Bitcoin’s MVRV ratio, SOPR’s slip may highlight strong hodlers’ presence

Bitcoin’s recent foray under $4000 created a bearish ripple effect that was felt across the digital market industry.

The world’s largest cryptocurrency dipped under the aforementioned range for the first time since early-2019 and assets such as Ethereum, XRP, and Litecoin also followed suit. Although Bitcoin’s valuation had risen above $5700 at press time, a key fundamental metric indicated a significant difference.

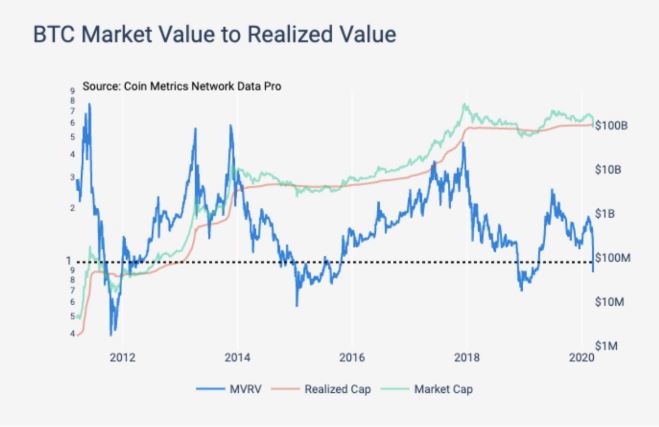

Source: Coinmetrics

According to Coinmetrics’ recent analysis, following Bitcoin’s 45 percent dip, the asset’s MVRV index dropped below 1 for the fourth time in history. The MVRV ratio is a comparison between Market Value (Market Cap) and Realized Value, where the realized value establishes an adjustment between the lost BTC coins and the assets used for hodling.

Source: Coinmetrics

Although the drop below 1 underlined a major bearish scenario, the analytics platform indicated that it could open the floodgates for accumulating a higher amount of Bitcoins at a reduced price.

However, a large drop in MVRV was not reciprocated by the realized cap that only dropped by 3 percent.

It was suggested that the small drop in realized cap indicated that long-term hodlers are currently unaffected by the recent decline and the price action is now, being driven by new investors in the market.

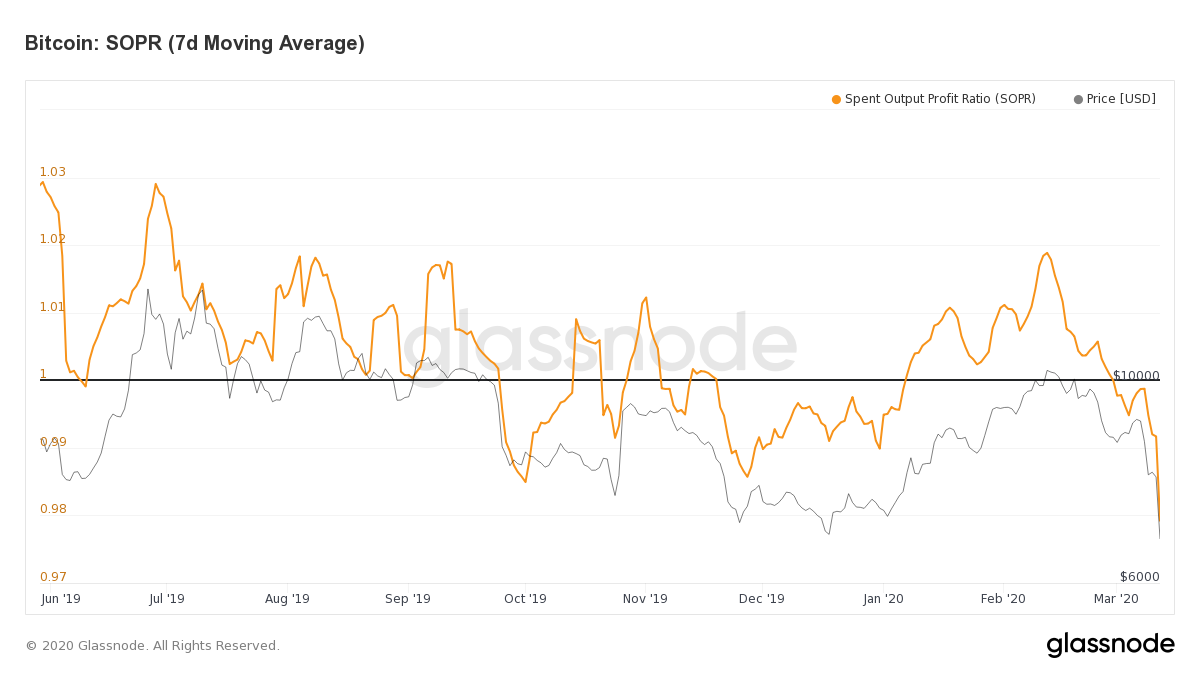

Source: Glassnode

Along with the MVRV ratio, Bitcoin’s SOPR index dived below 1 as well, something that suggested that the overall profitability of the market is more on the negative side, at press time.

The Spent Output Profit Ratio falling under 1 suggested that traders, on an average, would be incurring a loss, while selling their Bitcoins.

In hindsight, historically, it has been observed that the market usually corrects the SOPR value under 1 during a bull market, which likely improves the confidence of the traders during a rally.

The movement for SOPR and MVRV ratio should undergo a trend reversal as the market credentials were improving, at the time of writing. However, these indicators are still increasingly bearish and BTC’s valuation could consolidate at a lower range over the next few weeks.