Bitcoin’s falling trading volume may trigger period of volatility

Over the past week, Bitcoin’s valuation has registered a depreciation of 6 percent, with its effects being immediately noticed with its market statistics.

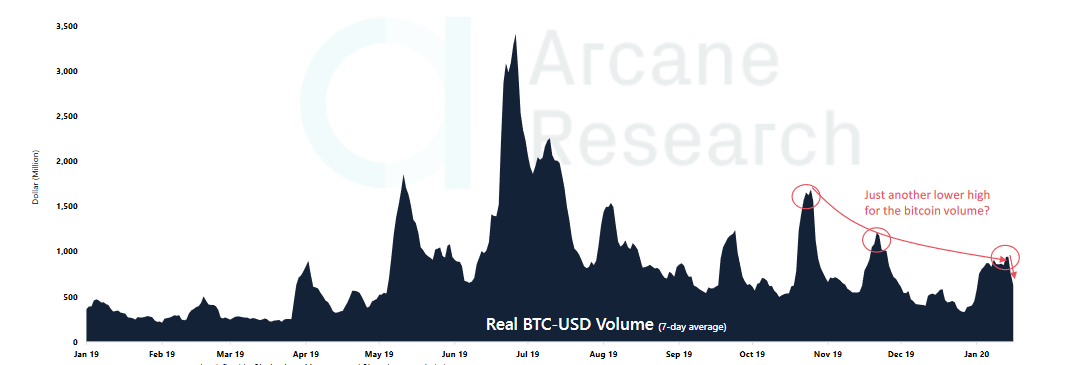

According to Arcane Research’s recent report, the 7-day average trading volume for Bitcoin has drastically slowed down over the past couple of days. The report noted that on 22 January, the trading volume went down to $306 million, a figure that was recorded to be the lowest since 1 January.

Source: Arcane Research

Considering the fact that the average volume in January has been above $700 million for most of the month, such a huge drop in volume may underline an increase in the king coin’s volatility in the future.

Source: BTC/USD on Trading View

Looking at the attached chart, it can be observed that the volume has periodically fallen since the start of December, despite registering a substantial hike on 14 January. The decreasing volume over the longer-term may also suggest that the market is due for a period of strong volatility.

A major downtrend was recently breached as well, a development that might have bullish implications in the coming weeks, spiking the trading volume again.

Source: Arcane Research

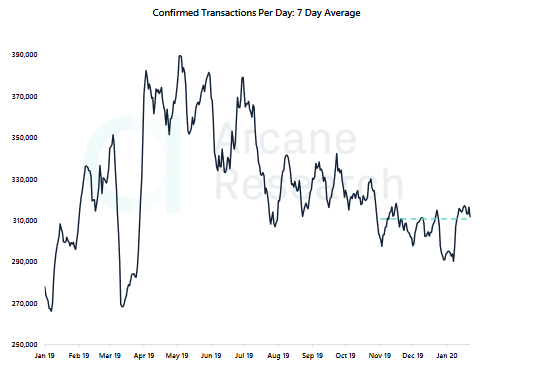

Additionally, the activity on Bitcoin’s blockchain remained flat as well, with the number of transactions and active addresses decreasing by about 1-2 percent.

The report added that over the past week, the average value of on-chain transactions dropped down to $4,676, registering a decline of 23.19 percent. However, the year-to-date valuation of average transactions is still up by 46.58 percent.

On-chain transactions slumped by almost 25%, something that suggested that a higher amount of smaller transactions were facilitated over the past week.

The present-day market performance comes on the back of a significant bullish period, with many in the crypto-community under the belief that the current corrections are long overdue after weeks of bullish performance.