Bitcoin

Bitcoin’s price rise is leading to a rapid increase in liquidity

Ever since Bitcoin broke the $10,000 mark, speculation has been rife whether BTC’s price is likely to go up, down or consolidate and move sideways. And in the last week, it is safe to say that Bitcoin’s volatility proved that it can do all three in a week’s time.

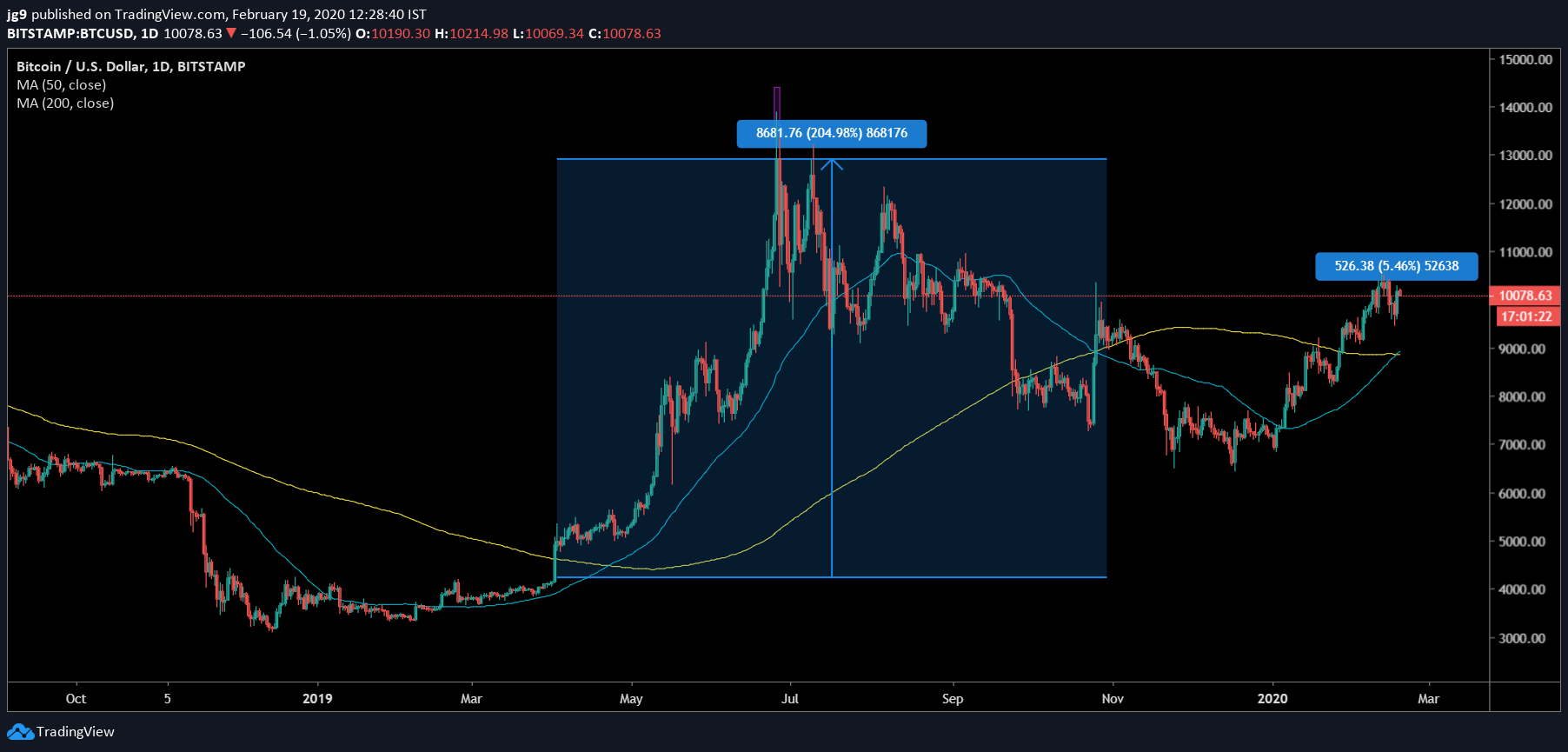

Source: BTC/USD TradingView

At the time of writing, BTC’s price continued to hover around $10,100. Interestingly, in the last 24 hours, starting on 18 Feb at around 1400 (GMT) Bitcoin’s price started to rise from $9731 registering a 5.6% increase to consolidate at a high of $10,185.52 around 2000 GMT the same day. This happened right after the formation of the golden cross that indicated the potential surge in Bitcoin price.

Source: BTC/USD TradingView

The golden cross formation is particularly significant for BTC. In April 2019, a similar golden cross led to BTC’s price rally to $13,000 a few months later. During the period following the formation of the golden cross, Bitcoin’s price rose by a staggering 204% in just 4 months. This precedent added immense significance to the golden cross formation that was initiated yesterday and has added more weight to claims of a bull run for BTC.

Along with the increase in BTC’s price the 24-hour BTC Futures volume also saw a substantial increase, with BitMEX, OKEx, and Huobi registering high volume in comparison to the smaller player in the BTC derivatives market like Binance and Kraken.

BitMEX alone registered an aggregated open interest [OI] ATH at around $1.6 billion Bitcoin Futures. OKEx saw high demand with around $1.3 billion aggregated open interest, and Huobi with $973 million for the same.

With an increase in trading interest on the derivatives front, liquidity is on the rise as can be seen in the tightening of the bid/offer spread on the exchanges. The 5 million B/O spread showed a contraction in BitMEX and the daily average dropped from 0.12% to 0.08%.

According to data from skew markets, the $10 million B/O spread continues to show a contraction. As BTC’s prices started to climb on 18 February, the $10 million B/O spread, registered a drastic dip in Bitfyler’s daily average spread from 7.11% to 5.21% the following day. The contraction saw a drop in B/O spread by 26%.

With the price increasing at a rapid pace, derivative investors are rushing into the market, evidenced by the volume and open interest surge. This rise in trading interest has resulted in an increase in market liquidity, as seen by the tightening spread on most major derivatives exchanges.