Bitcoin’s network health looks grim as indices show extreme fear

Bitcoin’s price movement appeared muted within the range of $6,600-$7,000 following several pullbacks and a short-lived upswing. At press time, the largest cryptocurrency stood at a value of $6,909.

Not much has changed since the price crash on 12th March and despite rising hash rate and difficulty, not all metrics exhibited a promising future for the coin. Bitcoin is in the extreme fear zone, since that fateful day, indicating that the currency is still undervalued.

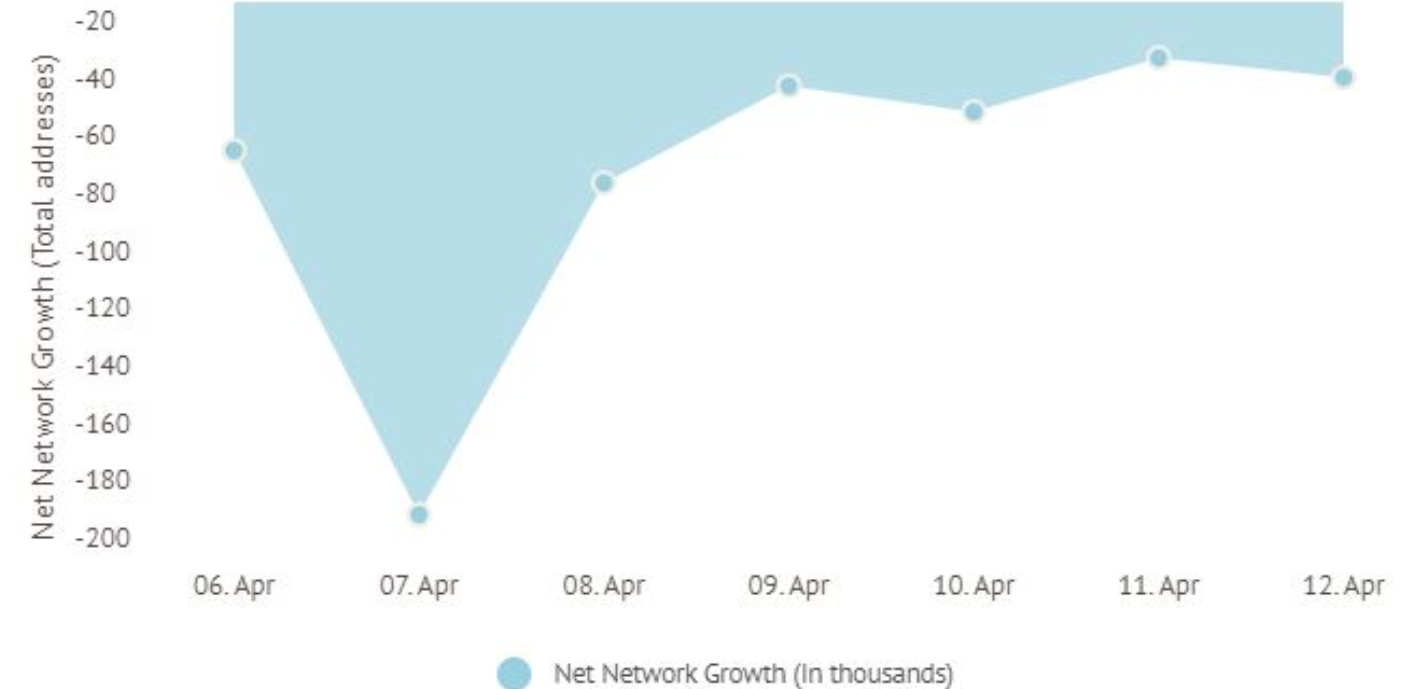

As fear grappled the king coin, another bearish factor that weighed in was the Net Network Growth signal. This momentum signal essentially indicated the coin’s underlying network health by measuring the number of new addresses minus the addresses that have their balances emptied. According to IntoTheBlock’s latest data, after a very long time, the Bitcoin network “didn’t grow”, rather, it lost over 450 thousand addresses.

Source: IntoTheBlock

IntoTheBlock further revealed,

“Over the past week, Bitcoin averaged a total of 382.95 thousand new addresses per day vs 448.27 thousand addresses that went to zero per day.”

More addresses being emptied indicated a bearish scenario for the coin. This trend was not seen for a long time and could be attributed to the growing concerns of the COVID-19 pandemic’s impact on a global financial scale. It’s a testing time for both – the traditional as well as the crypto industry, the latter’s momentum being dictated by Bitcoin’s actions. Investors are cautious as market volatility continued in light of the pandemic.

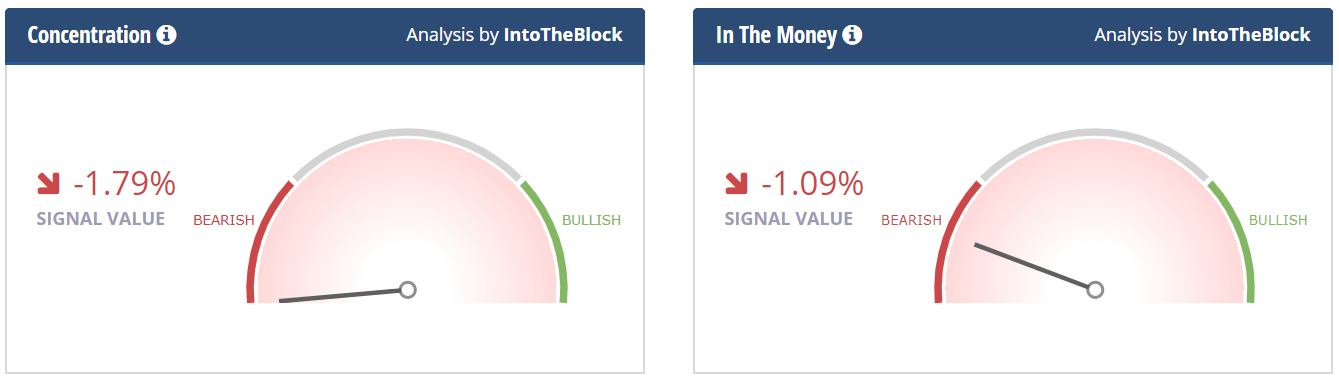

Source: CryptoCompare | IntoTheBlock

It isn’t surprising that all this chaos has driven Bitcoin to a highly uncertain phase. Providing further validation to this argument was the IntoTheBlock’s ‘Concentration’ signal, which saw a reduction of addresses with more than 0.1% of the total circulating supply, [the large investors] as well as addresses holding more than 1% of the total circulating supply [whales]. The signal value stood at – 1.79 indicating a bearish phase.

This was indicative of the fact that the short-term flight to fiat and liquidity has had severe ramifications on Bitcoin’s price. Additionally, ‘In The Money’ momentum signal, which calculates the net change of in/out of the money addresses also exhibited a bearish phase with a signal value of -1.09%.