central bank announced an immediate ban on ICO funding in March 2014 and President Xi Jinping endorsing blockchain technology (last month) for the first time was followed by Bitcoin’s sharp increase in its price, were interesting correlations.

Baidu searches for Bitcoin went up after the President’s remarks on blockchain recently and this was occasioned by Bitcoin’s price skyrocketing. However, this was soon followed by a negative correlation as the price fell even as Baidu searches continued to soar.

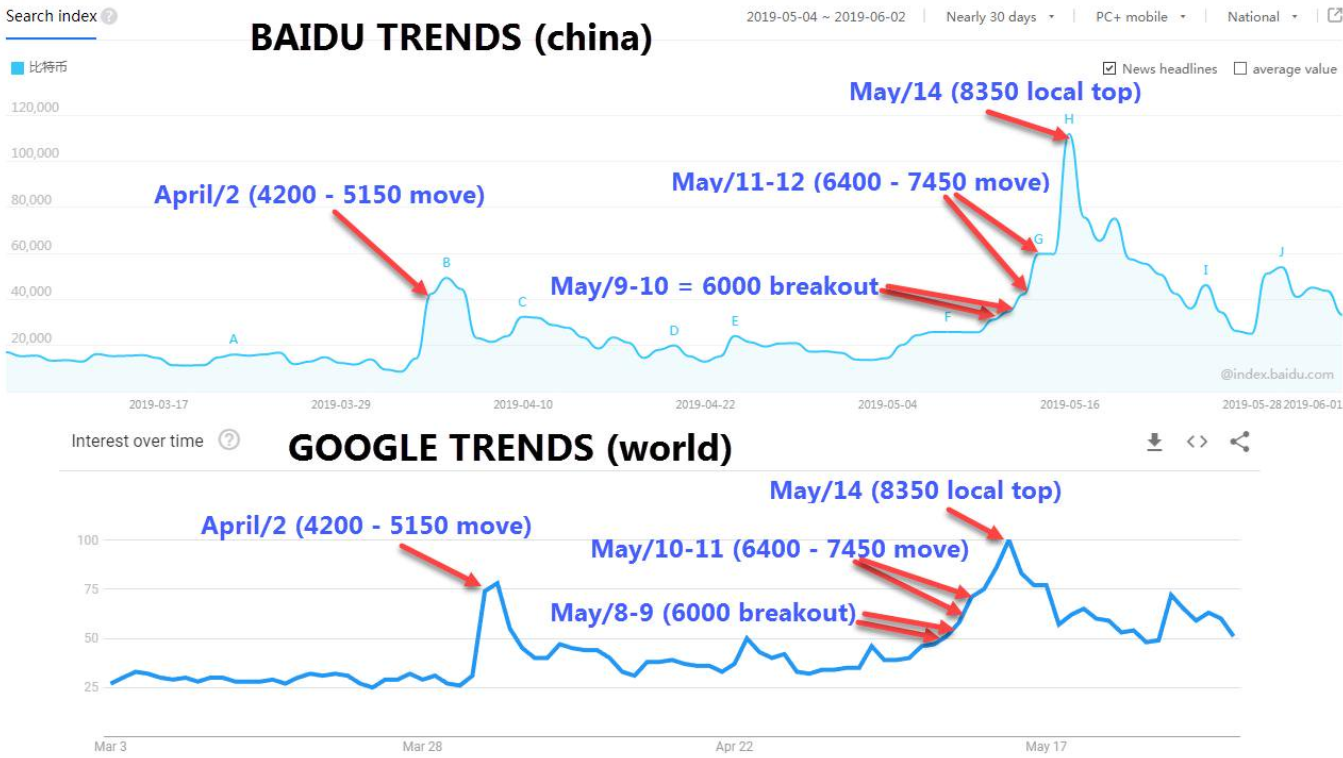

Previously, cryptocurrency trader, Alex Kruger found that Bitcoin searches on Baidu largely followed the pattern of Google searches across the rest of the world.

Source: Alex Kruger | Twitter

Additionally, the highest points of these searches mostly collided with price breakouts. He had earlier tweeted,

“Interest in bitcoin spiked either after price breakouts or during breakouts.”

Source: Alex Kruger | Twitter