Bitcoin’s Futures market registered trading volume worth $3 trillion in 2019

The price movement of digital assets in 2020 has been monumental, but the transition from 2018 to 2019 cannot be ignored from the market’s perspective.

Over the past 15-18 months, significant changes have been observed from a trading and valuation point-of-view, changes that have largely paved the way for the market’s current bullish sentiment.

Keeping all things aside and focusing on spot exchanges, a recent report has revealed that the total spot market trading volume over the past year was over $13.8 trillion.

According to TokenInsight’s latest report, the top 40 exchanges dominated the total annual trading volume, accounting for close to 82 percent of the entire market (254 exchanges were considered.) However, it is important to note that wash trading volume could have played a huge part in the above calculation, despite the fact that many believe wash trading volumes have fallen in 2020.

With respect to Bitcoin’s trading volume, the percentage dropped down to 48.29 percent, a huge fall from the king coin’s overall dominance of 80 percent during the 2017 bull run. Such a difference suggests that credibility in other crypto-assets has increased over time as traders are taking notice of other major altcoins as well.

Another major jump in interest registered in 2019 was in line with the Futures market. Futures trading received a major boost coming into 2019 when a rise in institutional investment paved the way for a dramatic improvement in Futures trading volume. According to TokenInsight’s data, daily average volume for the entirety of 2019 was around $8.5 billion and the total trading volume throughout the year reached $3 trillion.

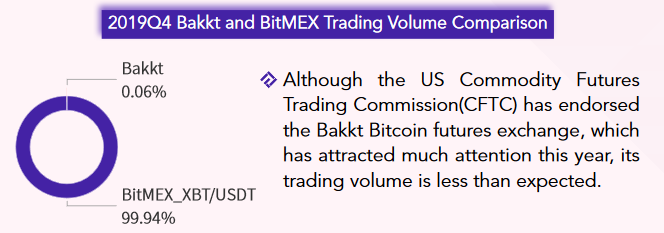

The introduction of the new Futures exchanges (Binance and Bakkt) played a major role in such a hike, but BitMEX continued to hold a stronghold over the market for the majority of 2019.

Source: Token Insight

BitMEX’s dominance is visually understood in the above chart, with the exchange responsible for 99.94 percent of the total trade in comparison to Bakkt’s 0.06 percent in Q4 of 2019.

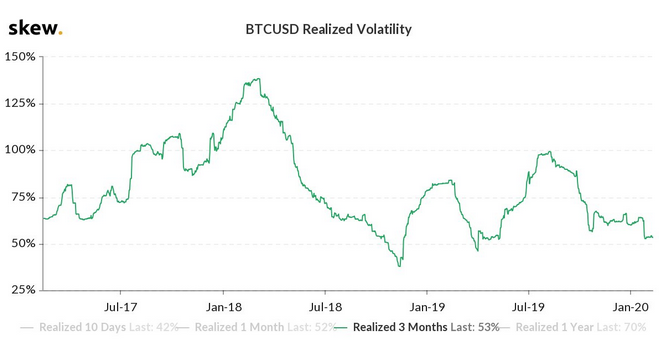

Coming into 2020, many had suggested that the rising volatility in Bitcoin’s price may have triggered causation for the aforementioned rise in interest. However, a recent skew markets chart begs to differ.

Source: Twitter

Bitcoin has been up by 42 percent in 2020, but its realized volatility has depreciated over the last few months. A decrease in realized volatility is a positive sign for Bitcoin from an investment perspective, contradicting the fact that increasing price or market volatility may alone dictate institutional interest.