Bitcoin derivatives market may reduce long-term price volatility

It is impossible to talk about the crypto-industry in 2019 without underlining the influence and impact of derivatives markets.

Over the past few months, Bitcoin Futures and Options trading has developed into a division of its own, and the introduction of new institutions such as ICE’s Bakkt has sown the seeds of interest that were already blooming on other exchanges.

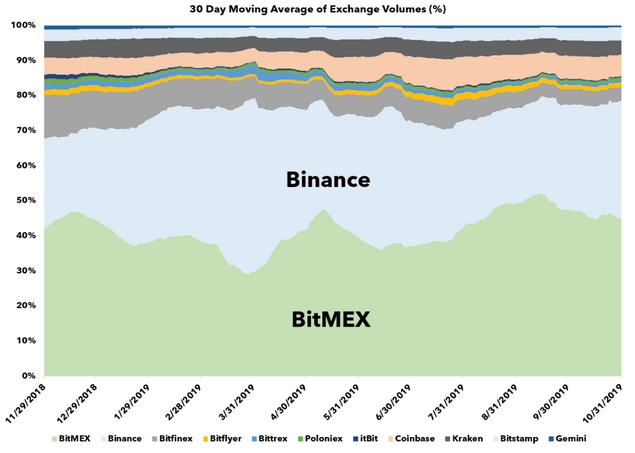

Source: Block Tower

Comparing BitMEX’s Future volume with other exchanges’ spot market volume in 2019, it is evident that the derivatives market has had an upper hand.

Increasing interest can also be identified if the numbers are calculated based on the activity on BitMEX. In 2018, BitMEX XBTUSD Perpetual Swaps advanced on the exchange were 2,363, whereas the Perpetual Swaps placed in 2019 are already 2,681. In fact, there are still more than 40 days left in the year.

According to a recent post, the growing derivatives market will have major implications for the industry.

Before the derivatives market received significant recognition in the space, exchanges used to design a spot price that would be derived from larger physical exchanges with higher volume. Previously, crypto-derivative contracts were not highly liquid. Hence, the index was a smart way to initiate margin calls without the fear of manipulation.

However, the growth of the Futures market led to the introduction of physical exchanges that were smaller in size, accumulating less than 10 percent of the total aggregated BTC volume in the industry. Hence, speculated manipulation became a way to yield more profits from trading on exchanges with low liquidity.

Hence, increased interest in the derivatives market is indirectly making the market more dependent on Bitcoin. A major reason for the same is the liquidity surrounding Bitcoin as BTC derivatives are extremely liquid and attract potential investors. The post read,

“Despite having periods of altcoin mania in the past, it’s possible that the derivatives market will drain those altcoin speculators and refocus them on Bitcoin derivatives.”

The derivatives market is also injecting a sense of diversification and imbuing a level of sophistication in the BTC market, a development that is expected to trim down the long-term volatility surrounding Bitcoin’s price. However, short-term volatility may undergo more turbulence due to the option of increased leverage.

The article added,

“Derivatives offer specialized ways to invest in the Bitcoin market, and offer investors ways to invest that were previously unavailable. This should open up the market to both the skittish and the bold.”