Bitcoin’s perpetual contracts performance overshadowed by altcoins

With an unexpected pandemic crippling financial markets across the world, people all over have been trying to secure themselves financially. However, a volatile market is no one’s first choice. While many investors are still considering digital assets to diversify their portfolios and mitigate risks, Bitcoin remains the first and potentially only choice for many users. However, a glance at the performance of these assets reveals something interesting. Bitcoin has been outperformed and how.

The world’s largest cryptocurrency, Bitcoin, is giving investors 30.98% in returns, a huge margin considering the traditional market. However, other altcoins seem to have overshadowed Bitcoin. Mid and small-cap assets like LINK, Cardano [ADA], Basic Attention Token [BAT], VeChain [VET], and IOST have been outperforming not only Bitcoin, but other alts in the market as well.

This was evidenced by the performance of the market’s altcoin perpetual contracts, with VET’s perpetual contracts delivering more than 40% in returns in the month of June, according to Binance.

Source: Binance

VeChain’s perpetual contracts weren’t the only ones to do so well, with BAT and IOST returning 19% and 17%, respectively. On the contrary, most large-cap assets were observed to be in the negative, with ETCUSDT noting a loss of 17.38%, closely followed by last year’s best performer, Tezos, with a 16% loss.

Interestingly, many of the market’s exchanges were quick to pick up on small-cap assets doing so well. Binance Futures, for instance, added 6 new contracts which included Algorand, Zilliqa, Kyber Network, 0x, Compound, and Omisego, with 50x leverage, citing increasing demand.

It must be noted, however, that since the market has been in a consolidation phase for more than a month now, June trading volumes and interest were hit across all platforms. According to a recent BitMEX report, the derivatives volume dropped by 35.7% in June to $393 billion. This was the lowest monthly volume in 2020, whereas the spot volume dropped by 49.3% to $642 billion.

According to Binance’s data, its Futures contracts noted a 36% month-on-month decrease, with $87.6 billion traded across its perpetual contracts.

Source: Binance

Further, Binance Futures registered a daily average volume of $2.9 billion, which was 34% lower than the average daily volume in May. Contributing to this low statistic was the limited BTC Futures demand.

On most days, the total volume traded across the BTC Futures markets was less than $10 billion, whereas the volume percentage across altcoin contracts was significantly higher than the previous months. It averaged at 26.7%, compared to 17.9% in May, while BTC contracts averaged at 73.3% in June v. 82% in May.

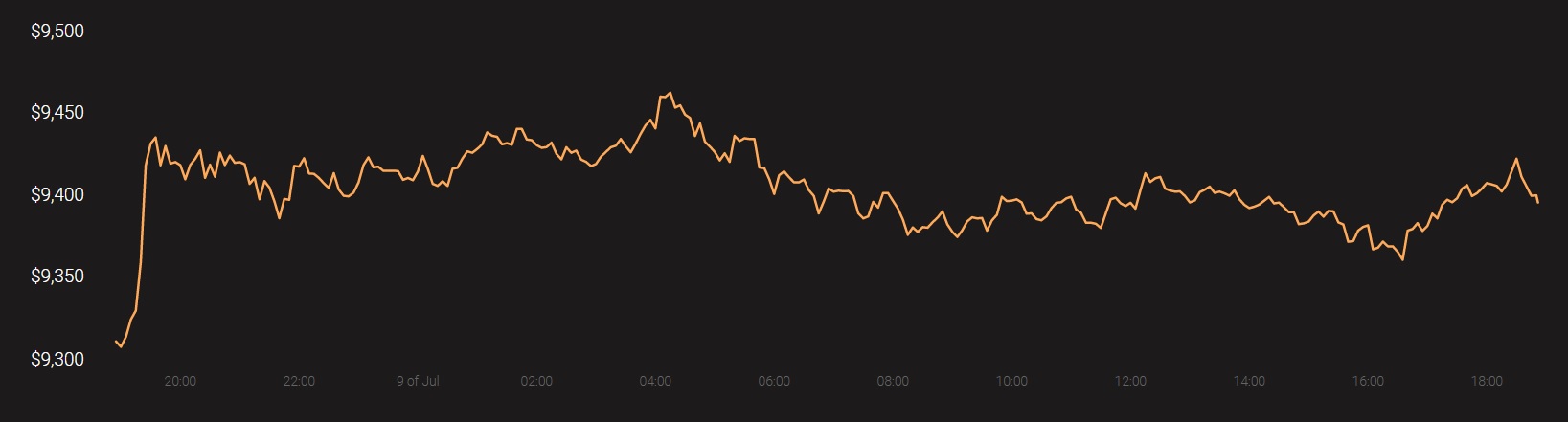

At press time, Bitcoin was trading at $9,396, with a 24-hour trading volume of $19.2 billion.

Source: Coinstats