Bitcoin’s increasing active entities is monumental, but unlikely to strengthen rally

On analyzing the top ten digital assets at press time, it was exhibited that only Bitcoin has incurred a positive rise of 2.63 percent in the past 24-hours.

Nothing can be taken away from the king coin, as the asset continues to consolidate higher and higher in the charts. Such positive ascend has inevitability improved various Bitcoin fundamentals that range from its hash rate to market sentiment.

However, the recent statistics shared by Glassnode could be extremely important going forward for Bitcoin and it has caught the attention of the entire space.

Source: Glassnode

According to the above chart, it can be identified that the number of Bitcoin active entities has been the highest at the present day, second to only the number of entities registered during the bull run of late December 2017.

The current feat is highly significant given the fact that the number of active entities is higher than the number witnessed during the rally of June 2019. It is important to note that, Bitcoin was worth around $13,000 in June 2019, and at press time, it is valued under $10,000.

Does it make a difference in the current rally?

Now, like every other surging metric, the common queries of the community comes back to the question as to whether this will have a bullish impact on Bitcoin’s price or not.

To be honest, in the short-term rally, the answer is possibly a No.

Without undermining the importance of the rise in entities, it is important to understand that increase in active entities is not directly linked to a possible price pump. It is a sign of improving market health in the Bitcoin space, which indirectly does solidify Bitcoin’s long-term valuation, but it hardly going to have a direct impact at the moment.

To further understand, we will analyze another key metric.

Source: Glassnode

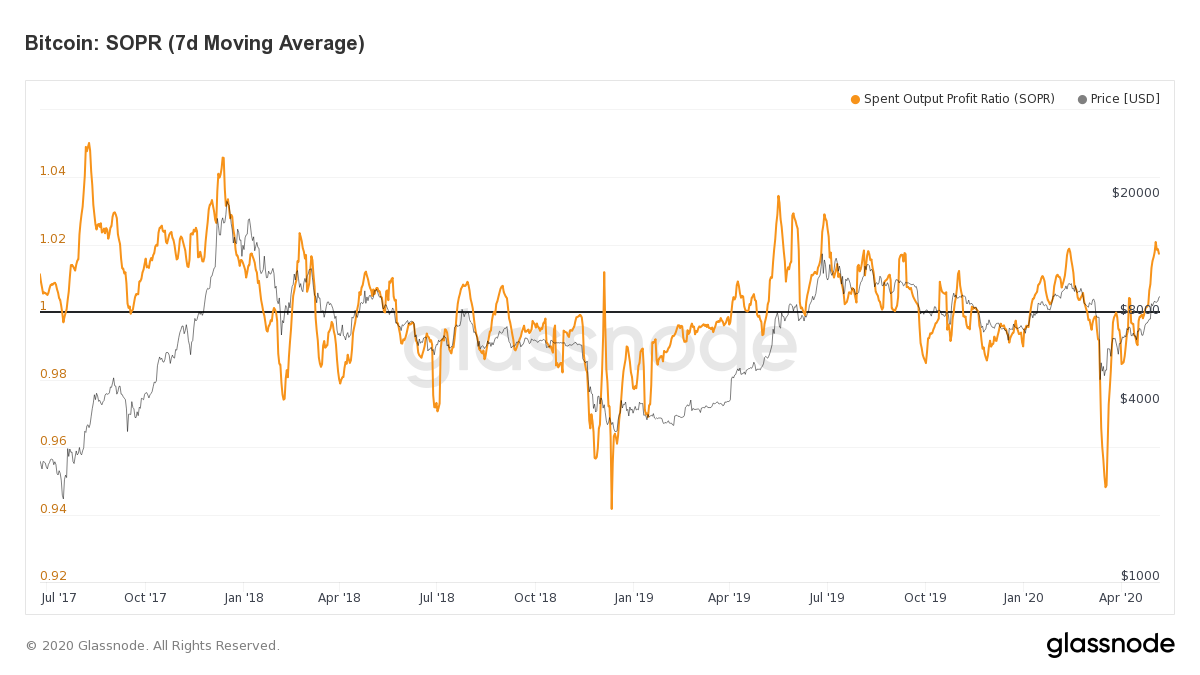

The above Bitcoin Spent Output Profit Ratio or SOPR chart indicates that Bitcoin is beginning to be profitable for buyers in the current trend. However, it is still now close to being as profitable as it was back in June 2019 or during the rally of 2017.

The SOPR is used to predict tops and bottoms, and the current chart indicates that Bitcoin is just starting to break away from its recent bottom.

Hence, even though the BTC active entities’ data is an important discovery, it might not make a difference over the next month or so.

Conclusion

Overall, it will be unfair to say that the active entities would not make a difference going forward in 2020 because it is a metric exhibiting possible improvement of Bitcoin, and such growth takes a bit of time to translate into the valuation market. If the active entities are maintained at a higher level throughout 2020, it might as well have a positive effect when Bitcoin reaches a new all-time-high price.