Bitcoin’s mining difficulty likely to increase as higher computing power will come into play

The first half of 2019 witnessed a Bitcoin bull surge that enabled the largest crypto asset to escape bearish winter. Bitcoin peaked at $13,800 on June 26th but bullish momentum slowly decreased. The 2nd half of 2019 was reaching its mid-way point at press time, and various price predictions were already taking over the crypto-verse with regard to the next bull run.

A major event anticipated in 2020 is the 3rd bitcoin halving, which would further reduce current block reward down to 6.25 BTC for miners.

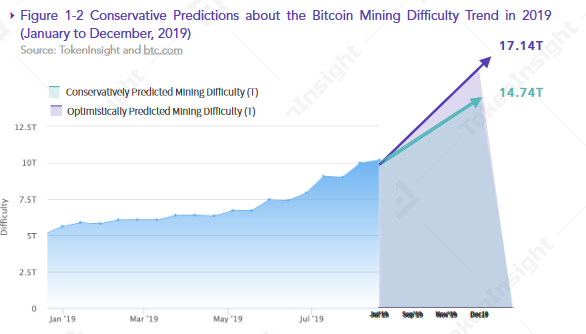

Now, according to a recent report by Token Insight, before the halving in 2020, Bitcoin mining difficulty is expected to be relatively higher in comparison to Bitcoin’s rise in valuation for the rest of 2019.

The quarterly reported suggested that mining equipment ordered by miners in the first and second quarter of 2019 would be active in operation only by the third and fourth quarter. Therefore, hardware built with higher computing power would increase computing power in 2nd half of 2019 which would increase the net mining difficulty.

On a 14-day Bitcoin difficulty adjustment period, average increase in mining difficulty was 3.29 percent in the first quarter. The 2nd quarter clocked in an increase of about 4.73 percent and at press time, the difficulty on the overall network was about 9.98 T with an average computing power of 74.35 EH/s. Hence, based on this data it can be assumed that the mining difficulty would at least increase by up to 5 percent in the third and fourth quarter of 2019.

Source: Token Insight

The predicted mining difficulty was broken down from a conservative and optimistic approach. It was stated,

According to conservative predictions, mining difficulty will increase to 14.74 T, and Bitcoin computing power will increase by 48% at the maximum, and reach to 109 EH/s.

According to optimistic predictions, mining difficulty will increase to 17.14 T, and Bitcoin computing power will increase by 72% at the maximum, and reach to 127 EH/s.