Bitcoin’s price may remain dormant before halving but research suggests coin to peak after

It’s no secret that Bitcoin halving is supposed to take place in 2020 and according to several experts, price is expected to rise right before the halving, as it happened before its first and second halving in 2012 and 2016, respectively. However, this might not be true.

According to research by Strix Leviathan, there was “no evidence that cryptocurrency assets experiencing a halving event outperform the broader market in the months leading up to and following a reduction in miner rewards.” The research highlighted that Bitcoin’s performance before and after halving is the stark opposite of Litecoin. While LTC’s price reacted positively before halving, BTC might exhibit poor relative performance leading up to the halving.

Many traders have questioned this and pointed out Bitcoin’s strong stock-to-flow ratio and reiterated that unlike Litecoin, Bitcoin’s price might react positively before halving.

Some people think that because litecoin didn’t jump on ltc halving, btc halving will also be irrelevant for #bitcoin. That logic is flawed. LTC price doesn’t have a significant relationship with stock to flow, so halvings are indeed irrelevant. BTC price-s2f relation is strong ? https://t.co/5Wx7vHLvUd

— PlanB (@100trillionUSD) August 31, 2019

This argument was dismissed by the research carried out by TokenInsight that highlights a historic positive correlation between Bitcoin price and mining difficulty. The report read:

“Historical data shows a positive correlation between Bitcoin price and mining diffculty, which means that the change (rise/fall) in the direction of Bitcoin price and mining diffculty are consistent under normal

circumstances.”

Source: Token Insight

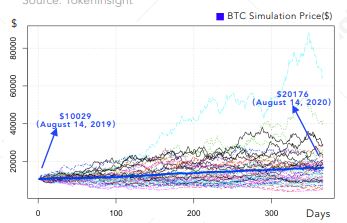

The report noted that in 2020, 95% confidence interval of Bitcoin price will be between $17,077.32 and $23,276.56. This range does not consider events that might impact Bitcoin’s price, like halving and is in reference to mining hardware and computing processing investments.

Even though the percentage rally of BTC cannot be predicted pre/post halving, it certainly might note an uptrend post halving as mining difficulty increases.